Answered step by step

Verified Expert Solution

Question

1 Approved Answer

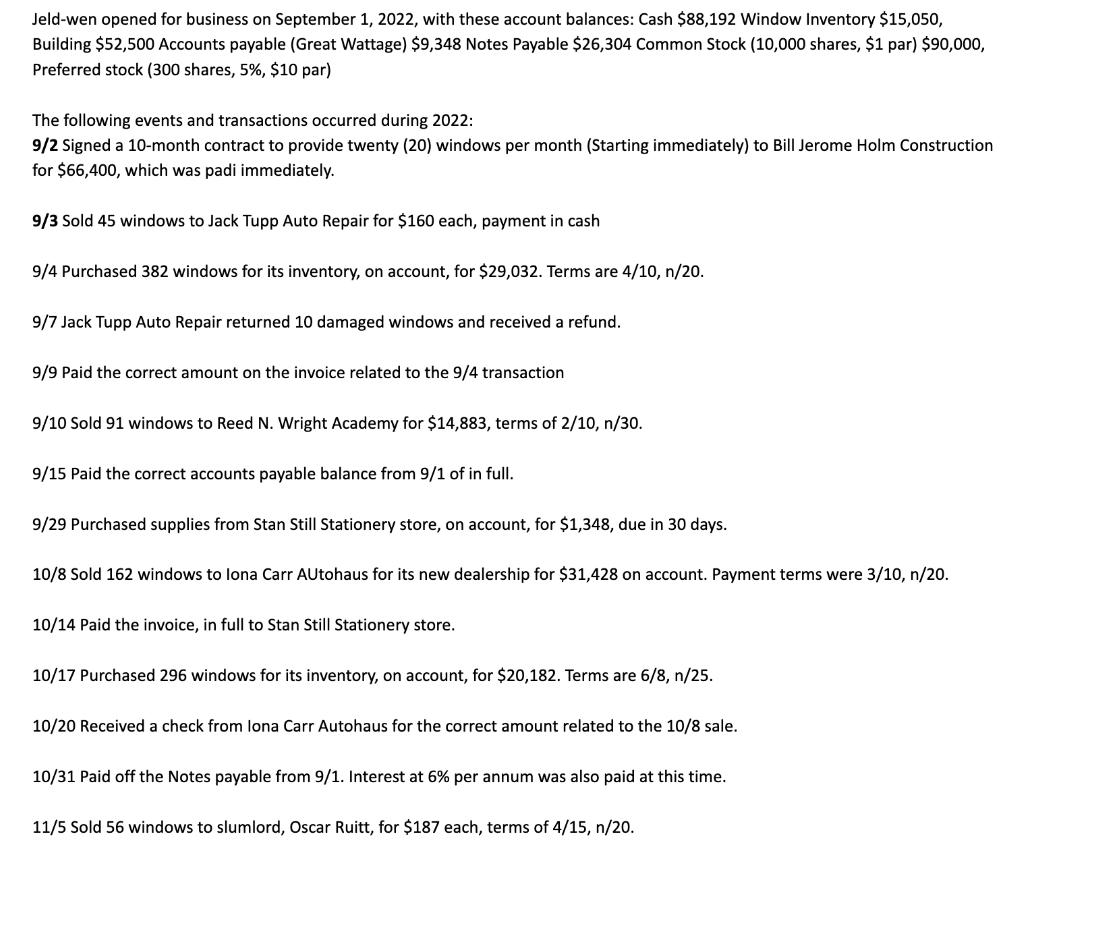

Jeld-wen opened for business on September 1, 2022, with these account balances: Cash $88,192 Window Inventory $15,050, Building $52,500 Accounts payable (Great Wattage) $9,348

