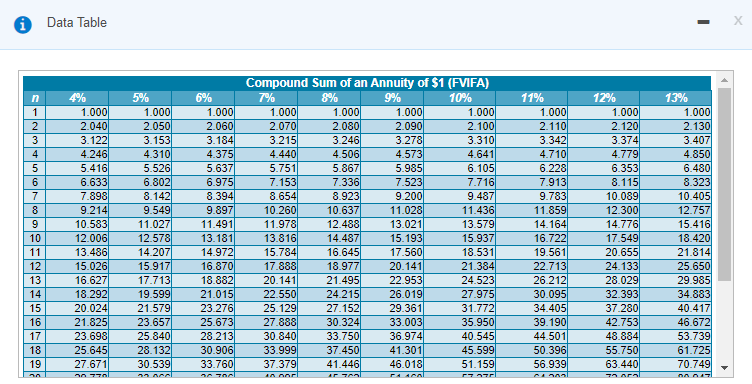

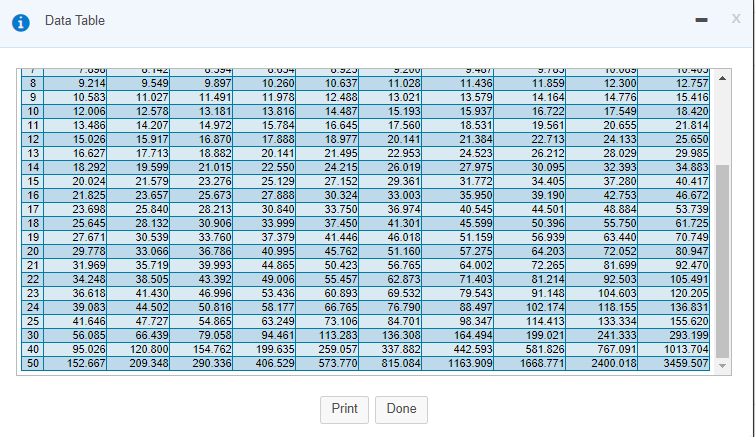

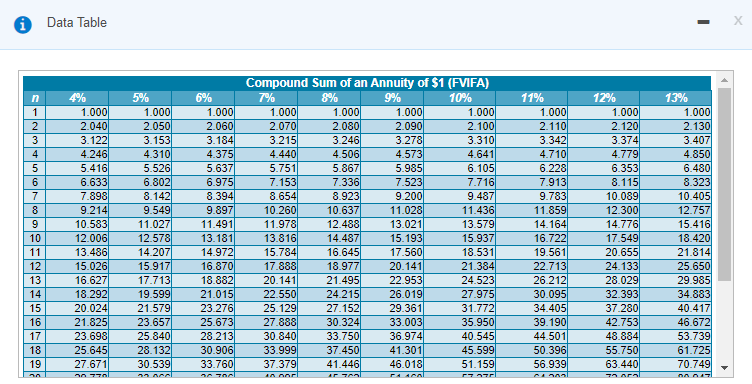

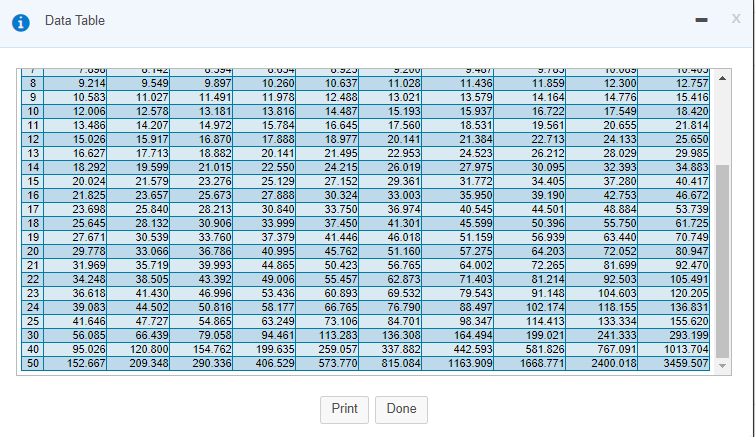

Javier is currently paying $1,200 in interest on his credit cards annually. If, instead of paying interest, he saved this amount every year, how much would he accumulate in a tax-deferred account earning 9 percent over 11, 16, or 21 years? Click on the table icon to view the FVIFA table : Data Table - VONS n 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 4% 1.000 2.040 3.122 4.246 5.416 6.633 7.898 9.214 10.583 12.006 13.486 15.026 16.627 18.292 20.024 21.825 23.698 25.645 27.671 5% 1.000 2.050 3.153 4.310 5.526 6.802 8.142 9.549 11.0271 12.5781 14.207 15.917 17.7131 19.599 21.579 23.657 25.840 28.132 30.539 ANAAL 6% 1.000 2.060 3.184 4.375 5.637 6.975 8.394 9.897 11.491 13.181 14.972 16.870 18.882 21.015 23.276 25.673 28.213 30.906 33.760 Compound Sum of an Annuity of $1 (FVIFA) 7% 8% 9% 10% 1.000 1.000 1.000 1.000 2.070 2.080 2.090 2.100 3.215 3.246 3.278 3.310 4.440 4.506 4.573 4.641 5.751 5.867 5.985 6.105 7.153 7.336 7.523 7.716 8.654 8.923 9.200 9.487 10.2601 10.6371 11.028 11.436 11.978 12.488 13.021 13.579 13.816 14.4871 15.193 15.937 15.784 16.645 17.560 18.531 17.888 18.977 20.141 21.384 20.141 21.495 22.9531 24.523| 22.550 24.215 26.019 27.975 25.129 27.152 29.361 31.772 27.888 30.324 33.003 35.950 30.8401 33.750 36.974 40.545 33.999 37.450 41.301 45.599 37.379 41.446 46.018 51.159 11% 1.000 2.110 3.342| 4.710 6.228 7.913 9.7831 11.859 14.164 16.722 19.561 22.713 26.212 30.095 34.405 39.190 44.501 50.396 56.939 12% 1.000 2.120 3.374 4.779 6.353 8.115 10.089| 12.300 14.776 17.549 20.655 24.133 28.029 32.393 37.280 42.753 48.884 55.750 63.440 13% 1.000 2.130 3.407 4.850 