Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jeff & Bezos is a fresh groceries delivery company. The company has access to borrowing funds at a pre-tax rate of 7% per year. Jeff

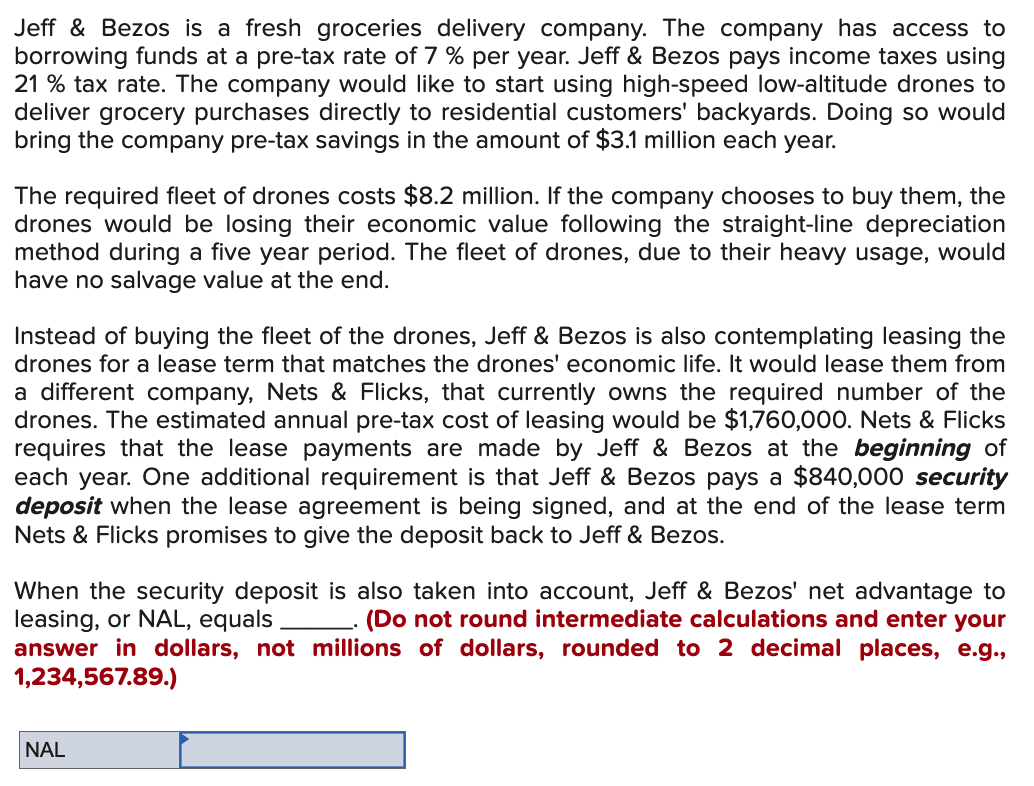

Jeff \& Bezos is a fresh groceries delivery company. The company has access to borrowing funds at a pre-tax rate of 7% per year. Jeff \& Bezos pays income taxes using 21% tax rate. The company would like to start using high-speed low-altitude drones to deliver grocery purchases directly to residential customers' backyards. Doing so would bring the company pre-tax savings in the amount of $3.1 million each year. The required fleet of drones costs $8.2 million. If the company chooses to buy them, the drones would be losing their economic value following the straight-line depreciation method during a five year period. The fleet of drones, due to their heavy usage, would have no salvage value at the end. Instead of buying the fleet of the drones, Jeff \& Bezos is also contemplating leasing the drones for a lease term that matches the drones' economic life. It would lease them from a different company, Nets \& Flicks, that currently owns the required number of the drones. The estimated annual pre-tax cost of leasing would be $1,760,000. Nets \& Flicks requires that the lease payments are made by Jeff \& Bezos at the beginning of each year. One additional requirement is that Jeff \& Bezos pays a $840,000 security deposit when the lease agreement is being signed, and at the end of the lease term Nets \& Flicks promises to give the deposit back to Jeff \& Bezos. When the security deposit is also taken into account, Jeff \& Bezos' net advantage to leasing, or NAL, equals (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)

Jeff \& Bezos is a fresh groceries delivery company. The company has access to borrowing funds at a pre-tax rate of 7% per year. Jeff \& Bezos pays income taxes using 21% tax rate. The company would like to start using high-speed low-altitude drones to deliver grocery purchases directly to residential customers' backyards. Doing so would bring the company pre-tax savings in the amount of $3.1 million each year. The required fleet of drones costs $8.2 million. If the company chooses to buy them, the drones would be losing their economic value following the straight-line depreciation method during a five year period. The fleet of drones, due to their heavy usage, would have no salvage value at the end. Instead of buying the fleet of the drones, Jeff \& Bezos is also contemplating leasing the drones for a lease term that matches the drones' economic life. It would lease them from a different company, Nets \& Flicks, that currently owns the required number of the drones. The estimated annual pre-tax cost of leasing would be $1,760,000. Nets \& Flicks requires that the lease payments are made by Jeff \& Bezos at the beginning of each year. One additional requirement is that Jeff \& Bezos pays a $840,000 security deposit when the lease agreement is being signed, and at the end of the lease term Nets \& Flicks promises to give the deposit back to Jeff \& Bezos. When the security deposit is also taken into account, Jeff \& Bezos' net advantage to leasing, or NAL, equals (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started