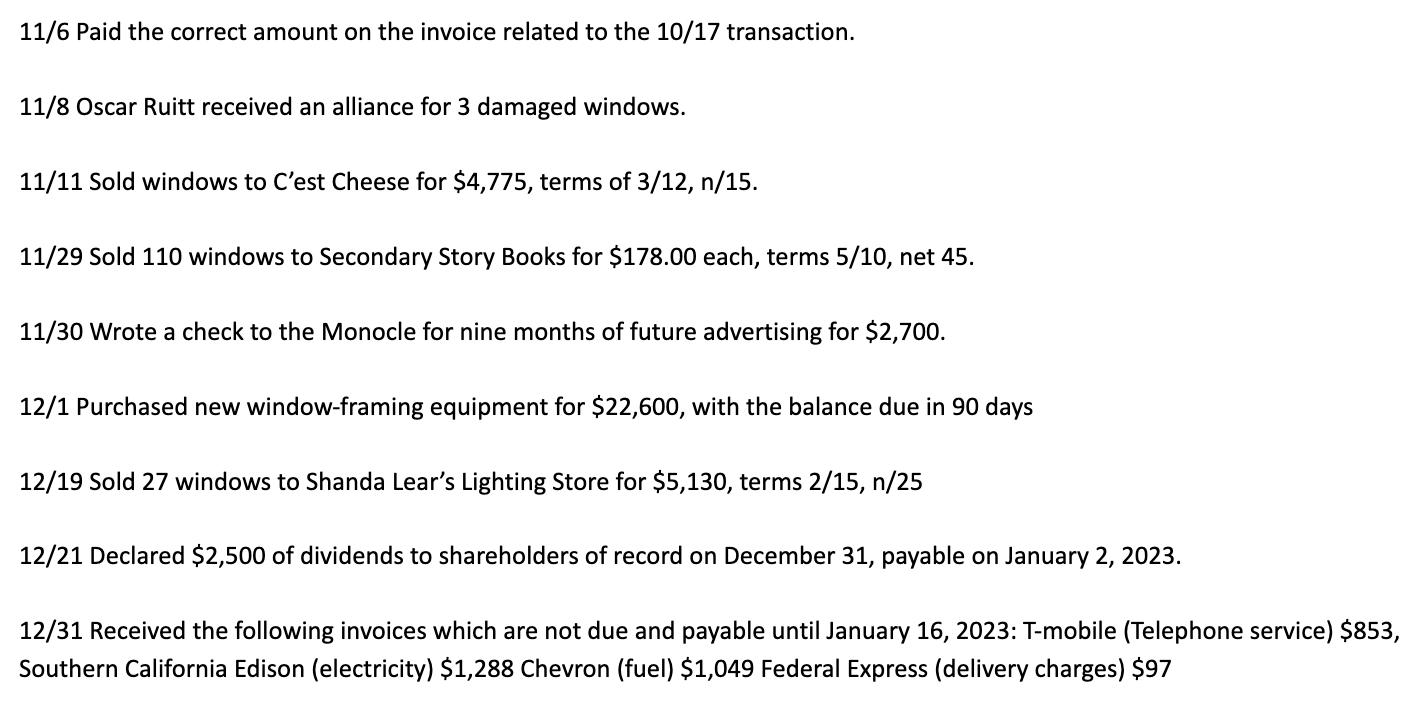

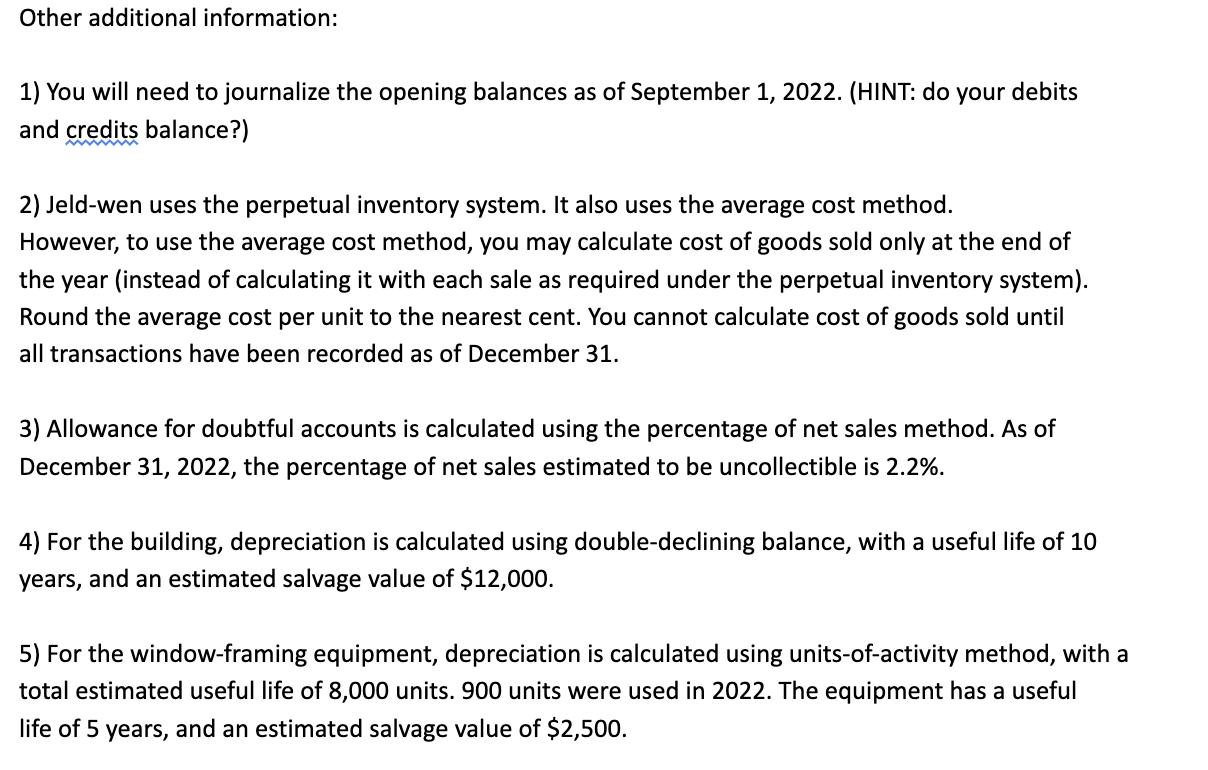

Jeld-wen opened for business on September 1, 2022, with these account balances: Cash $88,192 Window Inventory $15,050, Building $52,500 Accounts payable (Great Wattage) $9,348 Notes Payable $26,304 Common Stock (10,000 shares, par) $90,000, Preferred stock (300 shares, 5%, $10 par) The following events and transactions occurred during 2022: 9/2 Signed a 10-month contract to provide twenty (20) windows per month (Starting immediately) to Bill Jerome Holm Construction for $66,400, which was padi immediately. 9/3 Sold 45 windows to Jack Tupp Auto Repair for $160 each, payment in cash 9/4 Purchased 382 windows for its inventory, on account, for $29,032. Terms are 4/10, n/20. 9/7 Jack Tupp Auto Repair returned 10 damaged windows and received a refund. 9/9 Paid the correct amount on the invoice related to the 9/4 transaction 9/10 Sold 91 windows to Reed N. Wright Academy for $14,883, terms of 2/10, n/30. 9/15 Paid the correct accounts payable balance from 9/1 of in full. 9/29 Purchased supplies from Stan Still Stationery store, on account, for $1,348, due in 30 days. 10/8 Sold 162 windows to lona Carr Autohaus for its new dealership for $31,428 on account. Payment terms were 3/10, n/20. 10/14 Paid the invoice, in full to Stan Still Stationery store. 10/17 Purchased 296 windows for its inventory, on account, for $20,182. Terms are 6/8, n/25. 10/20 Received a check from lona Carr Autohaus for the correct amount related to the 10/8 sale. 10/31 Paid off the Notes payable from 9/1. Interest at 6% per annum was also paid at this time. 11/5 Sold 56 windows to slumlord, Oscar Ruitt, for $187 each, terms of 4/15, n/20. 11/6 Paid the correct amount on the invoice related to the 10/17 transaction. 11/8 Oscar Ruitt received an alliance for 3 damaged windows. 11/11 Sold windows to C'est Cheese for $4,775, terms of 3/12, n/15. 11/29 Sold 110 windows to Secondary Story Books for $178.00 each, terms 5/10, net 45. 