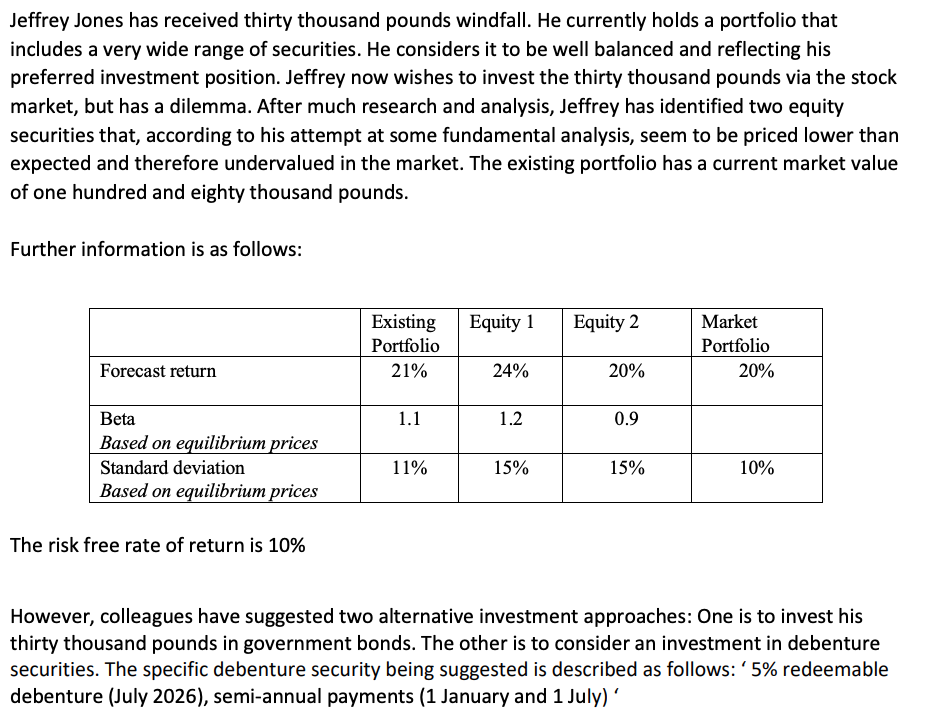

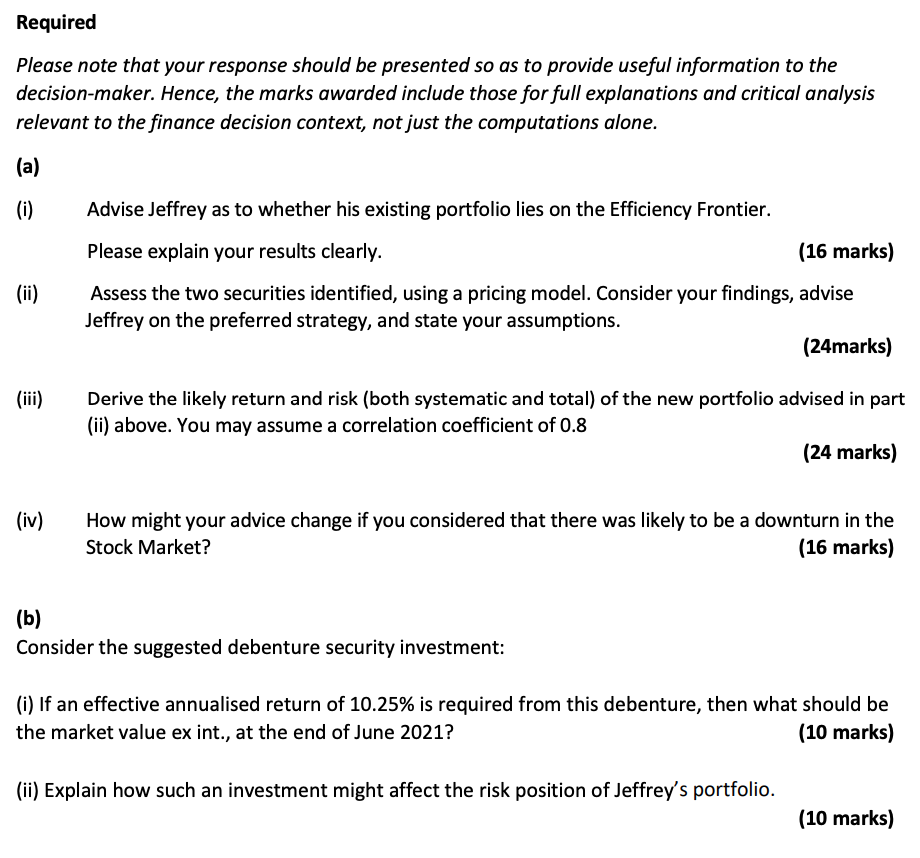

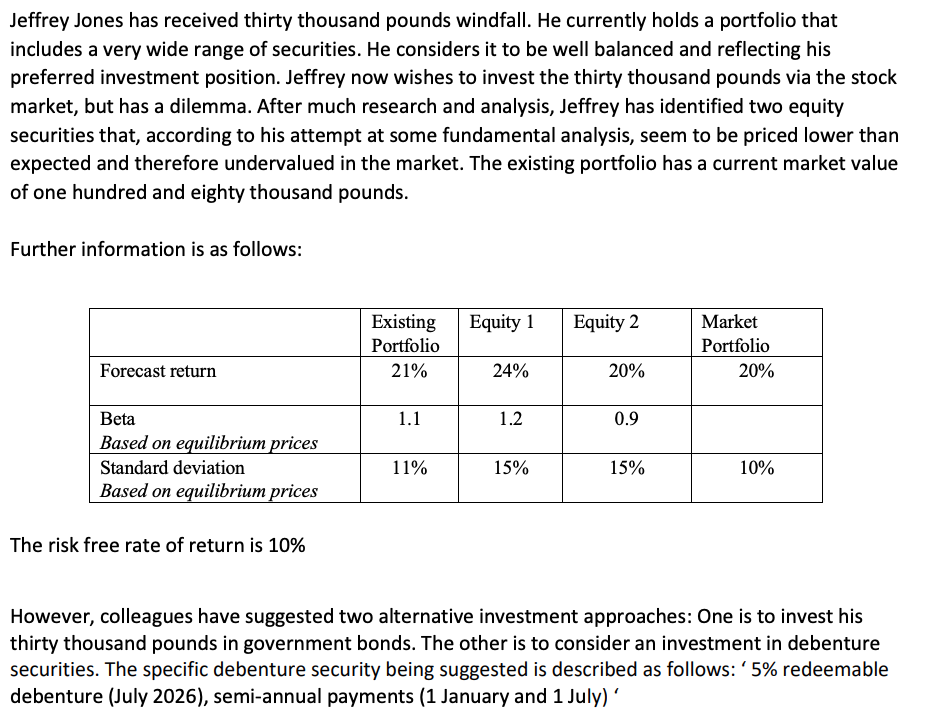

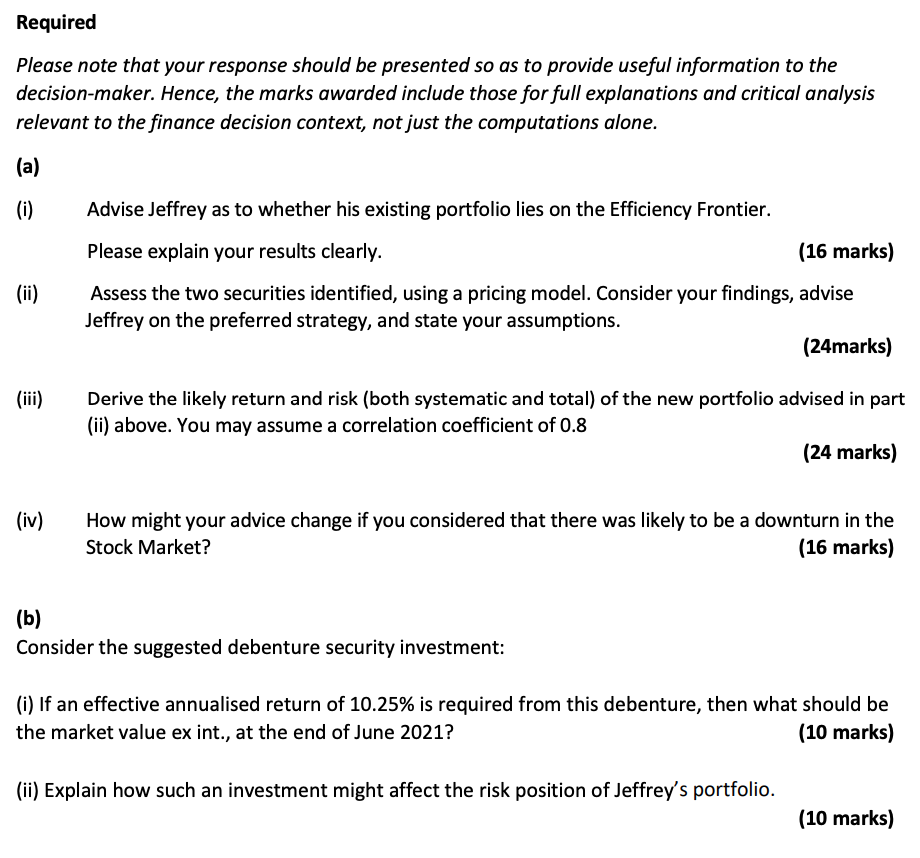

Jeffrey Jones has received thirty thousand pounds windfall. He currently holds a portfolio that includes a very wide range of securities. He considers it to be well balanced and reflecting his preferred investment position. Jeffrey now wishes to invest the thirty thousand pounds via the stock market, but has a dilemma. After much research and analysis, Jeffrey has identified two equity securities that, according to his attempt at some fundamental analysis, seem to be priced lower than expected and therefore undervalued in the market. The existing portfolio has a current market value of one hundred and eighty thousand pounds. Further information is as follows: Equity 1 Equity 2 Existing Portfolio 