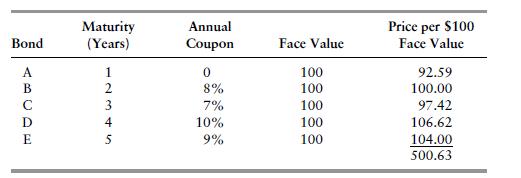

ABC Trust has the following bond portfolio: The coupon bonds in the portfolio all pay coupons annually

Question:

ABC Trust has the following bond portfolio:

The coupon bonds in the portfolio all pay coupons annually and all the bond prices are quoted per $100 face value to yield 8%.

a. Explain how the bond portfolio’s YTM is calculated.

b. Determine the bond portfolio’s YTM using a financial calculator, Excel program, or by trial and error (hint: try YTM = 8%).

c. Does the portfolio’s YTM equal the weighted average yield of the bonds? If so, is this always the case?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: