Question

Java tax calculator This is my java statement public static void main(String[] args) { final double RATE1 = 0.15; final double RATE2 = 0.28; final

Java tax calculator

This is my java statement

public static void main(String[] args)

{

final double RATE1 = 0.15;

final double RATE2 = 0.28;

final double RATE3 = 0.31;

final double S1 = 21450.0;

final double S2 = 51900.0;

final double M1 = 35800.0;

final double M2 = 86500.0;

char S = 0;

char status = S;

double income = 21450;

int Dependents = 0;

double Taxowed = 0;

Scanner in = new Scanner(System.in);

System.out.print("Filling status"+status);

System.out.print(" Annual Gross Income");

System.out.print(" Dependents: "+Dependents);

System.out.print(" Tax Owed");

if ( status == 'S' )

{

if ( income

Taxowed = RATE1 * income;

else if ( income

Taxowed = RATE1 * S1

+ RATE2 * (income - S1);

else

Taxowed = RATE1 * S1

+ RATE2 * (S2 - S1)

+ RATE3 * (income - S2);

}

else

{

if ( income

Taxowed = RATE1 * income;

else if ( income

Taxowed = RATE1 * M1

+ RATE2 * (income - M1);

else

Taxowed = RATE1 * M1

+ RATE2 * (M2 - M1)

+ RATE3 * (income - M2);

}

}

}

Output should follow this format

I don't know how to make code about dependents and tax owed when dependents present.

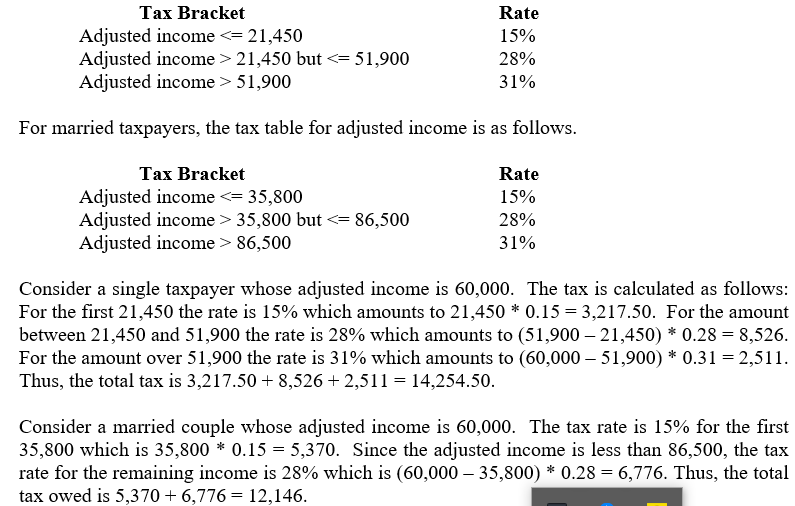

This is explanation about this problem

Thank you.

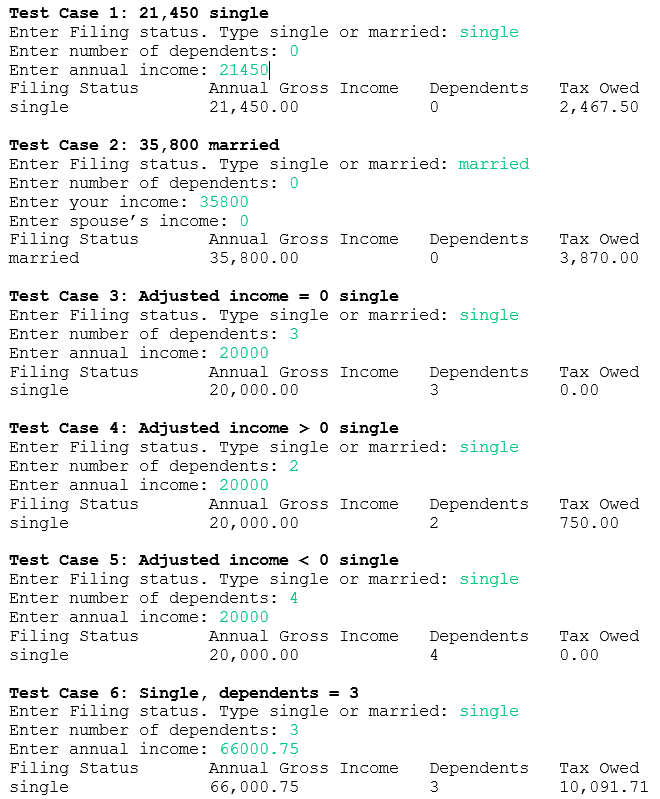

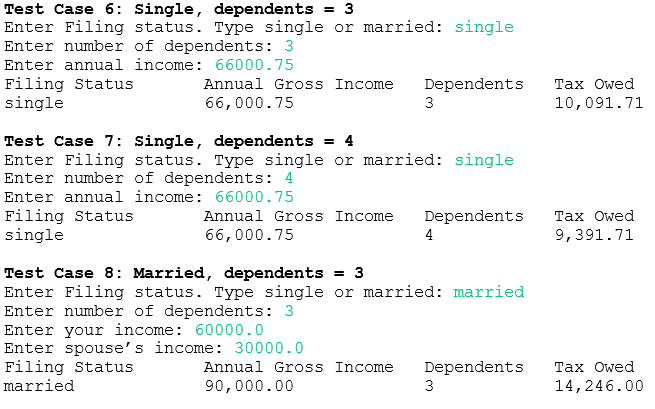

Test Case 1: 21,450 single Enter Filing status. Type single or married: single Enter number of dependents: 0 Enter annual income: 2145 Filing Status single Annual Gross Income Depndents Tax Owed 21,450.00 2, 467.50 Test Case 2: 35,800 married Enter Filing status. Type single or married: married Enter number of dependents: 0 Enter your income: 35800 Enter spouse' s income: 0 Filing Status married Annual Gross Income Depndents Tax Owed 35,800.00 3,870.00 Test Case 3: Adjusted income 0 single Enter Filing status. Type single or married: single Enter number of dependents: 3 Enter annual income: 20000 Filing Status single Annual Gross Income Depndents Tax Owed 20,000.00 3 0.00 Test Case 4: Adjusted income > 0 single Enter Filing status. Type single or married: single Enter number of dependents: 2 Enter annual income: 20000 Filing Status single Annual Gross Income Depndents Tax Owed 20,000.00 750.00 Test Case 5: Adjusted incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started