Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jay Pembroke started a business. During the first month (April 20--), the following transactions occurred. Invested cash in business, $18,063. Bought office supplies for $4,696:

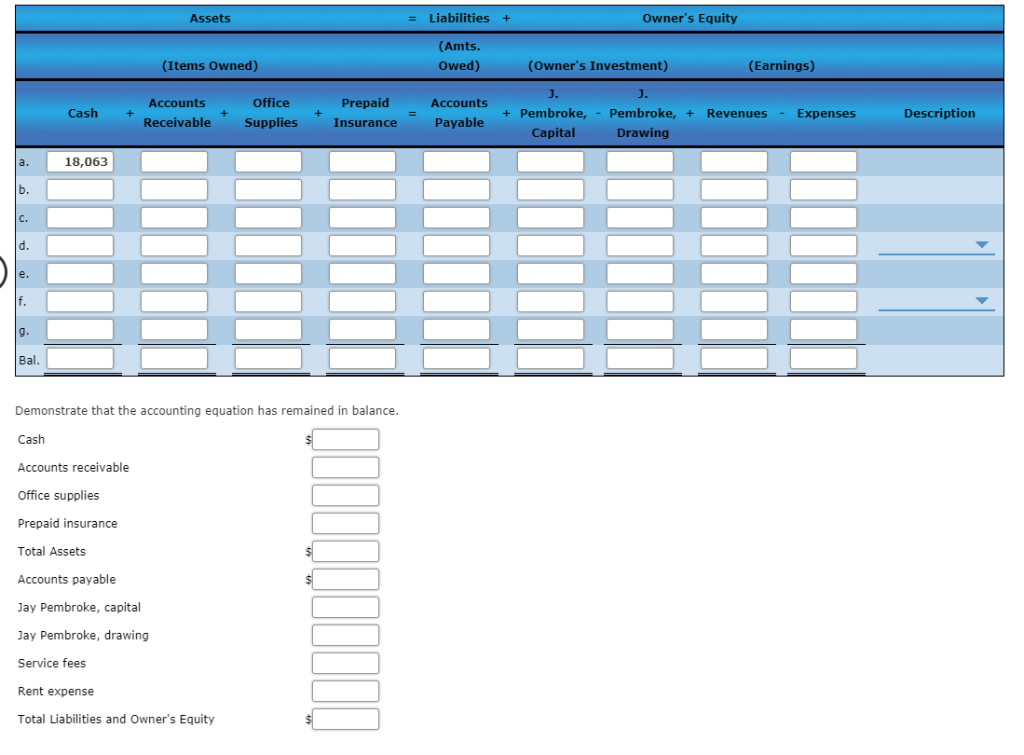

Jay Pembroke started a business. During the first month (April 20--), the following transactions occurred.

- Invested cash in business, $18,063.

- Bought office supplies for $4,696: $2,075 in cash and $2,621 on account.

- Paid one-year insurance premium, $1,170.

- Earned revenues totaling $3,365: $1,477 in cash and $1,888 on account.

- Paid cash on account to the company that supplied the office supplies in transaction (b), $2,329.

- Paid office rent for the month, $870.

- Withdrew cash for personal use, $149.

Required:

Show the effect of each transaction on the individual accounts of the expanded accounting equation: Assets = Liabilities + Owner's Equity (Capital - Drawing + Revenues - Expenses). After transaction (g), report the totals for each element. Use the minus sign to indicate a decrease or reduction in the account. If an amount box does not require an entry, leave it blank.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started