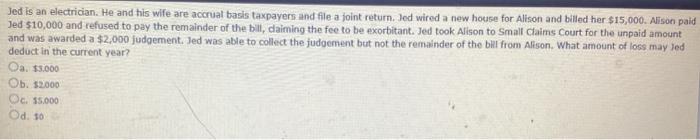

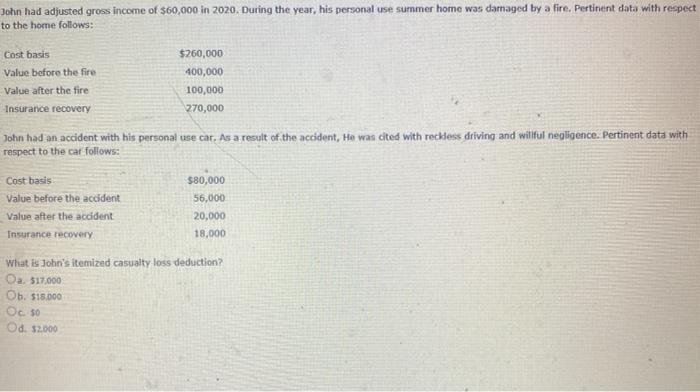

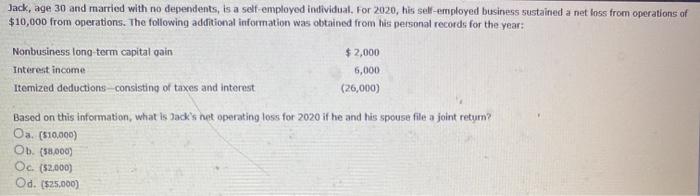

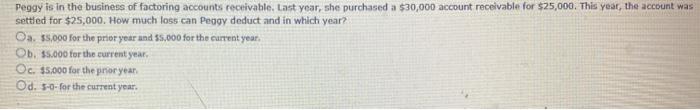

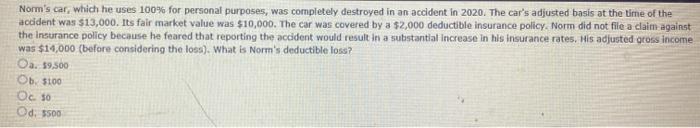

Jed Is an electrician. He and his wife are accrual basis taxpayers and file a joint return, Jed wired a new house for Alison and billed her $15,000. Alison paid Jed $10,000 and refused to pay the remainder of the bill, daiming the fee to be exorbitant. Jed took Alison to Small Claims Court for the unpaid amount and was awarded a $2,000 judgement. Jed was able to collect the judgement but not the remainder of the bill from Alison. What amount of loss may Jed deduct in the current year? Oa. 35.000 Ob. 52.000 OC 15.000 Od. 30 John had adjusted gross income of $60,000 in 2020. During the year, his personal use summer home was damaged by a fire. Pertinent data with respect to the home follows: Cost basis $260,000 Value before the fire 400,000 Value after the fire 100,000 Insurance recovery 270,000 John had an accident with his personal use car. As a result of the accident, He was cited with reckless driving and willful negligence. Pertinent data with respect to the car follows: Cost basis $80,000 Value before the accident 56,000 Value after the accident 20,000 Insurance recovery 18,000 What is John's itemized casualty loss deduction? Oa. 517.000 Ob. 515.000 Oc50 Od 12.000 Jack, age 30 and married with no dependents, is a self-employed individual. For 2020, his self-employed business sustained a net loss from operations of $10,000 from operations. The following additional information was obtained from his personal records for the year: $2,000 Nonbusiness long term capital gain Interest income 6,000 itemized deductions consisting of taxes and interest (26,000) Based on this information, what is Jack's ret operating loss for 2020 if he and his spouse file a joint return? Os. (510.000) Ob (58.000) Oc (52.000) Od. ($25.000) Peggy is in the business of factoring accounts receivable. Last year, she purchased a $30,000 account receivable for $25,000. This year, the account was settled for $25,000. How much loss can Peggy deduct and in which year? Oa 55.000 for the prior year and $5,000 for the current year. Ob $5.000 for the current year, Oc. $5.000 for the pror year Od. 5-6-for the current year. Norm's car, which he uses 100% for personal purposes, was completely destroyed in an accident in 2020. The car's adjusted basis at the time of the accident was $13,000. Its fair market value was $10,000. The car was covered by a $2,000 deductible insurance policy. Norm did not file a claim against the insurance policy because he feared that reporting the accident would result in a substantial increase in his insurance rates. His adjusted gross income was $14,000 (before considering the loss). What is Norm's deductible loss? Os 59.500 Ob $100 Oc 30 Od: 3500