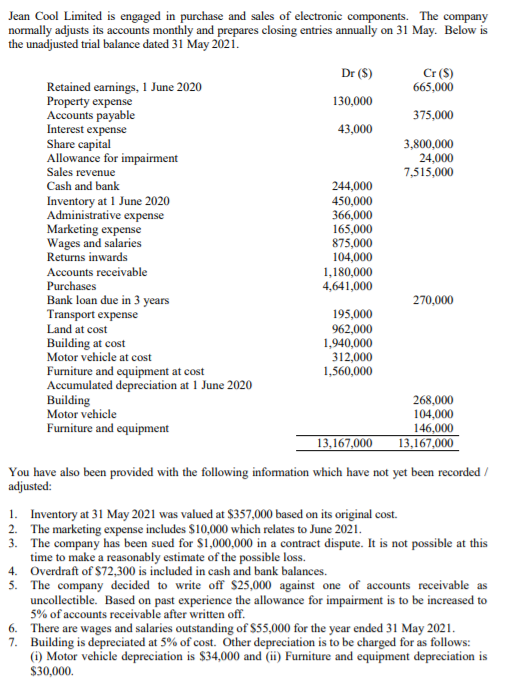

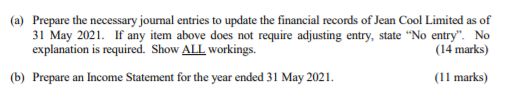

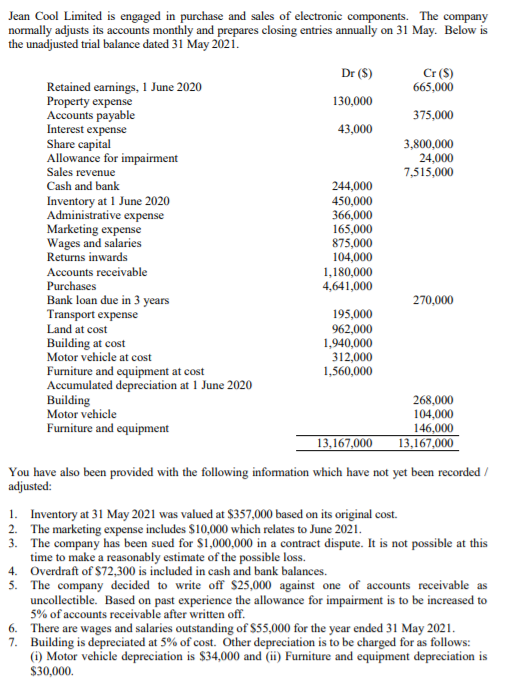

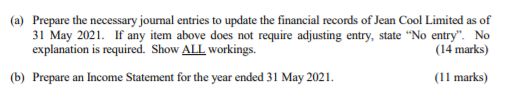

Jean Cool Limited is engaged in purchase and sales of electronic components. The company normally adjusts its accounts monthly and prepares closing entries annually on 31 May. Below is the unadjusted trial balance dated 31 May 2021. Dr ($) Cr (3) Retained earnings, 1 June 2020 665,000 Property expense 130,000 Accounts payable 375,000 Interest expense 43,000 Share capital 3,800,000 Allowance for impairment 24,000 Sales revenue 7,515,000 Cash and bank 244,000 Inventory at 1 June 2020 450,000 Administrative expense 366,000 Marketing expense 165,000 Wages and salaries 875,000 Returns inwards 104,000 Accounts receivable 1,180,000 Purchases 4,641,000 Bank loan due in 3 years 270,000 Transport expense 195,000 Land at cost 962,000 Building at cost 1,940,000 Motor vehicle at cost 312,000 Furniture and equipment at cost 1,560,000 Accumulated depreciation at 1 June 2020 Building 268,000 Motor vehicle 104,000 Furniture and equipment 146,000 13,167,000 13,167,000 You have also been provided with the following information which have not yet been recorded adjusted: 1. Inventory at 31 May 2021 was valued at $357,000 based on its original cost. 2. The marketing expense includes $10,000 which relates to June 2021. 3. The company has been sued for $1,000,000 in a contract dispute. It is not possible at this time to make a reasonably estimate of the possible loss. 4. Overdraft of $72,300 is included in cash and bank balances. 5. The company decided to write off $25,000 against one of accounts receivable as uncollectible. Based on past experience the allowance for impairment is to be increased to 5% of accounts receivable after written off. 6. There are wages and salaries outstanding of $55,000 for the year ended 31 May 2021. 7. Building is depreciated at 5% of cost. Other depreciation is to be charged for as follows: (1) Motor vehicle depreciation is $34,000 and (ii) Furniture and equipment depreciation is $30,000 (a) Prepare the necessary journal entries to update the financial records of Jean Cool Limited as of 31 May 2021. If any item above does not require adjusting entry, state "No entry". No explanation is required. Show ALL workings. (14 marks) (b) Prepare an Income Statement for the year ended 31 May 2021. (11 marks)