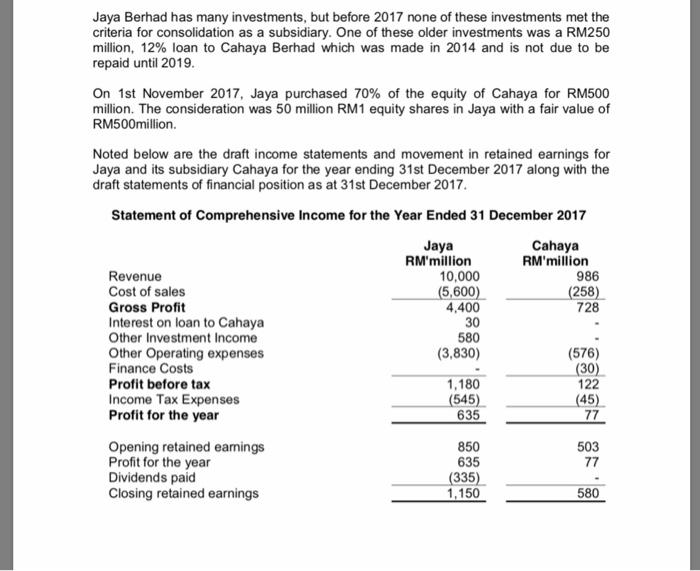

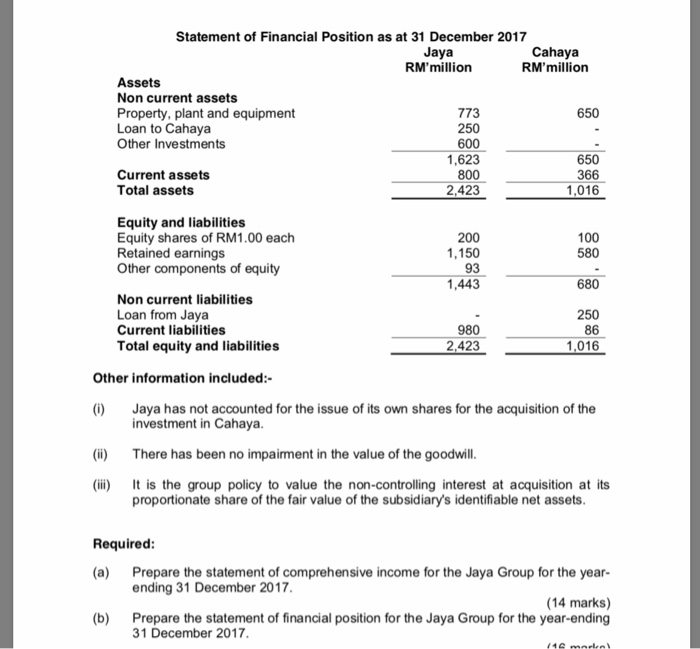

Jaya Berhad has many investments, but before 2017 none of these investments met the criteria for consolidation as a subsidiary. One of these older investments was a RM250 million, 12% loan to Cahaya Berhad which was made in 2014 and is not due to be repaid until 2019 On 1st November 2017, Jaya purchased 70% of the equity of Cahaya for RM500 million. The consideration was 50 million RM1 equity shares in Jaya with a fair value of RM500million Noted below are the draft income statements and movement in retained earnings for Jaya and its subsidiary Cahaya for the year ending 31st December 2017 along with the draft statements of financial position as at 31st December 2017 Statement of Comprehensive Income for the Year Ended 31 December 2017 Jaya RM'million Cahaya RM'million 986 (5,600)(258) 728 Revenue Cost of sales Gross Profit Interest on loan to Cahaya Other Investment Income Other Operating expenses Finance Costs Profit before tax Income Tax Expenses Profit for the year 10,000 4,400 30 580 (3,830) (576) 1,180 122 (545) 635 850 635 Opening retained eamings Profit for the year Dividends paid Closing retained earnings 503 335) 1,150 580 Statement of Financial Position as at 31 December 2017 Jaya RM'million Cahaya RM'million Assets Non current assets Property, plant and equipment Loan to Cahaya Other Investments 773 250 600 1,623 800 2,423 650 Current assets Total assets 650 366 1,016 Equity and liabilities Equity shares of RM1.00 each Retained earnings Other components of equity 100 580 200 1,150 93 1,443 680 Non current liabilities Loan from Jaya Current liabilities 980 2,423 250 86 1,016 Total equity and liabilities Other information included:- (i) Jaya has not accounted for the issue of its own shares for the acquisition of the (ii) There has been no impairment in the value of the goodwill (ili) is the group policy to value the non-controlling interest at acquisition at its investment in Cahaya proportionate share of the fair value of the subsidiary's identifiable net assets Required (a) Prepare the statement of comprehensive income for the Jaya Group for the year- ending 31 December 2017 (14 marks) (b) Prepare the statement of financial position for the Jaya Group for the year-ending 31 December 2017 Jaya Berhad has many investments, but before 2017 none of these investments met the criteria for consolidation as a subsidiary. One of these older investments was a RM250 million, 12% loan to Cahaya Berhad which was made in 2014 and is not due to be repaid until 2019 On 1st November 2017, Jaya purchased 70% of the equity of Cahaya for RM500 million. The consideration was 50 million RM1 equity shares in Jaya with a fair value of RM500million Noted below are the draft income statements and movement in retained earnings for Jaya and its subsidiary Cahaya for the year ending 31st December 2017 along with the draft statements of financial position as at 31st December 2017 Statement of Comprehensive Income for the Year Ended 31 December 2017 Jaya RM'million Cahaya RM'million 986 (5,600)(258) 728 Revenue Cost of sales Gross Profit Interest on loan to Cahaya Other Investment Income Other Operating expenses Finance Costs Profit before tax Income Tax Expenses Profit for the year 10,000 4,400 30 580 (3,830) (576) 1,180 122 (545) 635 850 635 Opening retained eamings Profit for the year Dividends paid Closing retained earnings 503 335) 1,150 580 Statement of Financial Position as at 31 December 2017 Jaya RM'million Cahaya RM'million Assets Non current assets Property, plant and equipment Loan to Cahaya Other Investments 773 250 600 1,623 800 2,423 650 Current assets Total assets 650 366 1,016 Equity and liabilities Equity shares of RM1.00 each Retained earnings Other components of equity 100 580 200 1,150 93 1,443 680 Non current liabilities Loan from Jaya Current liabilities 980 2,423 250 86 1,016 Total equity and liabilities Other information included:- (i) Jaya has not accounted for the issue of its own shares for the acquisition of the (ii) There has been no impairment in the value of the goodwill (ili) is the group policy to value the non-controlling interest at acquisition at its investment in Cahaya proportionate share of the fair value of the subsidiary's identifiable net assets Required (a) Prepare the statement of comprehensive income for the Jaya Group for the year- ending 31 December 2017 (14 marks) (b) Prepare the statement of financial position for the Jaya Group for the year-ending 31 December 2017