Answered step by step

Verified Expert Solution

Question

1 Approved Answer

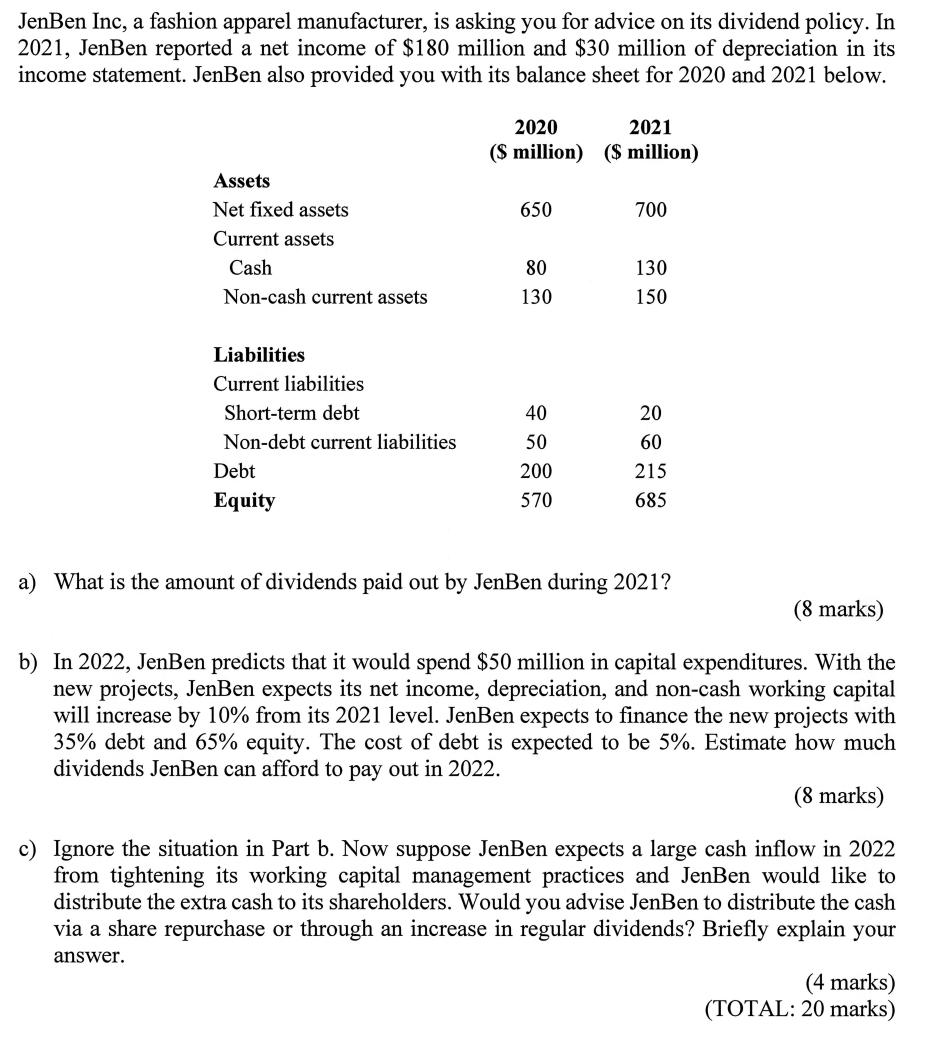

JenBen Inc, a fashion apparel manufacturer, is asking you for advice on its dividend policy. In 2021, JenBen reported a net income of $180

JenBen Inc, a fashion apparel manufacturer, is asking you for advice on its dividend policy. In 2021, JenBen reported a net income of $180 million and $30 million of depreciation in its income statement. JenBen also provided you with its balance sheet for 2020 and 2021 below. Assets Net fixed assets Current assets Cash Non-cash current assets Liabilities Current liabilities Short-term debt Non-debt current liabilities Debt Equity 2020 2021 ($ million) ($ million) 650 80 130 40 50 200 570 700 130 150 20 60 215 685 a) What is the amount of dividends paid out by JenBen during 2021? (8 marks) b) In 2022, JenBen predicts that it would spend $50 million in capital expenditures. With the new projects, JenBen expects its net income, depreciation, and non-cash working capital will increase by 10% from its 2021 level. JenBen expects to finance the new projects with 35% debt and 65% equity. The cost of debt is expected to be 5%. Estimate how much dividends JenBen can afford to pay out in 2022. (8 marks) c) Ignore the situation in Part b. Now suppose JenBen expects a large cash inflow in 2022 tightening its working capital management practices and JenBen would ke to distribute the extra cash to its shareholders. Would you advise JenBen to distribute the cash via a share repurchase or through an increase in regular dividends? Briefly explain your answer. (4 marks) (TOTAL: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the amount of dividends paid out by JenBen during 2021 we need to find the change in equity from 2020 to 2021 which represents the net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started