Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jennifer Ross, an employee of Hampton Company, worked 43 hours during the week of February 9 through 15 . Her rate of pay is $22.40

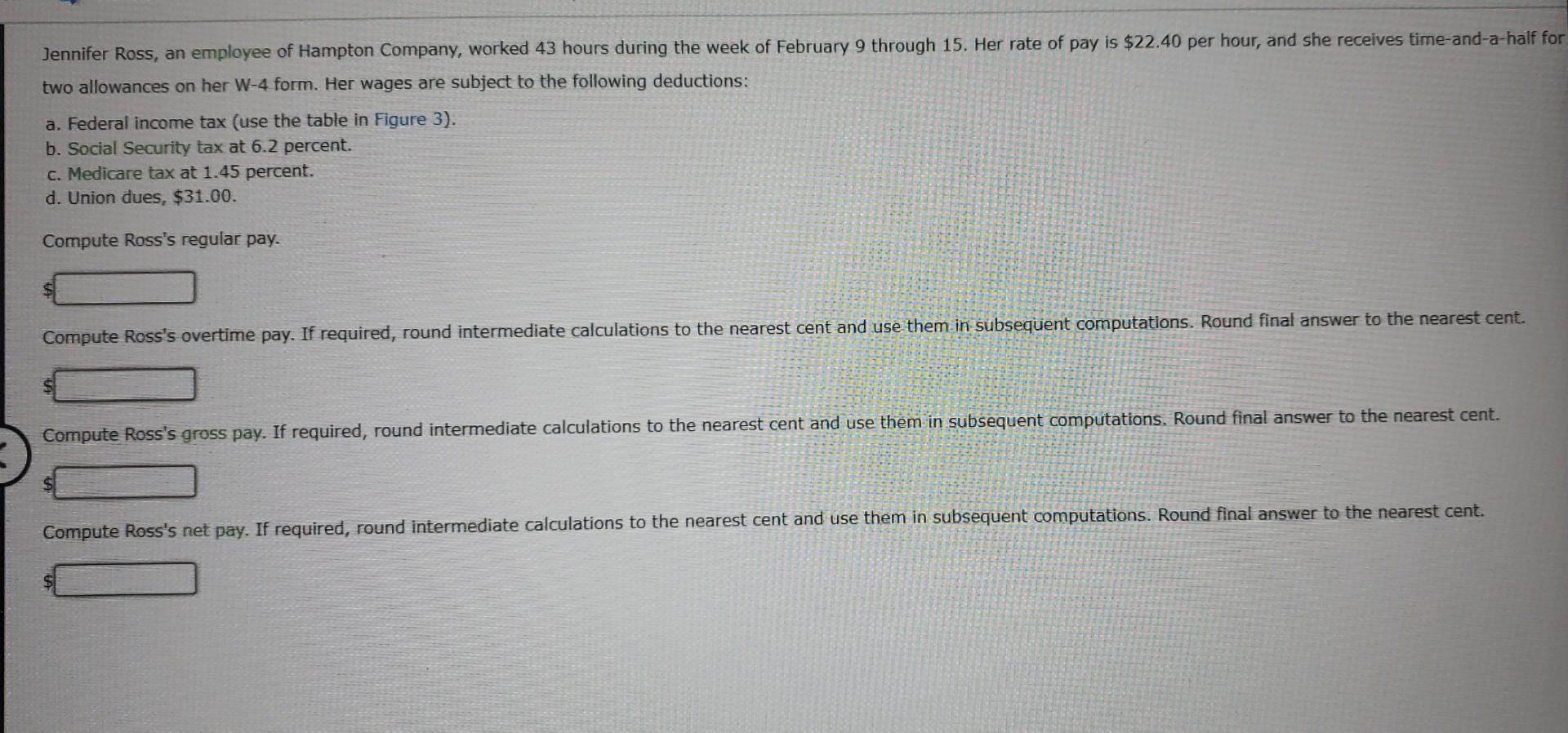

Jennifer Ross, an employee of Hampton Company, worked 43 hours during the week of February 9 through 15 . Her rate of pay is $22.40 per hour, and she receives time-and-a-half fo two allowances on her W-4 form. Her wages are subject to the following deductions: a. Federal income tax (use the table in Figure 3). b. Social Security tax at 6.2 percent. c. Medicare tax at 1.45 percent. d. Union dues, $31.00. Compute Ross's regular pay. Compute Ross's overtime pay. If required, round intermediate calculations to the nearest cent and use them in subsequent computations. Round final answer to the nearest cent. Compute Ross's gross pay. If required, round intermediate calculations to the nearest cent and use them in subsequent computations. Round final answer to the nearest cent. Compute Ross's net pay. If required, round intermediate calculations to the nearest cent and use them in subsequent computations. Round final answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started