Question

JDI Ltd. owned several manufacturing facilities. On September 15 of the current year, JDI decided to sell one of its manufacturing buildings. The building had

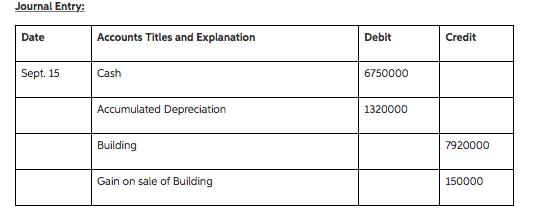

JDI Ltd. owned several manufacturing facilities. On September 15 of the current year, JDI decided to sell one of its manufacturing buildings. The building had cost $7,920,000 when originally purchased 5 years ago, and had been depreciated using the straight-line method with no residual value. JDI estimated that the building had a 30 year life when purchased.

The journal entry to record the sale of the building on JDI's books, assuming 5 years of depreciation has already been recorded in the accounts the building was sold for $6,750,000 cash.

Prepare the journal entry to record the sale of the building on JDI's books, assuming 5 years of depreciation has already been recorded in the accounts the building was sold for $6,600,000 cash.

Journal Entry: Date Accounts Titles and Explanation Debit Credit Sept. 15 Cash 6750000 Accumulated Depreciation 1320000 Building 7920000 Gain on sale of Building 150000

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

punehase priee of Buileing 7920000 30 years Estimated life of buf...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started