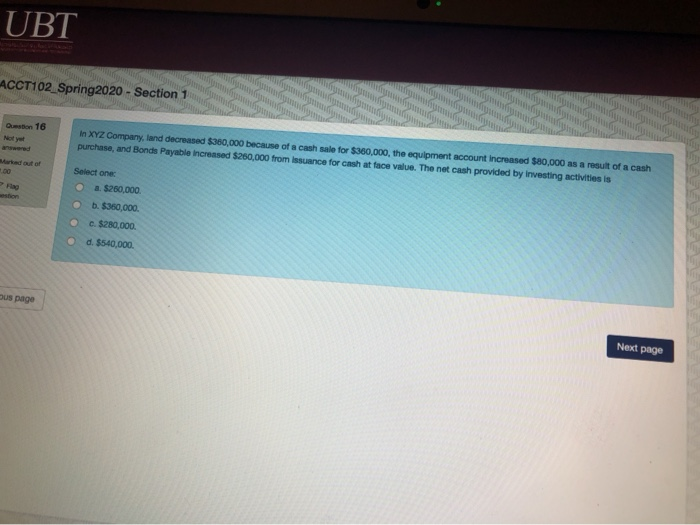

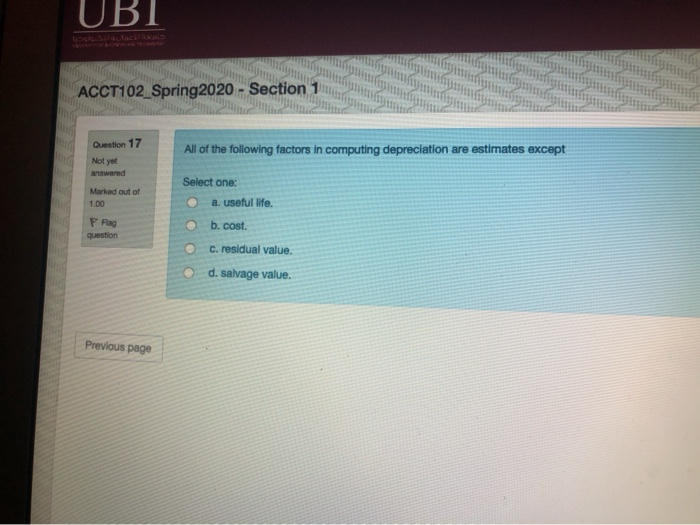

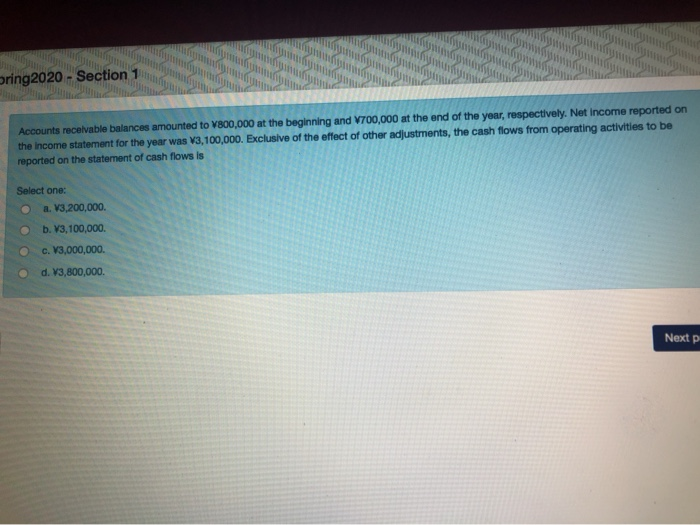

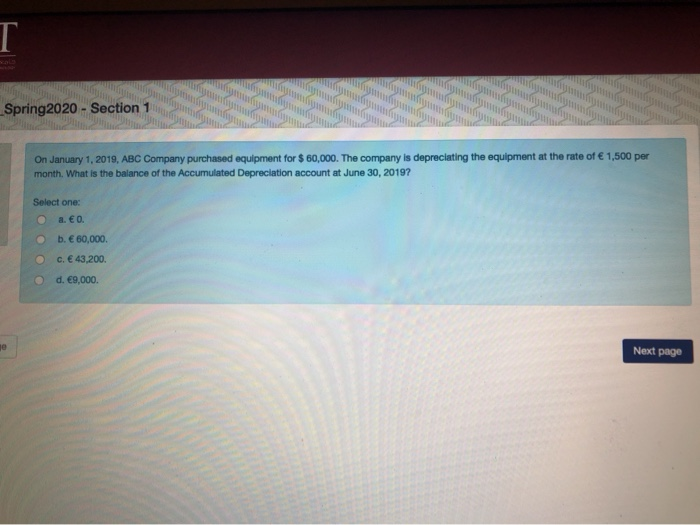

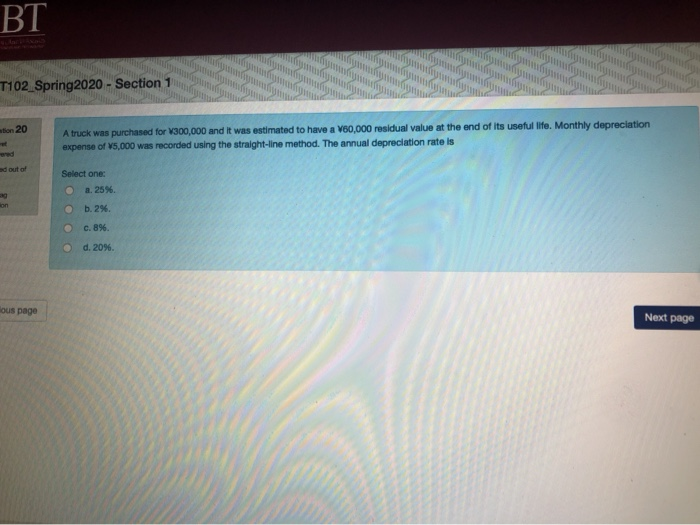

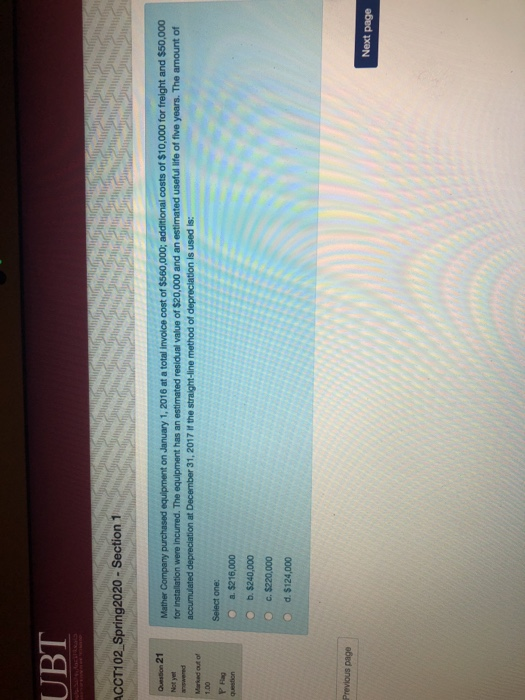

JBT CCT102 Spring 2020 - Section 1 ston 16 in XYZ Company, and decreased $360,000 because of cash sale for $360,000, the equipment account increased $80,000 as a result of cash purchase, and Bonds Payable increased $200,000 from issuance for cash at face value. The net cash provided by investing activities is Select one a. $260,000 b. $360,000 c. $280,000 d. $540,000 us page Next page UBI ACCT102_Spring2020 - Section 1 Question 17 All of the following factors in computing depreciation are estimates except Not yet answered Marked out of 1.00 Select one: a. useful life. b. cost P Flag question c. residual value. d. salvage value. Previous page www Bring 2020 - Section 1 Accounts receivable balances amounted to V800,000 at the beginning and V700,000 at the end of the year, respectively. Net Income reported on the income statement for the year was 3,100,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is Select one: a. 13,200,000 b. 13,100,000 c. 13,000,000 d. 13,800,000 Next Spring2020 - Section 1 On January 1, 2019, ABC Company purchased equipment for $ 60,000. The company is depreciating the equipment at the rate of 1,500 per month. What is the balance of the Accumulated Depreciation account at June 30, 20197 Select one: a 0 b. 60,000 c. 43,200 d. 9,000 Next page BT T102_Spring2020 - Section 1 Www mtion 20 A truck was purchased for 300,000 and it was estimated to have a V60,000 residual value at the end of its useful life. Monthly depreciation expense of 5,000 was recorded using the straight-line method. The annual depreciation rate is ed out of Select one: 0.25% O b.2% c.8%. d. 20% lous page Next page UBT W ACCT102_Spring2020 - Section 1 www. WW Question 21 Mather Company purchased equipment on January 1, 2016 at a total invoice cost of $560,000; additional costs of $10,000 for freight and $50,000 for installation were incurred. The equipment has an estimated residual value of $20,000 and an estimated useful life of five years. The amount of accumulated depreciation at December 31, 2017 If the straight-line method of depreciation is used is: Marked out of Select one: a. $216,000 b. $240,000 O c. $220,000 O d. $124,000 Previous page Next page