Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jay is a single, self-employed individual who owns his own business. During 2022, Jay reported $250,000 gross income and $20,000 of business expenses. He also

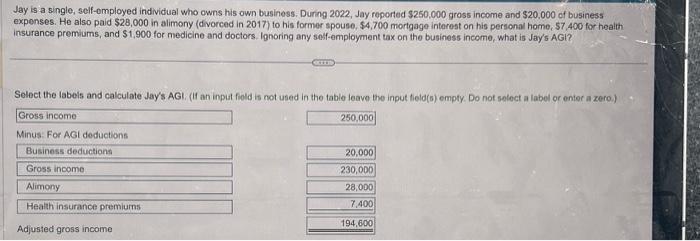

Jay is a single, self-employed individual who owns his own business. During 2022, Jay reported $250,000 gross income and $20,000 of business expenses. He also paid $28,000 in alimony (divorced in 2017) to his former spouse, $4,700 mortgage interest on his personal home, $7,400 for health insurance premiums, and $1,900 for medicine and doctors. Ignoring any self-employment tax on the business income, what is Jay's AGI? Select the labels and calculate Jay's AGI. (If an input field is not used in the table leave the input field(s) empty. Do not select a label or enter a zero.) Gross income 250,000 Minus: For AGI deductions Business deductions Gross income Alimony Health insurance premiums Adjusted gross income 20,000 230,000 28,000 7,400 194,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started