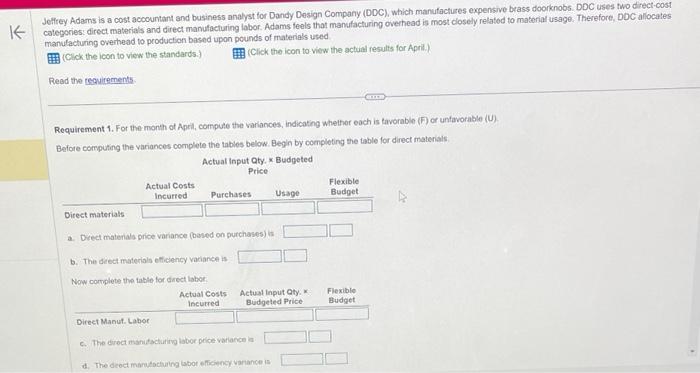

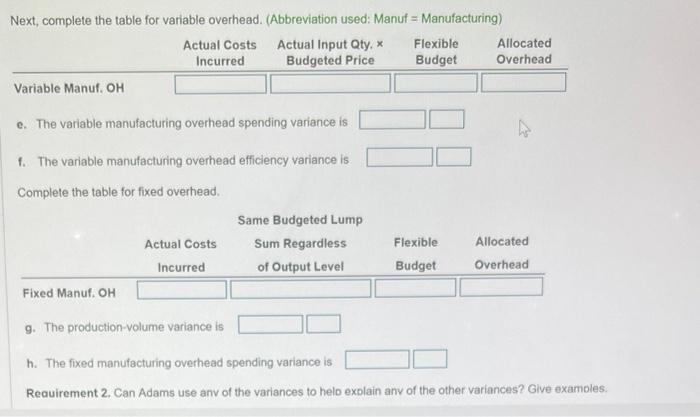

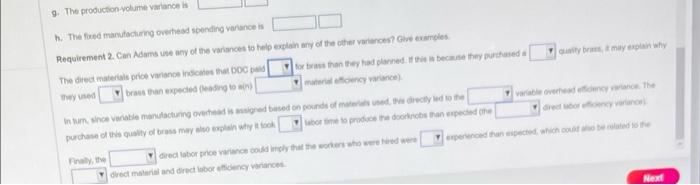

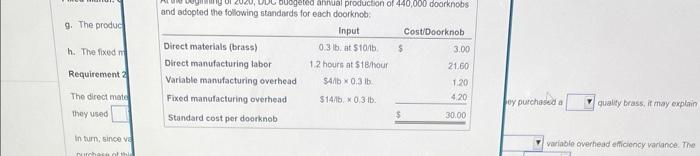

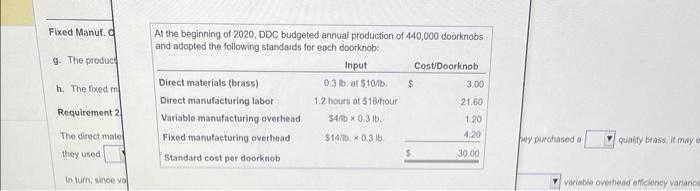

Jefferey Adams is a cost acocuntant and business analyst for Dandy Design Company (DDC), which manufactures expensive brass doorknobs. DDC uses two direct-cost categories: direct materials and direct manufacturing labor. Adams feels that manufacturing overhead is most closely relatod to matorial usage, Therefore, DDC allocates manulacturing overhead to production based upon pounds of materials used (Click the icon to view the standards.) (Click the icon to view the actual results for April.). Read the regulitements. Requirement 1. For the month of April, compute the variances, indicating whether each is favorable (F) or untavorable (U) Befole corrputing the variances complete the tables below. Begin by comploting the table for direct materials: Next, complete the table for variable overhead. (Abbreviation used: Manuf = Manufacturing) e. The variable manufacturing overhead spending variance is f. The variable manufacturing overhead efficiency variance is Complete the table for fixed overhead. g. The production-volume variance is h. The fixed manufacturing overhead spending variance is Reauirement 2. Can Adams use anv of the variances to helo explain anv of the other variances? Give examoles. h. The foced mandocturing overhesd soending variance is Requirement 2. Can Adams ise any of the variances to help explan any of the other varianoes? Gwe euancies materiat ex oxicy parancel). Thery vied brats than expecied (lenging to sin). Pinaly, the and adopted the following standards for each doorknob; oy purchasid a qualty brass, it may explain variable overhead eficiency variance. The Al the beginning of 2020, DDC budgeted annual production of 440,000 doorknobs: and adopted the following standards for each doorknob: hey purchased a quality brass. it maye hetad alfieiency variance Jefferey Adams is a cost acocuntant and business analyst for Dandy Design Company (DDC), which manufactures expensive brass doorknobs. DDC uses two direct-cost categories: direct materials and direct manufacturing labor. Adams feels that manufacturing overhead is most closely relatod to matorial usage, Therefore, DDC allocates manulacturing overhead to production based upon pounds of materials used (Click the icon to view the standards.) (Click the icon to view the actual results for April.). Read the regulitements. Requirement 1. For the month of April, compute the variances, indicating whether each is favorable (F) or untavorable (U) Befole corrputing the variances complete the tables below. Begin by comploting the table for direct materials: Next, complete the table for variable overhead. (Abbreviation used: Manuf = Manufacturing) e. The variable manufacturing overhead spending variance is f. The variable manufacturing overhead efficiency variance is Complete the table for fixed overhead. g. The production-volume variance is h. The fixed manufacturing overhead spending variance is Reauirement 2. Can Adams use anv of the variances to helo explain anv of the other variances? Give examoles. h. The foced mandocturing overhesd soending variance is Requirement 2. Can Adams ise any of the variances to help explan any of the other varianoes? Gwe euancies materiat ex oxicy parancel). Thery vied brats than expecied (lenging to sin). Pinaly, the and adopted the following standards for each doorknob; oy purchasid a qualty brass, it may explain variable overhead eficiency variance. The Al the beginning of 2020, DDC budgeted annual production of 440,000 doorknobs: and adopted the following standards for each doorknob: hey purchased a quality brass. it maye hetad alfieiency variance