Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jennifer Taxpayer separated from her husband Michael Taxpayer on July 1 5 , 2 0 2 2 , and moved with their children, Lisa and

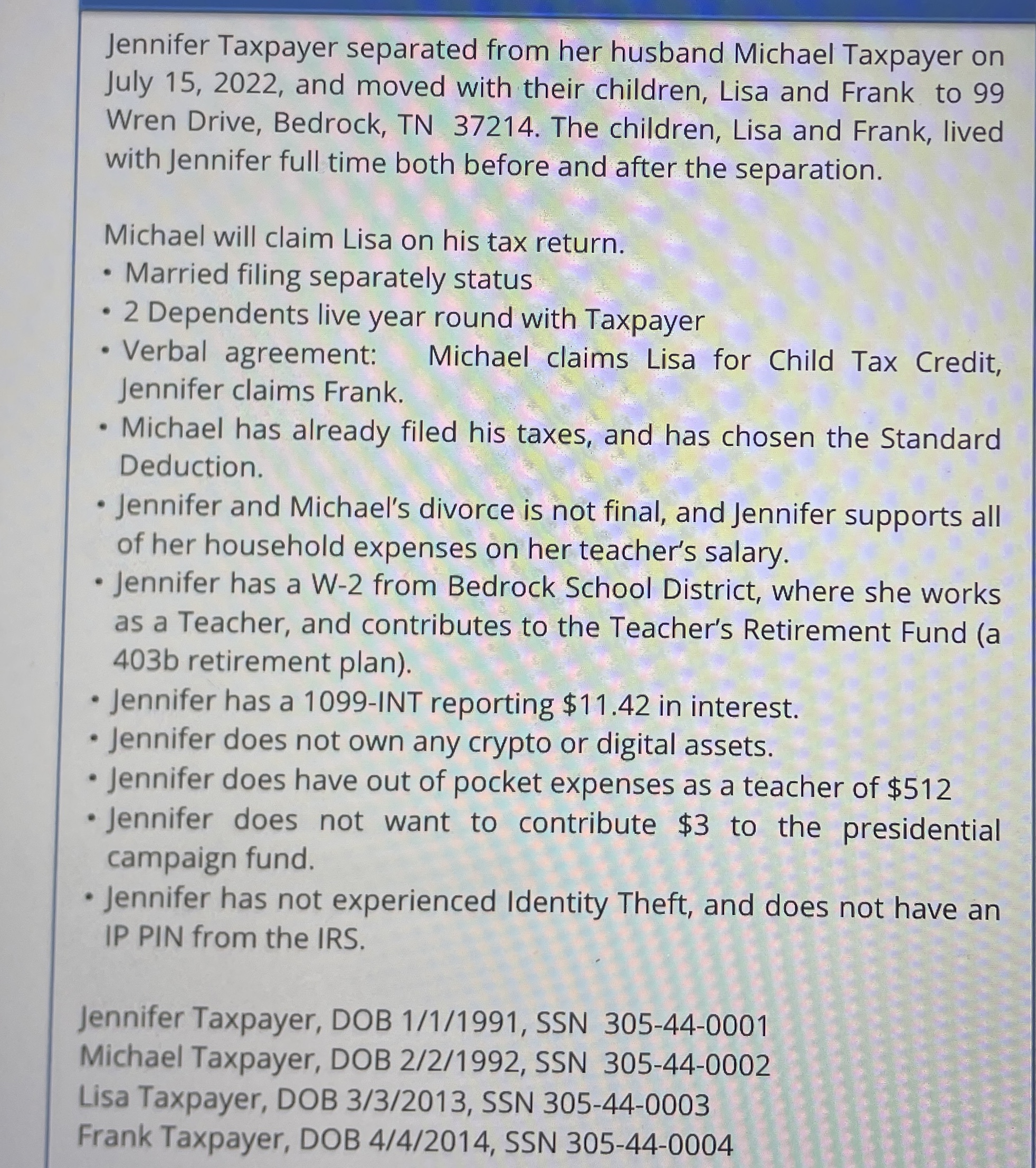

Jennifer Taxpayer separated from her husband Michael Taxpayer on

July and moved with their children, Lisa and Frank to

Wren Drive, Bedrock, TN The children, Lisa and Frank, lived

with Jennifer full time both before and after the separation.

Michael will claim Lisa on his tax return.

Married filing separately status

Dependents live year round with Taxpayer

Verbal agreement: Michael claims Lisa for Child Tax Credit,

Jennifer claims Frank.

Michael has already filed his taxes, and has chosen the Standard

Deduction.

Jennifer and Michael's divorce is not final, and Jennifer supports all

of her household expenses on her teacher's salary.

Jennifer has a W from Bedrock School District, where she works

as a Teacher, and contributes to the Teacher's Retirement Fund a

b retirement plan

Jennifer has a INT reporting $ in interest.

Jennifer does not own any crypto or digital assets.

Jennifer does have out of pocket expenses as a teacher of $

Jennifer does not want to contribute $ to the presidential

campaign fund.

Jennifer has not experienced Identity Theft, and does not have an

IP PIN from the IRS.

Jennifer Taxpayer, DOB SSN

Michael Taxpayer, DOB SSN

Lisa Taxpayer, DOB SSN

Frank Taxpayer, DOB SSN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started