Question

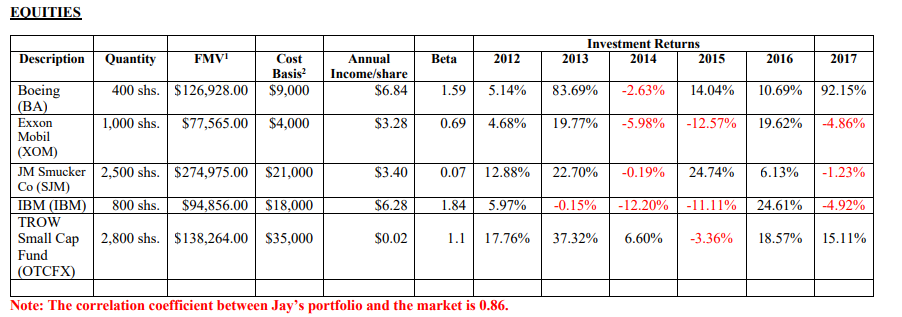

Jay's Current Portfolio. Use to answer question below. Please explain answer as best as possible. Your investment research department is currently recommending any of the

Jay's Current Portfolio. Use to answer question below. Please explain answer as best as possible.

Your investment research department is currently recommending any of the following securities for purchase by firm clients, assuming each is suitable for client objectives:

Investment Current FMV Current Yield Correlation Coefficient

Fund A $32.875 1.25% 0.95

Fund B $25.500 3.22% 0.89

Fund C $12.625 5.63% 0.78

Fund D $18.375 2.10% -0.26

From the perspective of total risk reduction, which fund would you be inclined to recommend to Jay for consideration at your next client meeting?

| Fund A, because it has the highest price per share and its correlation coefficient would raise the correlation coefficient of Jay's portfolio. |

| Fund B, because it pays a reasonable current return and is closest to the correlation coefficient of Jay's portfolio. |

| Fund C, because it is the least costly and the highest yielding, which reduces risk |

| Fund D, because it would be expected to reduce the portfolio's overall correlation coefficient with the market |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started