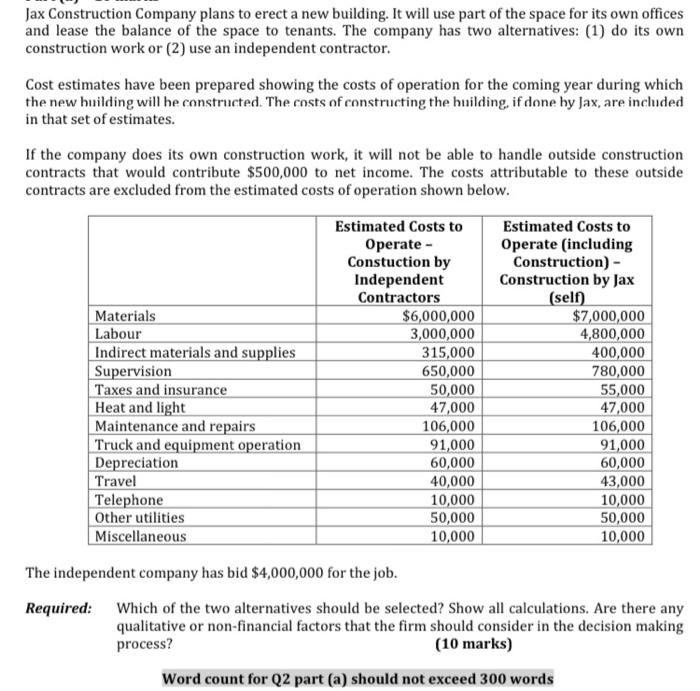

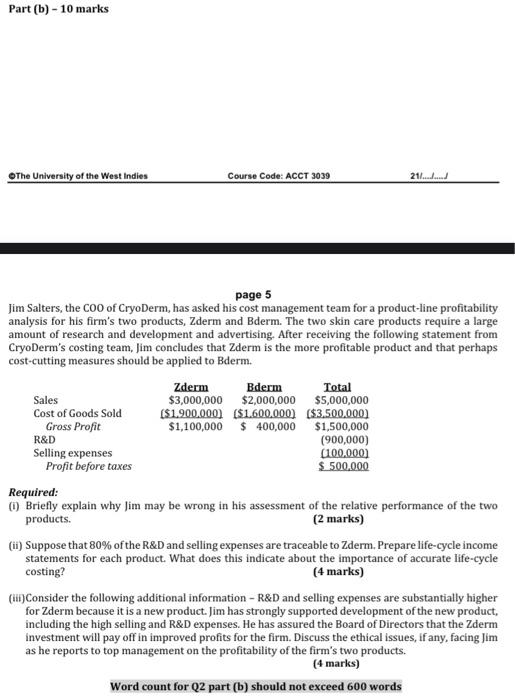

Jax Construction Company plans to erect a new building. It will use part of the space for its own offices and lease the balance of the space to tenants. The company has two alternatives: (1) do its own construction work or (2) use an independent contractor. Cost estimates have been prepared showing the costs of operation for the coming year during which the new building will be constructed. The costs of constructing the building, if done by Jax, are included in that set of estimates. If the company does its own construction work, it will not be able to handle outside construction contracts that would contribute $500,000 to net income. The costs attributable to these outside contracts are excluded from the estimated costs of operation shown below. Materials Labour Indirect materials and supplies Supervision Taxes and insurance Heat and light Maintenance and repairs Truck and equipment operation Depreciation Travel Telephone Other utilities Miscellaneous Estimated Costs to Operate - Constuction by Independent Contractors $6,000,000 3,000,000 315,000 650,000 50,000 47,000 106,000 91,000 60,000 40,000 10,000 50,000 10,000 Estimated Costs to Operate (including Construction) - Construction by Jax (self) $7,000,000 4,800,000 400,000 780,000 55,000 47,000 106,000 91,000 60,000 43,000 10,000 50,000 10,000 The independent company has bid $4,000,000 for the job. Required: Which of the two alternatives should be selected? Show all calculations. Are there any qualitative or non-financial factors that the firm should consider in the decision making process? (10 marks) Word count for Q2 part (a) should not exceed 300 words Part (b) - 10 marks The University of the West Indies Course Code: ACCT 3039 211 page 5 Jim Salters, the COO of CryoDerm, has asked his cost management team for a product-line profitability analysis for his firm's two products, Zderm and Bderm. The two skin care products require a large amount of research and development and advertising. After receiving the following statement from CryoDerm's costing team, Jim concludes that Zderm is the more profitable product and that perhaps cost-cutting measures should be applied to Bderm. Zderm Bderm Total Sales $3,000,000 $2,000,000 $5,000,000 Cost of Goods Sold ($1.900.000) ($1.600.000) ($3.500.000) Gross Profit $1,100,000 $400,000 $1,500,000 R&D (900,000) Selling expenses (100.000) Profit before taxes $ 500.000 Required: O Briefly explain why Jim may be wrong in his assessment of the relative performance of the two products. (2 marks) (ii) Suppose that 80% of the R&D and selling expenses are traceable to Zderm. Prepare life-cycle income statements for each product. What does this indicate about the importance of accurate life-cycle costing? (4 marks) (11)Consider the following additional information - R&D and selling expenses are substantially higher for Zderm because it is a new product. Jim has strongly supported development of the new product, including the high selling and R&D expenses. He has assured the Board of Directors that the Zderm investment will pay off in improved profits for the firm. Discuss the ethical issues, if any, facing Jim as he reports to top management on the profitability of the firm's two products. (4 marks) Word count for Q2 part (b) should not exceed 600 words