Answered step by step

Verified Expert Solution

Question

1 Approved Answer

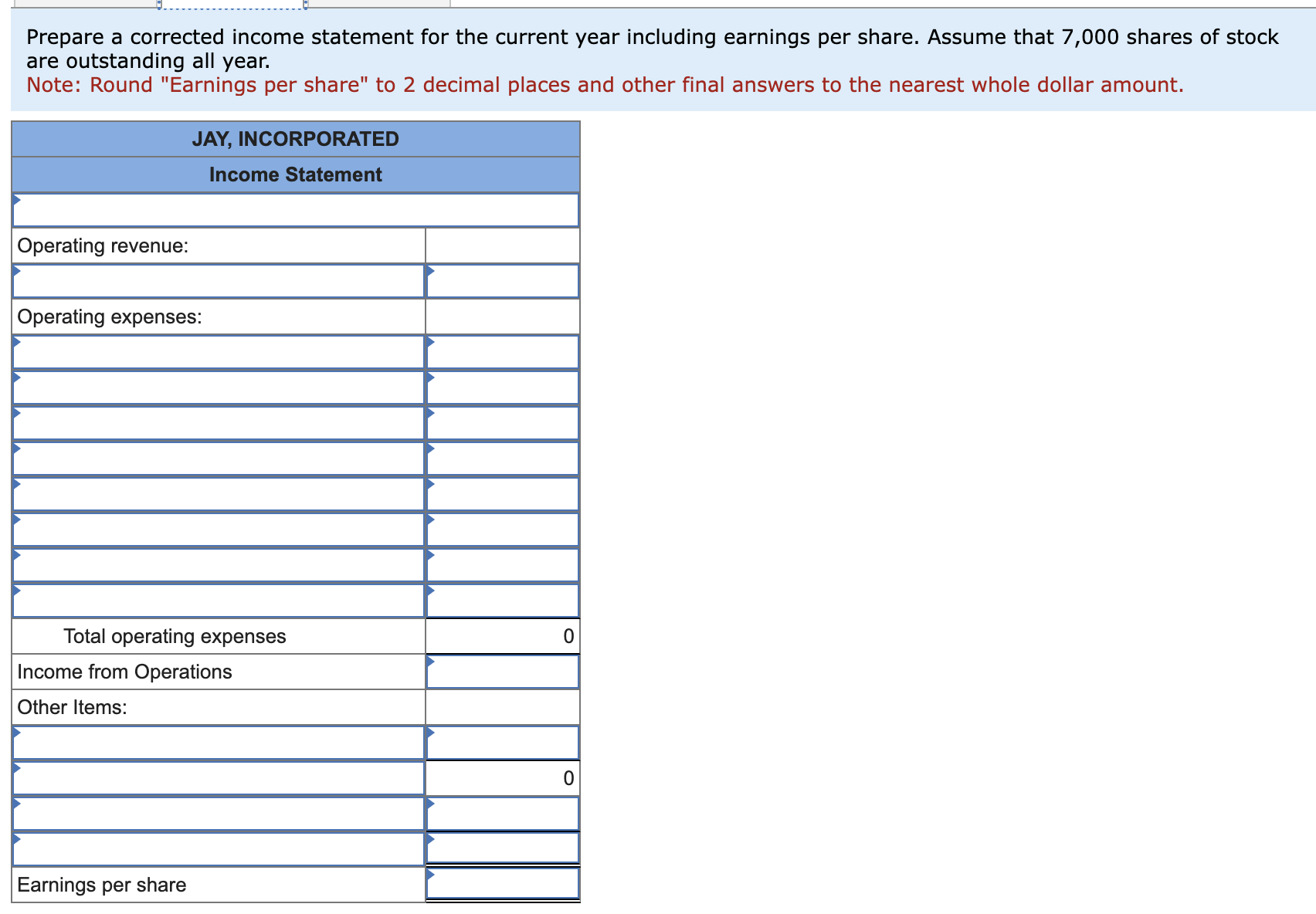

Jay, Incorporated, a party rental business, completed its third year of operations on December 3 1 . Because this is the end of the annual

Jay, Incorporated, a party rental business, completed its third year of operations on December Because this is the end of the annual

accounting period, the company bookkeeper prepared the following tentative income statement:

You are an independent CPA hired by the company to audit the company's accounting systems and review the financial statements. In

your audit, you developed additional data as follows:

a Salaries and wages for the last three days of December amounting to $ were not recorded or paid.

b Jay estimated telephone usage at $ for December, but nothing has been recorded or paid.

c Depreciation on rental autos, amounting to $ for the current year, was not recorded.

d Interest on a $ oneyear, percent note payable dated October of the current year was not recorded. The percent

interest is payable on the maturity date of the note.

e Maintenance expense excludes $ representing the cost of maintenance supplies used during the current year.

f The Unearned Rent Revenue account includes $ of revenue to be earned in January of next year.

g The income tax expense is $ Payment of income tax will be made next year.Prepare a corrected income statement for the current year including earnings per share. Assume that shares of stock

are outstanding all year.

Note: Round "Earnings per share" to decimal places and other final answers to the nearest whole dollar amount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started