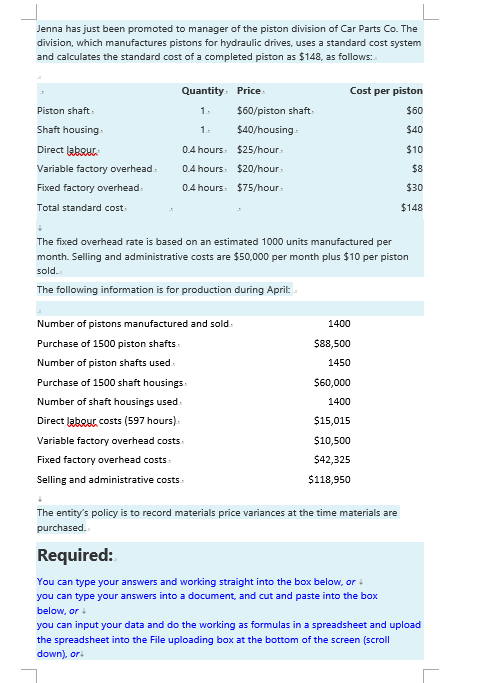

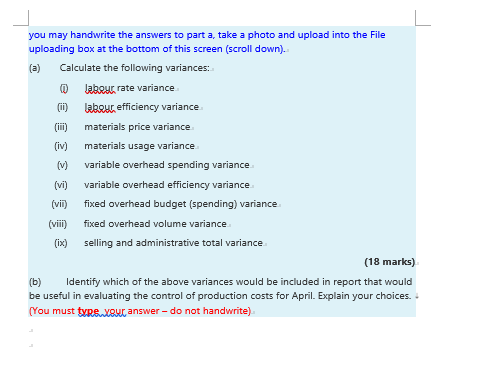

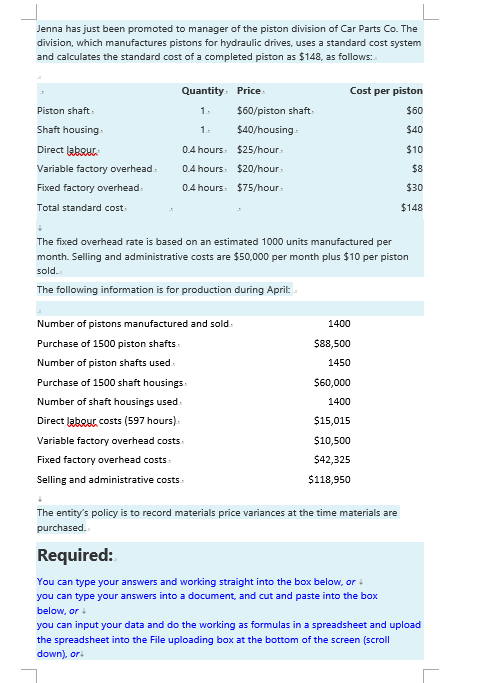

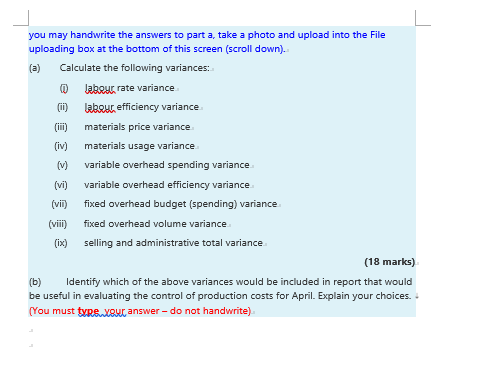

Jenna has just been promoted to manager of the piston division of Car Parts Co. The division, which manufactures pistons for hydraulic drives, uses a standard cost system and calculates the standard cost of a completed piston as $148, as follows: 1. Quantity Price Cost per piston Piston shaft 1. $60/piston shaft $60 Shaft housing $40/housing $40 Direct labour. 0.4 hours. $25/hour: $10 Variable factory overhead 0.4 hours $20/hour: $8 Fixed factory overhead 0.4 hours: $75/hour $30 Total standard cost $148 + The fixed overhead rate is based on an estimated 1000 units manufactured per month. Selling and administrative costs are $50,000 per month plus $10 per piston sold. The following information is for production during April 1400 Number of pistons manufactured and sold. Purchase of 1500 piston shafts Number of piston shafts used Purchase of 1500 shaft housings Number of shaft housings used. Direct labeur costs (597 hours) Variable factory overhead costs: Fixed factory overhead costs Selling and administrative costs $88,500 1450 $60,000 1400 $15,015 $10,500 $42,325 $118,950 The entity's policy is to record materials price variances at the time materials are purchased. Required: You can type your answers and working straight into the box below, or you can type your answers into a document, and cut and paste into the box below, or you can input your data and do the working as formulas in a spreadsheet and upload the spreadsheet into the File uploading box at the bottom of the screen (scroll down), or you may handwrite the answers to part a, take a photo and upload into the File uploading box at the bottom of this screen (scroll down). Calculate the following variances: labeurate variance (ii) labeur efficiency variance (iii) materials price variance (iv) materials usage variance (V) variable overhead spending variance (vi) variable overhead efficiency variance (vii) fixed overhead budget (spending) variance (vii) fixed overhead volume variance (ix) selling and administrative total variance (18 marks) (b) Identify which of the above variances would be included in report that would be useful in evaluating the control of production costs for April. Explain your choices.. [You must tyre.xewc answer - do not handwrite)