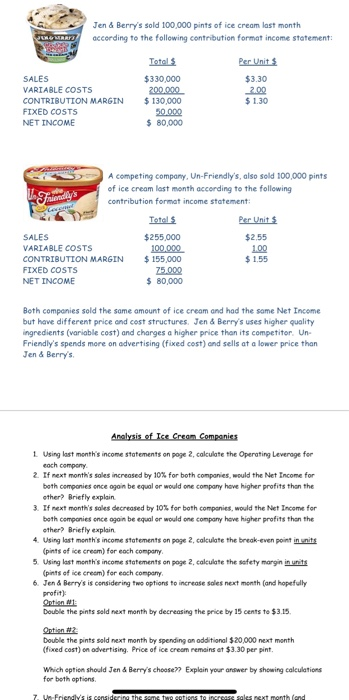

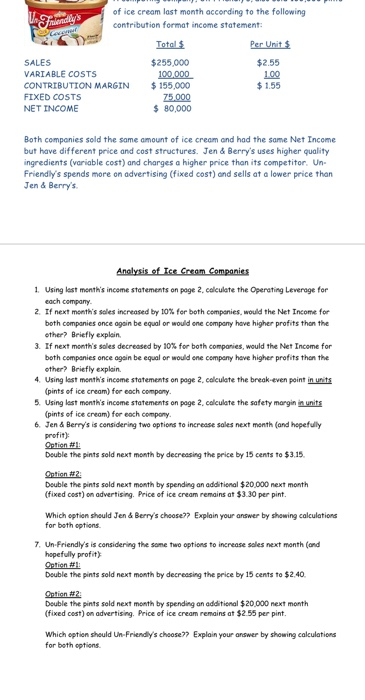

Jen & Berry's sold 100,000 pints of ice cream last month according to the following contribution format income statement JURG MARIE Per Units SALES VARIABLE COSTS CONTRIBUTION MARGIN FIXED COSTS NET INCOME Total $330.000 200.000 $ 130,000 50.000 $ 80,000 $3.30 2.00 $ 1.30 Friendly A competing company, Un-Friendly's, also sold 100,000 pints of ice cream last month according to the following contribution format income statement: Total Per Units SALES $255,000 $2.55 VARIABLE COSTS 100.000 100 CONTRIBUTION MARGIN $ 155,000 $ 1.55 FIXED COSTS 75.000 NET INCOME $ 80,000 Both companies sold the same amount of ice cream and had the same Net Income but have different price and cost structures. Jen & Berry's uses higher quality ingredients (variable cost) and charges a higher price than its competitor. Un Friendly's spends more on advertising (fixed cost) and sells at a lower price than Jen & Berry's Analysis of Ice Cream Companies 1 Using last month's income statements on poge 2, calculate the Operating Leverage for each company 2. If next month's soles increased by 10% for both companies would the Net Income for both companies once ogain be equal or would one company have higher profits than the other Briefly explain 3. If next month's sales decreased by 10% for both companies, would the Net Income for both companies once again be equal or would one company have higher profits then the other Briefly explain 4. Using last month's income statements on page 2, calculate the break-even point in units pints of ice cream) for each company 5. Using last month's income statements on page 2, calculate the safety margin in units (pints of ice cream) for each company 6. Jen & Berry's is considering two options to increase soles next month (and hopefully profit Option Double the pints sold next month by decreasing the price by 15 cents to $3.15 Ontion 2 Double the pints sold next month by spending an additional $20,000 next month (fixed cost) on advertising. Price of ice cream remains of $3.30 per pint. Which option should Jen & Berry's choose? Explain your order by showing calculations for both options 7. Ve Friendly's is considering the same two options to increase sales ext month and of ice cream last month according to the following contribution format income statement: Per Unit $ SALES VARIABLE COSTS CONTRIBUTION MARGIN FIXED COSTS NET INCOME Total $ $255,000 100.000 $ 155,000 75,000 $ 80,000 $2.55 100 $1.55 Both companies sold the same amount of ice cream and had the same Net Income but have different price and cost structures. Jen & Berry's uses higher quality ingredients (variable cost) and charges a higher price than its competitor. Un Friendly's spends more on advertising (fixed cost) and sells at a lower price than Jen & Berry's Analysis of Ice Cream Companies 1. Using last month's income statements on page 2. calculate the Operating Leverage for each company 2. If next month's soles increased by 10% for both companies, would the Net Income for both companies once again be equal or would one company have higher profits thon the other? Briefly explain 3. If next month's soles decreased by 10% for both companies, would the Net Income for both companies once again be equal or would one company have higher profits than the other Briefly explain 4. Using last month's income statements on page 2. calculate the break-even point in units (pints of ice cream) for each company. 5. Using last month's income statements on page 2, calculate the safety margin in units (pints of ice cream) for each company 6. Jen & Berry's is considering two options to increase sales next month (and hopefully profit Gotion : Double the pints sold next month by decreasing the price by 15 cents to $3.15 Double the pints sold next month by spending an additional $20 000 next month (fixed cost) on advertising. Price of ice cream remains at $3.30 per pint. Which option should Jen & Berry's choose?? Explain your answer by showing calculations for both options 7. Un-Friendly's is considering the same two options to increase sales next month (and hopefully profit) Option : Double the pints sold next month by decreasing the price by 15 cents to $2.40 Option 2: Double the pints sold next month by spending on additional $20 000 next month (fixed cost) on advertising. Price of ice cream remains at $2.55 per pint. Which option should Un-Friendly's choose?? Explain your answer by showing calculations for both options