Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jennifer is age 3 0 and has a son, age 4 . She earns $ 5 0 , 0 0 0 each year. Jennifer uses

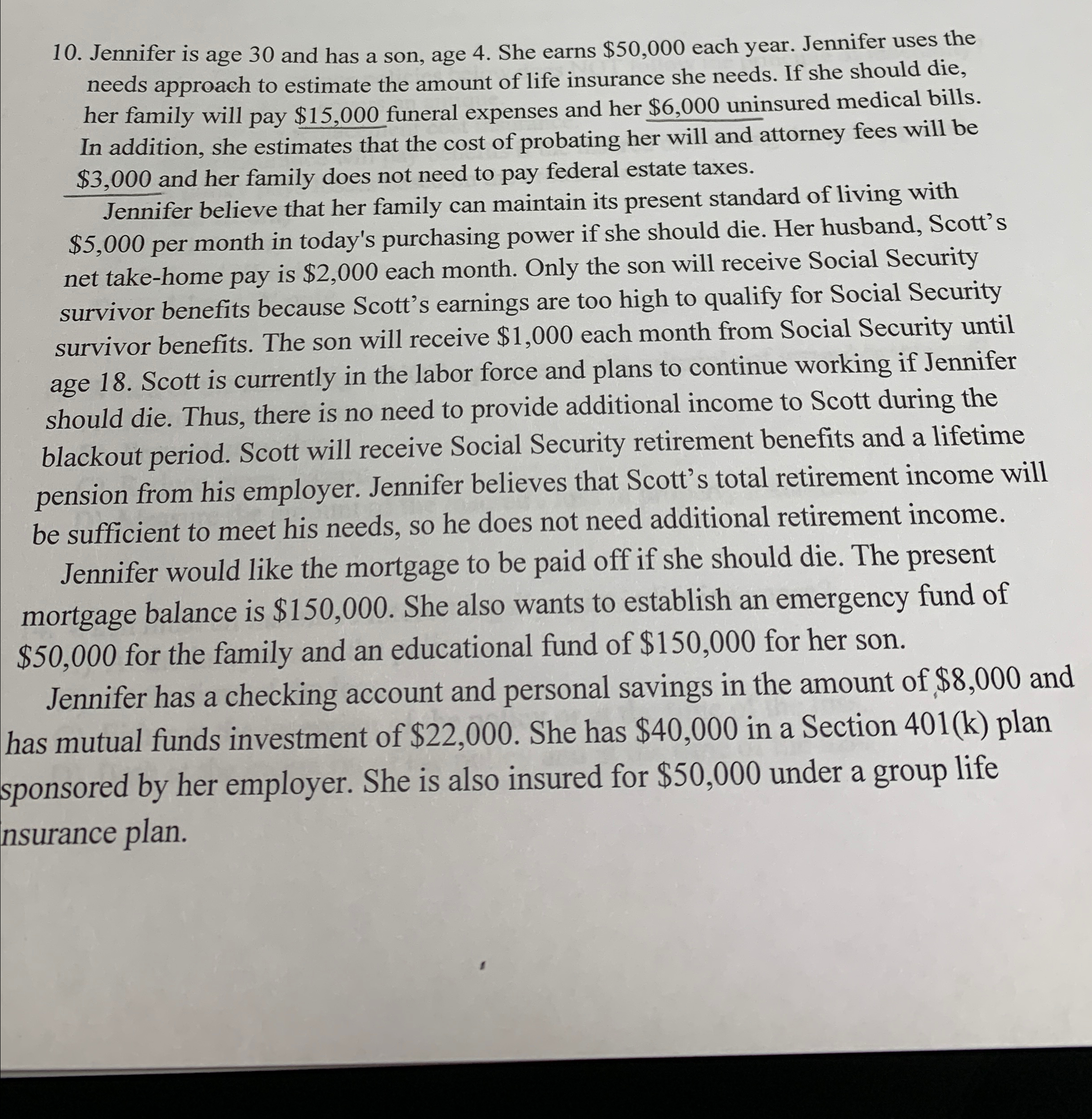

Jennifer is age and has a son, age She earns $ each year. Jennifer uses the needs approach to estimate the amount of life insurance she needs. If she should die, her family will pay $ funeral expenses and her $ uninsured medical bills. In addition, she estimates that the cost of probating her will and attorney fees will be $ and her family does not need to pay federal estate taxes.

Jennifer believe that her family can maintain its present standard of living with $ per month in today's purchasing power if she should die. Her husband, Scott's net takehome pay is $ each month. Only the son will receive Social Security survivor benefits because Scott's earnings are too high to qualify for Social Security survivor benefits. The son will receive $ each month from Social Security until age Scott is currently in the labor force and plans to continue working if Jennifer should die. Thus, there is no need to provide additional income to Scott during the blackout period. Scott will receive Social Security retirement benefits and a lifetime pension from his employer. Jennifer believes that Scott's total retirement income will be sufficient to meet his needs, so he does not need additional retirement income.

Jennifer would like the mortgage to be paid off if she should die. The present mortgage balance is $ She also wants to establish an emergency fund of $ for the family and an educational fund of $ for her son.

Jennifer has a checking account and personal savings in the amount of $ and has mutual funds investment of $ She has $ in a Section plan sponsored by her employer. She is also insured for $ under a group life nsurance plan.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started