Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jebali Corporation, a calendar year taxpayer utilizing the completed contract method of accounting, constructed a building for Samson, Inc., under a long-term contract. The gross

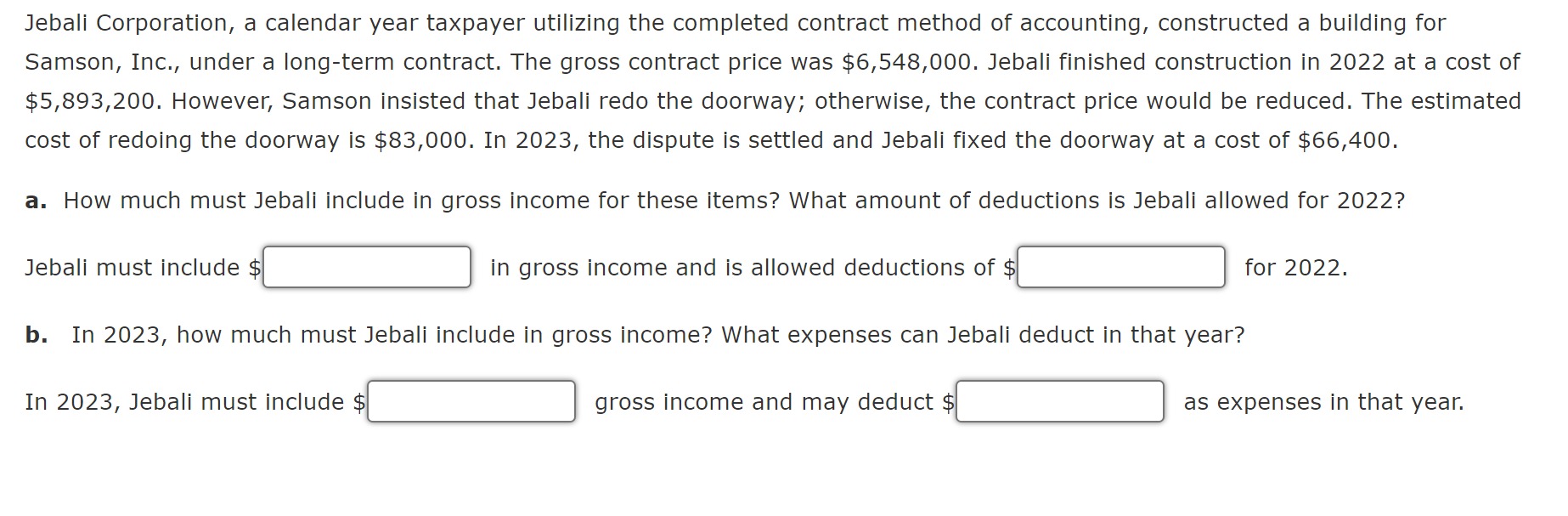

Jebali Corporation, a calendar year taxpayer utilizing the completed contract method of accounting, constructed a building for Samson, Inc., under a long-term contract. The gross contract price was $6,548,000. Jebali finished construction in 2022 at a cost of $5,893,200. However, Samson insisted that Jebali redo the doorway; otherwise, the contract price would be reduced. The estimated cost of redoing the doorway is $83,000. In 2023 , the dispute is settled and Jebali fixed the doorway at a cost of $66,400. a. How much must Jebali include in gross income for these items? What amount of deductions is Jebali allowed for 2022? Jebali must include in gross income and is allowed deductions of \$ for 2022. b. In 2023, how much must Jebali include in gross income? What expenses can Jebali deduct in that year? In 2023, Jebali must include $ gross income and may deduct \$ as expenses in that year

Jebali Corporation, a calendar year taxpayer utilizing the completed contract method of accounting, constructed a building for Samson, Inc., under a long-term contract. The gross contract price was $6,548,000. Jebali finished construction in 2022 at a cost of $5,893,200. However, Samson insisted that Jebali redo the doorway; otherwise, the contract price would be reduced. The estimated cost of redoing the doorway is $83,000. In 2023 , the dispute is settled and Jebali fixed the doorway at a cost of $66,400. a. How much must Jebali include in gross income for these items? What amount of deductions is Jebali allowed for 2022? Jebali must include in gross income and is allowed deductions of \$ for 2022. b. In 2023, how much must Jebali include in gross income? What expenses can Jebali deduct in that year? In 2023, Jebali must include $ gross income and may deduct \$ as expenses in that year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started