21% Market Portfolio 20% Forecast return 24% 20% 1.1 1.2 0.9 Beta Based on equilibrium prices Standard deviation Based on equilibrium prices 11% 15% 15% 10% The risk free rate of return is 10% However, colleagues have suggested two alternative investment approaches: One is to invest his thirty thousand pounds in government bonds. The other is to consider an investment in debenture securities. The specific debenture security being suggested is described as follows:' 5% redeemable debenture (July 2026), semi-annual payments (1 January and 1 July)' Required Please note that your response should be presented so as to provide useful information to the decision-maker. Hence, the marks awarded include those for full explanations and critical analysis relevant to the finance decision context, not just the computations alone. (a) (i) Advise Jeffrey as to whether his existing portfolio lies on the Efficiency Frontier. Please explain your results clearly. (16 marks) (ii) Assess the two securities identified, using a pricing model. Consider your findings, advise Jeffrey on the preferred strategy, and state your assumptions. (24marks) (iii) Derive the likely return and risk (both systematic and total) of the new portfolio advised in part (ii) above. You may assume a correlation coefficient of 0.8 (24 marks) (iv) How might your advice change if you considered that there was likely to be a downturn in the Stock Market? (16 marks) (b) Consider the suggested debenture security investment: (i) If an effective annualised return of 10.25% is required from this debenture, then what should be the market value ex int., at the end of June 2021? (10 marks) (ii) Explain how such an investment might affect the risk position of Jeffrey's portfolio. (10 marks)