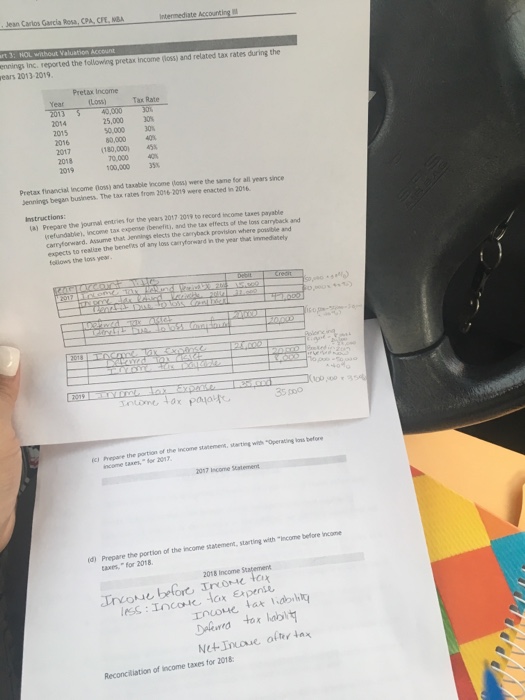

Jean Carlos Garcia Rosa, CPA, cr. NEA Internediate Accounting nnings Inc., reported the followng pretax Income (loss) and related tax rates during the ears 2013 2019 Pretax Income (Loss) Tax Rate 25,000 30 50.000 30% 80.000 40 (180,000 4% 2017 2018 100,000 Pretax finaecial income (oss) and taxable income (loss) were the sane for all years since ennings began business. The tax rates from 2016 2019 were enacted in 2016 Instructions (a) Prepare the yournal entries for the years 2017 2019 to record income tases payable tax effects of the loss carryback and refundable. income tax experwe ibenefit, and the ta-et-ects of carryforward. Assume that Jernings elects the carryback provision where expects to follows the loss year carryback provision where posibie and esliae the benetis of any loss carryforward in the year that inmediately 35 too (ci Prepare the portion of the incone statemeatig hoperating lons before 2017 Income Statement d) Prepare the portion of the income statement, starting with "income before income taxes, "for 2018 2018 Income LCOL belor rome tax Reconcikilation of income taxes for 2018 Jean Carlos Garcia Rosa, CPA, cr. NEA Internediate Accounting nnings Inc., reported the followng pretax Income (loss) and related tax rates during the ears 2013 2019 Pretax Income (Loss) Tax Rate 25,000 30 50.000 30% 80.000 40 (180,000 4% 2017 2018 100,000 Pretax finaecial income (oss) and taxable income (loss) were the sane for all years since ennings began business. The tax rates from 2016 2019 were enacted in 2016 Instructions (a) Prepare the yournal entries for the years 2017 2019 to record income tases payable tax effects of the loss carryback and refundable. income tax experwe ibenefit, and the ta-et-ects of carryforward. Assume that Jernings elects the carryback provision where expects to follows the loss year carryback provision where posibie and esliae the benetis of any loss carryforward in the year that inmediately 35 too (ci Prepare the portion of the incone statemeatig hoperating lons before 2017 Income Statement d) Prepare the portion of the income statement, starting with "income before income taxes, "for 2018 2018 Income LCOL belor rome tax Reconcikilation of income taxes for 2018