JAVA or PYTHON WOULD WORK

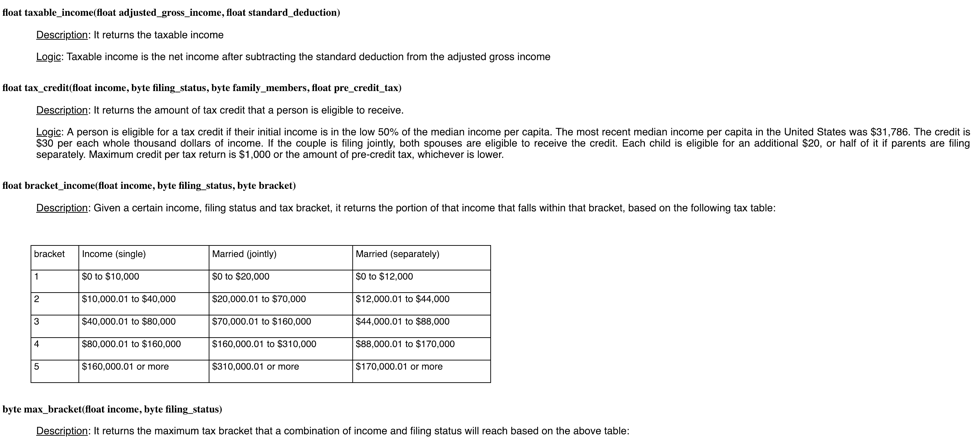

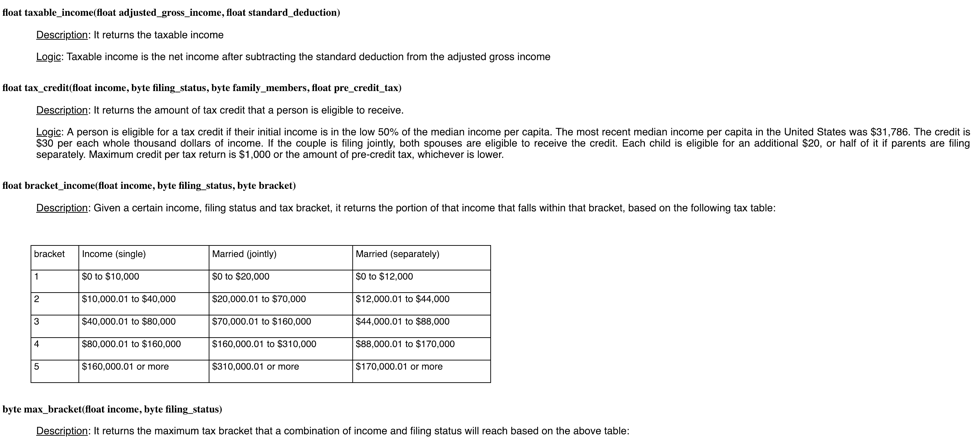

float taxable_income(float adjusted_gross income, float standard deduction) Description: It returns the taxable income Logic: Taxable income is the net income after subtracting the standard deduction from the adjusted gross income float tax credit float income, byte filing status, byte family members, float pre_credit tax) Description: It returns the amount of tax credit that a person is eligible to receive. Logic: A person is eligible for a tax credit if their initial income is in the low 50% of the median income per capita. The most recent median income per capita in the United States was $31,786. The credit is S30 per each whole thousand dollars of income. If the couple is filing jointly, both spouses are eligible to receive the credit. Each child is eligible for an additional $20, or half of it if parents are filing separately. Maximum credit per tax return is $1,000 or the amount of pre-credit tax, whichever is lower float bracket income(float income, byte filing status, byte bracket) Description: Given a certain income, filing status and tax bracket, it returns the portion of that income that falls within that bracket, based on the following tax table: bracketIncome (single) $0 to $10,000 $10,000.01 to $40,000 40,000.01 to $80,000 $80,000.01 to $160,000 $160,000.01 or more Married (iointly) $0 to $20,000 $20,000.01 to $70,000 $70,000.01 to $160,000 $160,000.01 to $310,000 $310,000.01 or more Married (separately $0 to $12,000 $12,000.01 to $44,000 $44,000.01 to $88,000 $88,000.01 to $170,000 $170,000.01 or more byte max bracket(float income, byte filing status) Description: It returns the maximum tax bracket that a combination of income and filing status will reach based on the above table: float taxable_income(float adjusted_gross income, float standard deduction) Description: It returns the taxable income Logic: Taxable income is the net income after subtracting the standard deduction from the adjusted gross income float tax credit float income, byte filing status, byte family members, float pre_credit tax) Description: It returns the amount of tax credit that a person is eligible to receive. Logic: A person is eligible for a tax credit if their initial income is in the low 50% of the median income per capita. The most recent median income per capita in the United States was $31,786. The credit is S30 per each whole thousand dollars of income. If the couple is filing jointly, both spouses are eligible to receive the credit. Each child is eligible for an additional $20, or half of it if parents are filing separately. Maximum credit per tax return is $1,000 or the amount of pre-credit tax, whichever is lower float bracket income(float income, byte filing status, byte bracket) Description: Given a certain income, filing status and tax bracket, it returns the portion of that income that falls within that bracket, based on the following tax table: bracketIncome (single) $0 to $10,000 $10,000.01 to $40,000 40,000.01 to $80,000 $80,000.01 to $160,000 $160,000.01 or more Married (iointly) $0 to $20,000 $20,000.01 to $70,000 $70,000.01 to $160,000 $160,000.01 to $310,000 $310,000.01 or more Married (separately $0 to $12,000 $12,000.01 to $44,000 $44,000.01 to $88,000 $88,000.01 to $170,000 $170,000.01 or more byte max bracket(float income, byte filing status) Description: It returns the maximum tax bracket that a combination of income and filing status will reach based on the above table