11/30 Wrote a check to the Monocle for nine months of future advertising for $2,700. 12/1 Purchased new window-framing equipment for $22,600, with the balance due in 90 days 12/19 Sold 27 windows to Shanda Lear's Lighting Store for $5,130, terms 2/15, n/25 12/21 Declared $2,500 of dividends to shareholders of record on December 31, payable on January 2, 2023. 12/31 Received the following invoices which are not due and payable until January 16, 2023: T-mobile (Telephone service) $853, Southern California Edison (electricity) $1,288 Chevron (fuel) $1,049 Federal Express (delivery charges) $97 Other additional information: 1) You will need to journalize the opening balances as of September 1, 2022. (HINT: do your debits and credits balance?) 2) Jeld-wen uses the perpetual inventory system. It also uses the average cost method. However, to use the average cost method, you may calculate cost of goods sold only at the end of the year (instead of calculating it with each sale as required under the perpetual inventory system). Round the average cost per unit to the nearest cent. You cannot calculate cost of goods sold until all transactions have been recorded as of December 31. 3) Allowance for doubtful accounts is calculated using the percentage of net sales method. As of December 31, 2022, the percentage of net sales estimated to be uncollectible is 2.2%. 4) For the building, depreciation is calculated using double-declining balance, with a useful life of 10 years, and an estimated salvage value of $12,000. 5) For the window-framing equipment, depreciation is calculated using units-of-activity method, with a total estimated useful life of 8,000 units. 900 units were used in 2022. The equipment has a useful life of 5 years, and an estimated salvage value of $2,500.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the events and transactions for Jeldwen during the given period lets prepare a chronological summary 1 September 2 2022 Signed a 10month co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started