6.480 8.323 10.405 12.757 15.4161 18.420 21.814 25.650 29.985 34.883 40.417 46.672 53.739 61.725 70.749 AnnA T. 70 Aral Data Table - 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 30 40 50 7.09U 9.214 10.583 12.006 13.486 15.026 16.627 18.292 20.024 21.825 23.698 25.645 27.6711 29.778 31.969 34.248 36.618 39.083 41.646 56.085 95.026 152.667 0.1421 9.549 11.0271 12.578 14 207 15.917 17.7131 19.599 21.579 23.657 25.840 28.132 30.539 33.066 35.719 38.505 41.430 44.502 47.727 66.439 120.800 209.348 9.897 11.491 13.181) 14.972 16.870 18.882 21.015 23.276 25.673 28.213 30.906 33.760 36.786 39.993 43.392 46.996 50.816 54.865 79.058 154.762 290.336 0.009 | 10.260 11.978 13.816 15.784 17.888 20.1411 22.550 25.129 27.888 30.8401 33.999 37.379 40.995 44.865 49.006 53.436 58.177 63.249 94.461 199.635 406.529 0.92 10.637 12.488 14.487 16.645 18.977 21.495 24.215 27.152 30.324 33.750 37.450 41.446 45.762 50.423 55.457 60.8931 66.765 73.106 113.283 259.057 573.770 9.2VV 11.028 13.021 15.193 17.560 20.141 22.953 26.019 29.361 33.003 36.974 41.301 46.0181 51.160 56.765 62.873 69.532 76.790 84.701 136.308 337.882 815.084 9.07 11.436 13.579 15.937 18.5311 21.384 24.523 27.975 31.772 35.950 40.545 45.599 51.159 57.275 64.0021 71.403 79.543 88.497 98.347 164.494 442.593 1163.909 9.70 11.859 14.164 16.722 19.561 22.713 26.212 30.095 34.4051 39.190 44.501 50.396 56.939 64.203 72.265 81.214 91.148 102. 174 114.413 199.021 581.826 1668.771 TV.VU 12.300 14.776 17.549 20.655 24.133 28.029 32.393 37.280 42.753 48.884 55.750 63.440 72.052 81.699 92.503 104.603 118.155 133.334 241.333 767.091 2400.018 TU.400 12.7571 15.416 18.420 21.814 25.650 29.985 34.883 40.417 46.672 53.739 61.725 70.749 80.947 92.470 105.491 120.205 136.831 155.620 293.199 1013.704 3459.507 Print Done