Answered step by step

Verified Expert Solution

Question

1 Approved Answer

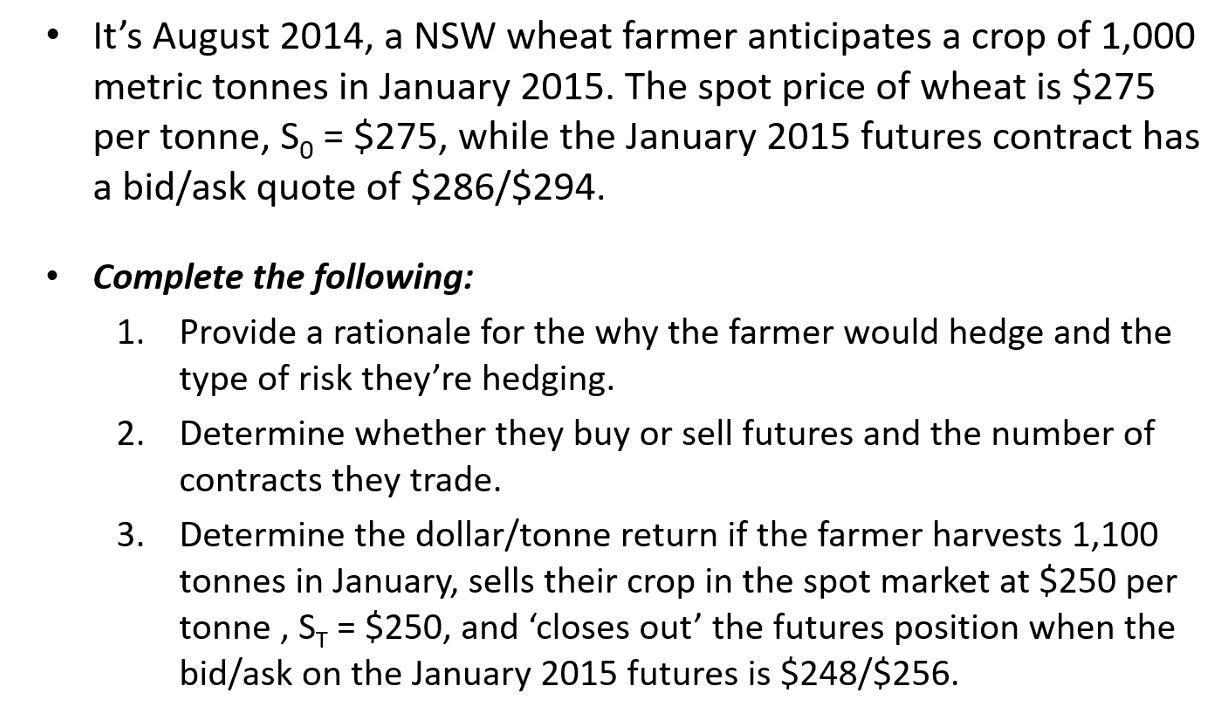

It's August 2014, a NSW wheat farmer anticipates a crop of 1,000 metric tonnes in January 2015. The spot price of wheat is $275

It's August 2014, a NSW wheat farmer anticipates a crop of 1,000 metric tonnes in January 2015. The spot price of wheat is $275 per tonne, So = $275, while the January 2015 futures contract has a bid/ask quote of $286/$294. Complete the following: 1. Provide a rationale for the why the farmer would hedge and the type of risk they're hedging. 2. Determine whether they buy or sell futures and the number of contracts they trade. 3. Determine the dollar/tonne return if the farmer harvests 1,100 tonnes in January, sells their crop in the spot market at $250 per tonne, S = $250, and 'closes out' the futures position when the bid/ask on the January 2015 futures is $248/$256.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 The farmer is hed ging against the risk of the wheat price falling below 286 per ton ne by January ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started