Answered step by step

Verified Expert Solution

Question

1 Approved Answer

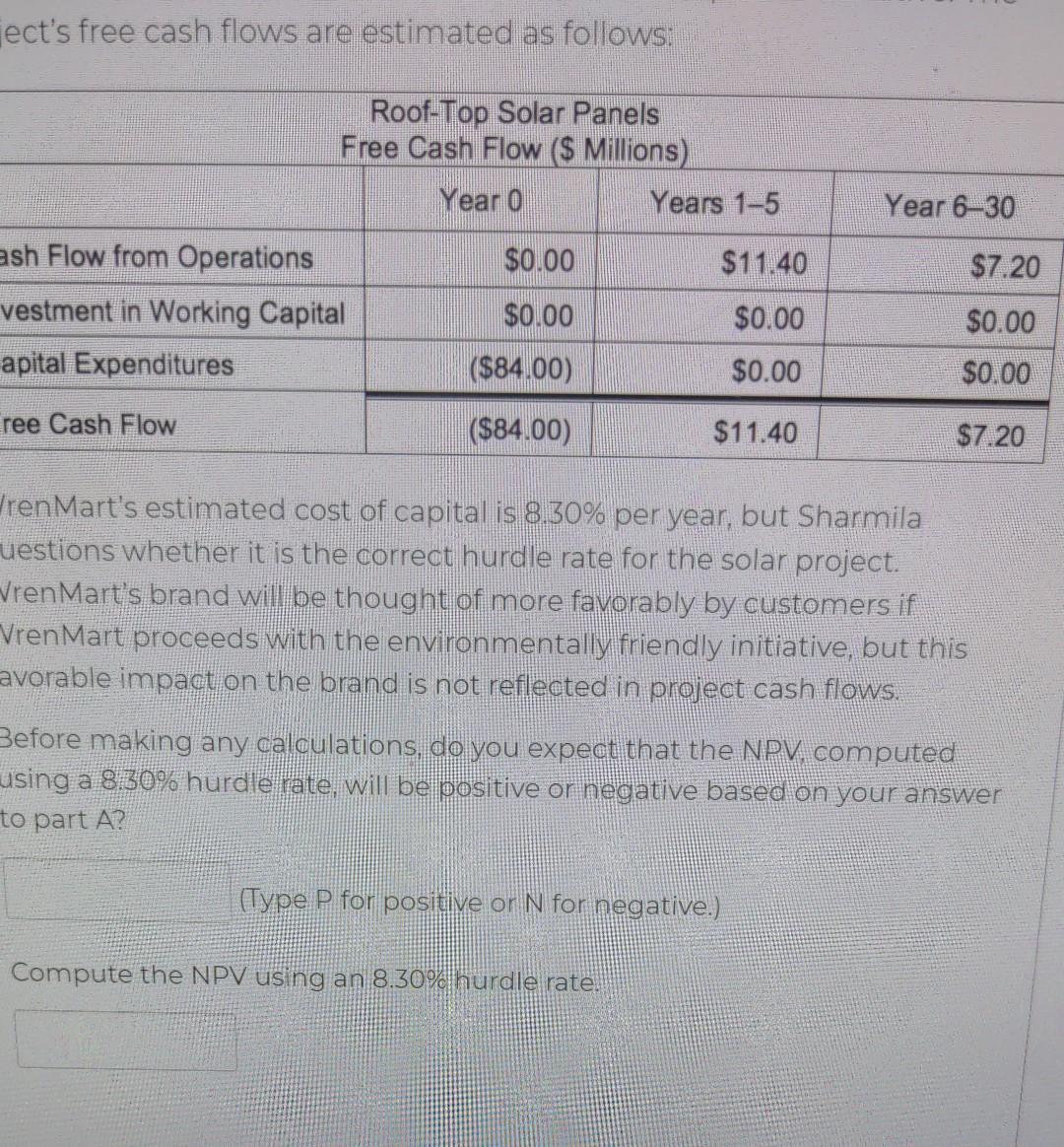

ject's free cash flows are estimated as follows: Roof-Top Solar Panels Free Cash Flow ($ Millions) Year 0 ash Flow from Operations $0.00 $11.40 $7.20

ject's free cash flows are estimated as follows: Roof-Top Solar Panels Free Cash Flow ($ Millions) Year 0 ash Flow from Operations $0.00 $11.40 $7.20 vestment in Working Capital $0.00 $0.00 $0.00 apital Expenditures ($84.00) $0.00 $0.00 ree Cash Flow ($84.00) $11.40 $7.20 WrenMart's estimated cost of capital is 8.30% per year, but Sharmila uestions whether it is the correct hurdle rate for the solar project. Vren Mart's brand will be thought of more favorably by customers if VrenMart proceeds with the environmentally friendly initiative, but this avorable impact on the brand is not reflected in project cash flows. Before making any calculations, do you expect that the NPV, computed using a 8.30% hurdle rate, will be positive or negative based on your answer to part A? (Type P for positive or N for negative.) Compute the NPV using an 8.30% hurdle rate. Years 1-5 Year 6-30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started