Jennifer, a single taxpayer, operates a business that produces $95,000 of income before any amounts are paid to her. She has no dependents and

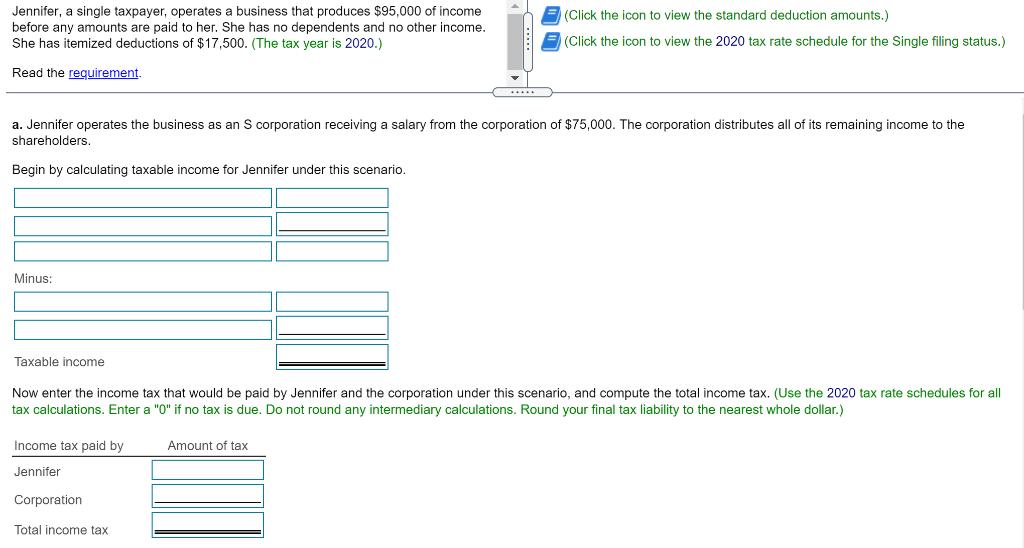

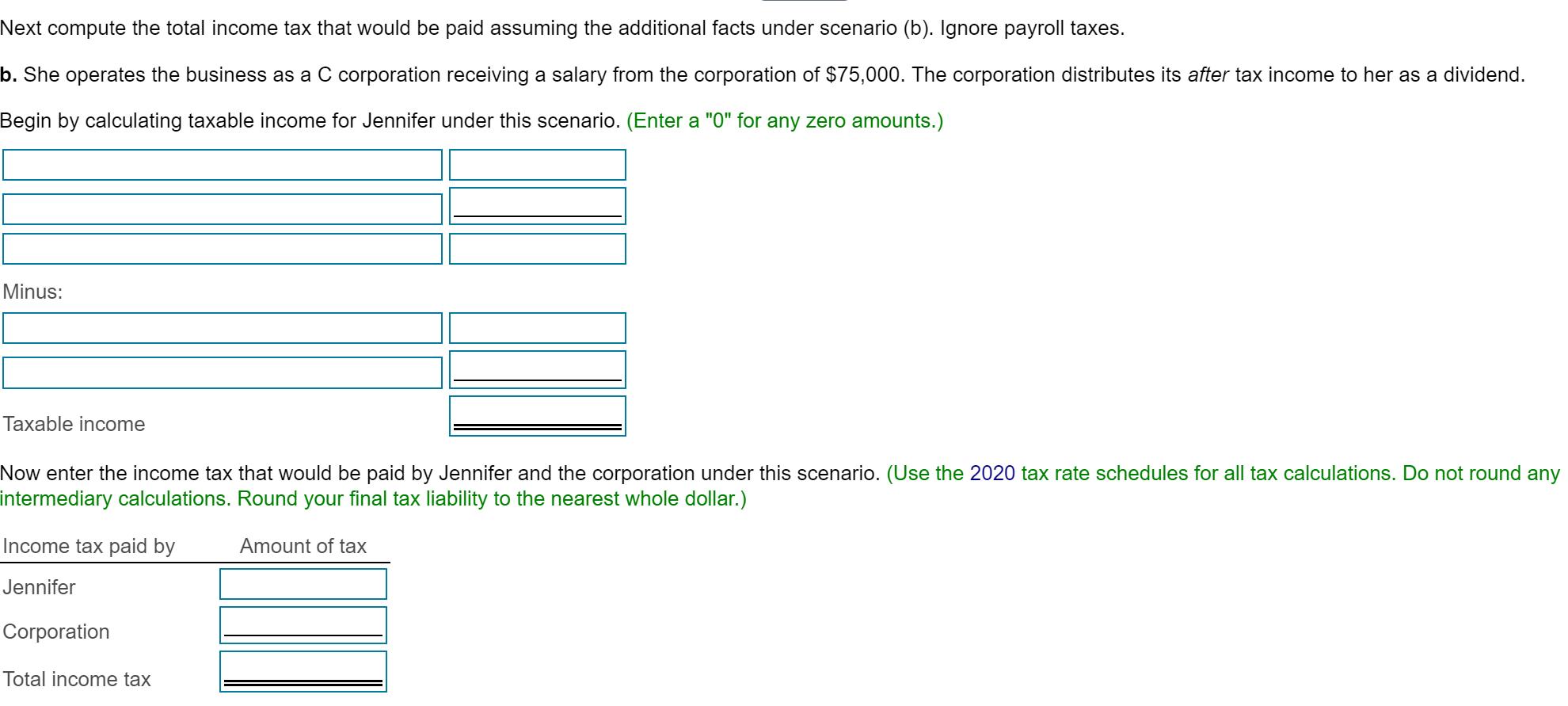

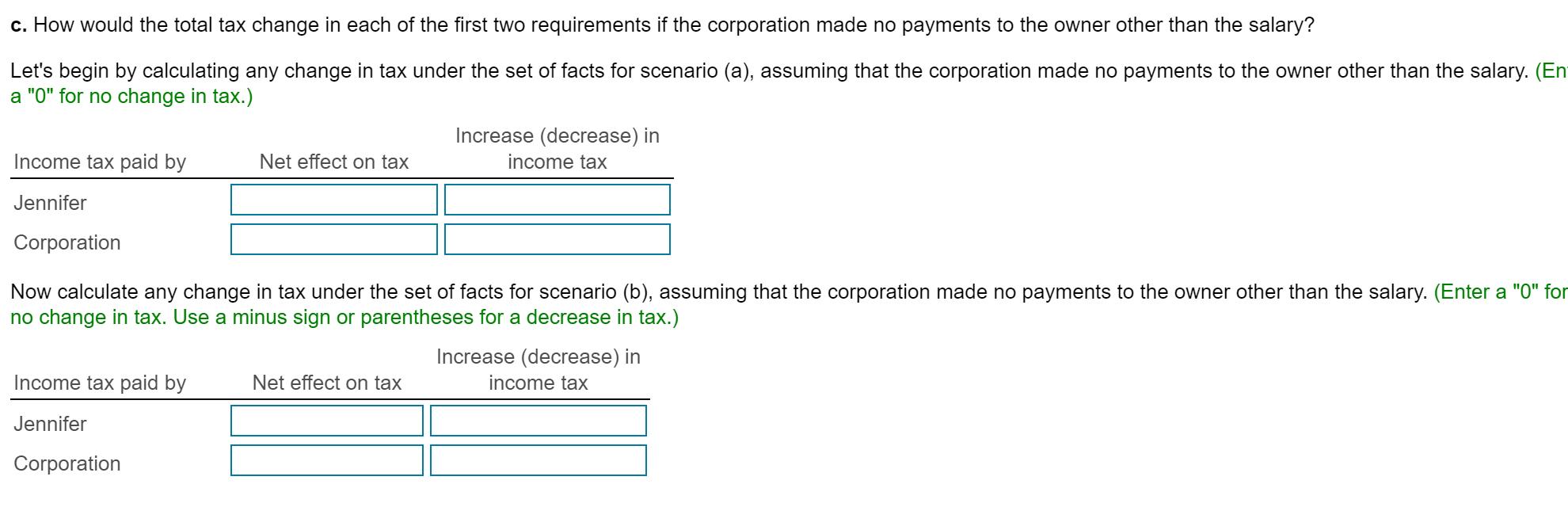

Jennifer, a single taxpayer, operates a business that produces $95,000 of income before any amounts are paid to her. She has no dependents and no other income. (Click the icon to view the standard deduction amounts.) She has itemized deductions of $17,500. (The tax year is 2020.) (Click the icon to view the 2020 tax rate schedule for the Single filing status.) Read the reguirement. a. Jennifer operates the business as an S corporation receiving a salary from the corporation of $75,000. The corporation distributes all of its remaining income to the shareholders. Begin by calculating taxable income for Jennifer under this scenario. Minus: Taxable income Now enter the income tax that would be paid by Jennifer and the corporation under this scenario, and compute the total income tax. (Use the 2020 tax rate schedules for all tax calculations. Enter a "0" if no tax is due. Do not round any intermediary calculations. Round your final tax liability to the nearest whole dollar.) Income tax paid by Amount of tax Jennifer Corporation Total income tax Next compute the total income tax that would be paid assuming the additional facts under scenario (b). Ignore payroll taxes. b. She operates the business as a C corporation receiving a salary from the corporation of $75,000. The corporation distributes its after tax income to her as a dividend. Begin by calculating taxable income for Jennifer under this scenario. (Enter a "0" for any zero amounts.) Minus: Taxable income Now enter the income tax that would be paid by Jennifer and the corporation under this scenario. (Use the 2020 tax rate schedules for all tax calculations. Do not round any intermediary calculations. Round your final tax liability to the nearest whole dollar.) Income tax paid by Amount of tax Jennifer Corporation Total income tax c. How would the total tax change in each of the first two requirements if the corporation made no payments to the owner other than the salary? Let's begin by calculating any change in tax under the set of facts for scenario (a), assuming that the corporation made no payments to the owner other than the salary. (En a "0" for no change in tax.) Increase (decrease) in Income tax paid by Net effect on tax income tax Jennifer Corporation Now calculate any change in tax under the set of facts for scenario (b), assuming that the corporation made no payments to the owner other than the salary. (Enter a "0" for no change in tax. Use a minus sign or parentheses for a decrease in tax.) Increase (decrease) in Income tax paid by Net effect on tax income tax Jennifer Corporation

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a when Jennifes operates the bustness as an S corporotion dieci ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started