Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jayden s Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mrs

Jaydens Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mrs Wilson, the banker, will finance construction if the firm can present an acceptable threemonth financial plan for January through March. The following are actual and forecast sales figures:Jayden's Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mrs Wilson, the banker, will finance construction if the firm can present an acceptable threemonth financial plan for January through March. The following are actual and forecast sales figures:

tableActualForecast,Additional InformationNovember$January,$April forecast,$

Actual Forecast Additional Information

November $ January $ April forecast $ Of the firm's sales, percent are for cash and the remaining percent are on credit. Of credit sales, percent are pald in the

month after sale and percent are pald in the second month after the sale. Materlals cost percent of sales and are purchased and

recelved each month In an amount sufficlent to cover the following month's expected sales. Materlals are pald for in the month after

they are recelved. Labor expense is percent of sales and is pald for in the month of sales. Selling and administrative expense is

percent of sales and is paid in the month of sales. Overhead expense is $ in cash per month.

Depreclation expense is $ per month. Taxes of $ will be pald in January, and dividends of $ will be pald in March.

Cash at the beginning of January is $ and the minimum desired cash balance is $

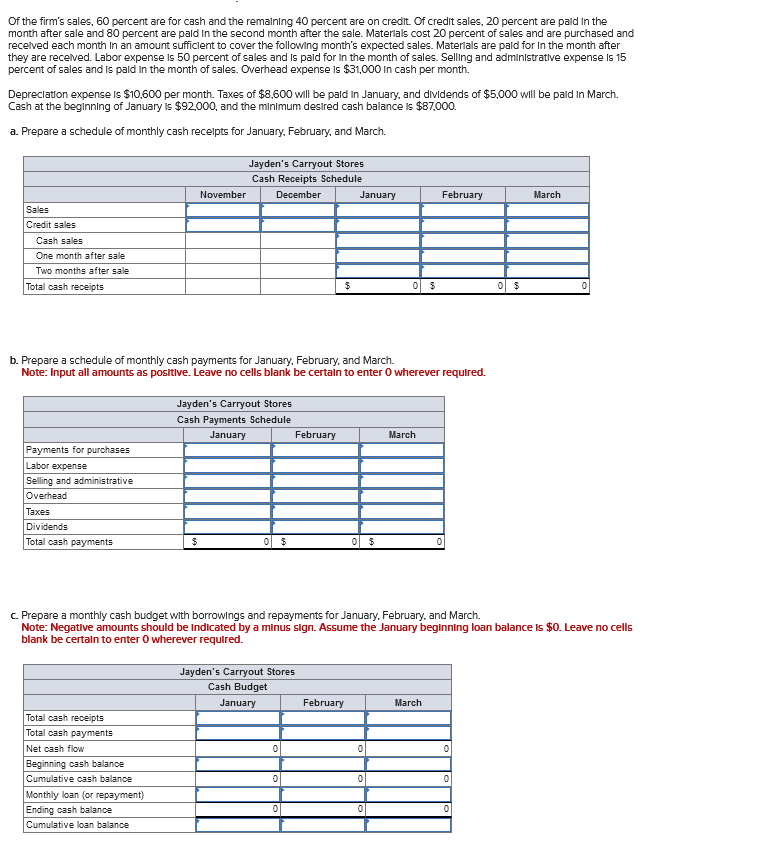

a Prepare a schedule of monthly cash recelpts for January, February, and March.

b Prepare a schedule of monthly cash payments for January, February, and March.

Note: Input all amounts as positive. Leave no cells blank be certain to enter wherever required.

c Prepare a monthly cash budget with borrowings and repayments for January, February, and March.

Note: Negative amounts should be indicated by a minus sign. Assume the January beginning loan balance is $ Leave no cells

blank be certain to enter wherever required.

December February

March

Of the firms sales, percent are for cash and the remaining percent are on credit. Of credit sales, percent are paid in the month after sale and percent are paid in the second month after the sale. Materials cost percent of sales and are purchased and received each month in an amount sufficient to cover the following months expected sales. Materials are paid for in the month after they are received. Labor expense is percent of sales and is paid for in the month of sales. Selling and administrative expense is percent of sales and is paid in the month of sales. Overhead expense is $ in cash per month.

Depreciation expense is $ per month. Taxes of $ will be paid in January, and dividends of $ will be paid in March. Cash at the beginning of January is $ and the minimum desired cash balance is $

Prepare a schedule of monthly cash receipts for January, February, and March.

Prepare a schedule of monthly cash payments for January, February, and March.

Note: Input all amounts as positive. Leave no cells blank be certain to enter wherever required.

Prepare a monthly cash budget with borrowings and repayments for January, February, and March.

Note: Negative amounts should be indicated by a minus sign. Assume the January beginning loan balance is $ Leave no cells blank be certain to enter wherever required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started