Question

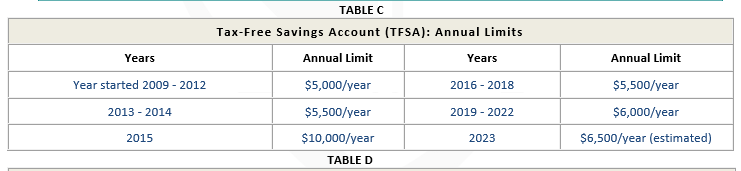

Jenna understands Tax-Free Savings Account (TFSA) but also understands that the available contribution room can be tricky to calculate. See Table C to help with

Jenna understands Tax-Free Savings Account (TFSA) but also understands that the available contribution room can be tricky to calculate. See Table C to help with your responses. She knows the following:

- you can withdraw any amount from your TFSA whenever you want;

- all withdrawals are tax-free;

- withdrawing from your TFSA doesnt result in lost TFSA contribution room;

- withdrawals you make this year will be added to your unused contribution room the following year (i.e. withdrawing from your TFSA has no effect on your contribution room in the year that you make the withdrawal, it only affects your contribution room for the following year); and

- you can re-contribute any funds that you have withdrawn from your TFSA back into your account starting the year after the year in which you make the withdrawal (i.e. January 1st of the following year).

Complete the TFSA available contribution room below. Fill in the amounts indicated by a question mark (?).

TFSA Available Contribution Room

| Date | TFSA Available Contribution Room | |

| March 2, 2022 | Mariela turns 18 and opens a TFSA | $ ? contribution room in 2022 |

| July 3, 2022 | Contributes $3,000 | $ ? contribution room in 2022 |

| August 10, 2022 | Withdraws $1,800 | $ ? contribution room in 2022 |

| September 12, 2022 | Contributes $1,200 | $ ? contribution room in 2022 |

| Jan. 1, 2023 | New contribution room available | $ ? contribution room in 2023 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started