Answered step by step

Verified Expert Solution

Question

1 Approved Answer

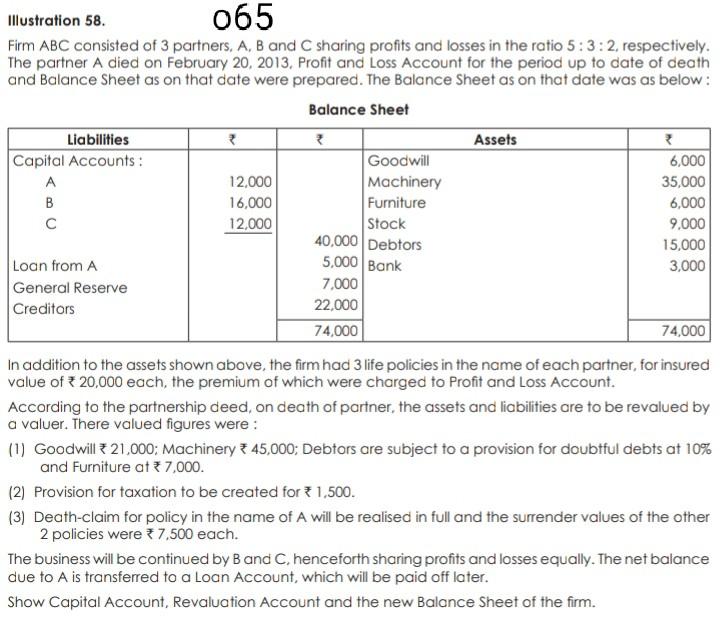

jej Illustration 58. 065 Firm ABC consisted of 3 partners, A, B and C sharing profits and losses in the ratio 5:3:2, respectively. The partner

jej

Illustration 58. 065 Firm ABC consisted of 3 partners, A, B and C sharing profits and losses in the ratio 5:3:2, respectively. The partner A died on February 20, 2013, Profit and Loss Account for the period up to date of death and Balance Sheet as on that date were prepared. The Balance Sheet as on that date was as below: Balance Sheet Liabilities Assets 2 Capital Accounts: Goodwill 6,000 A 12.000 Machinery 35,000 B 16,000 Furniture 6,000 12,000 Stock 9,000 15,000 Loan from A 3,000 General Reserve 7,000 Creditors 22.000 74,000 74,000 40,000 Debtors 5,000 Bank In addition to the assets shown above, the firm had 3 life policies in the name of each partner, for insured value of 20,000 each, the premium of which were charged to Profit and Loss Account. According to the partnership deed, on death of partner, the assets and liabilities are to be revalued by a valuer. There valued figures were : (1) Goodwill 21.000: Machinery + 45,000; Debtors are subject to a provision for doubtful debts at 10% and Furniture at 7,000. (2) Provision for taxation to be created for 1.500. (3) Death-claim for policy in the name of A will be realised in full and the surrender values of the other 2 policies were *7.500 each. The business will be continued by B and C, henceforth sharing profits and losses equally. The net balance due to A is transferred to a Loan Account, which will be paid off later. Show Capital Account, Revaluation Account and the new Balance Sheet of the firmStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started