'Jenny Cochran, a graduate of The University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to

'Jenny Cochran, a graduate of The University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components.

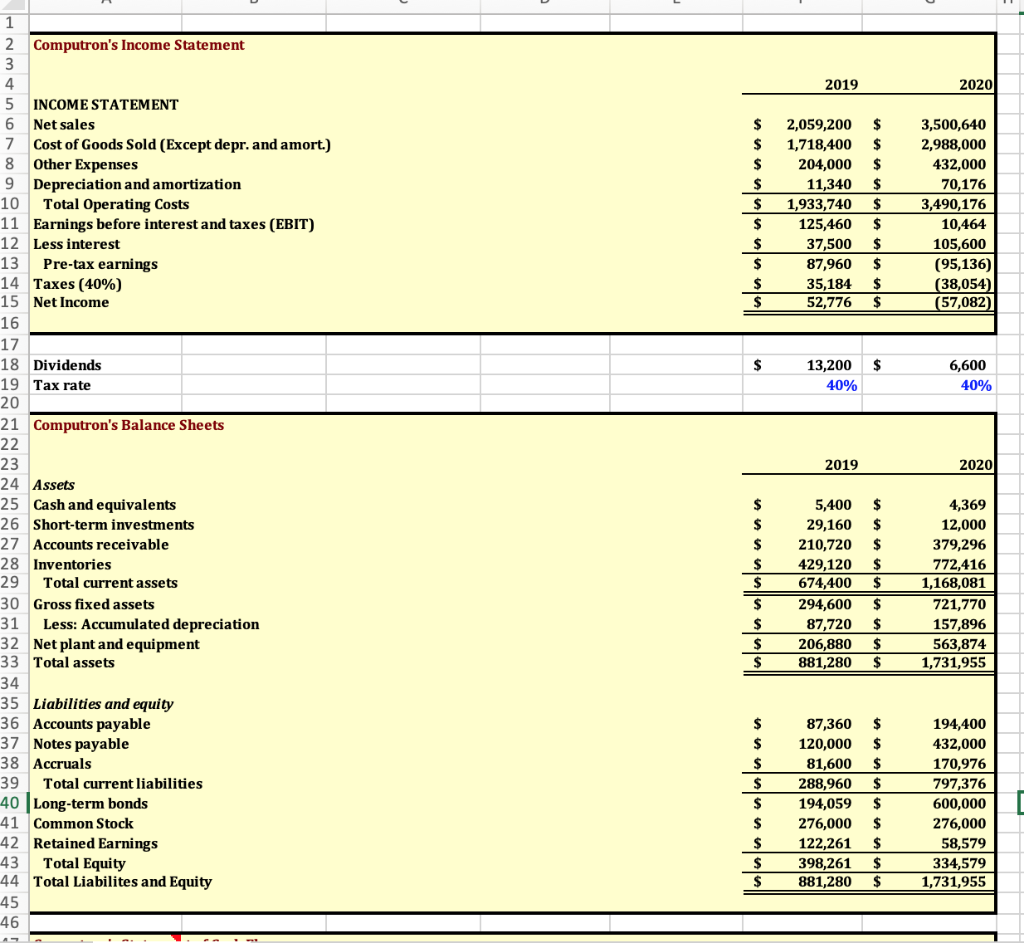

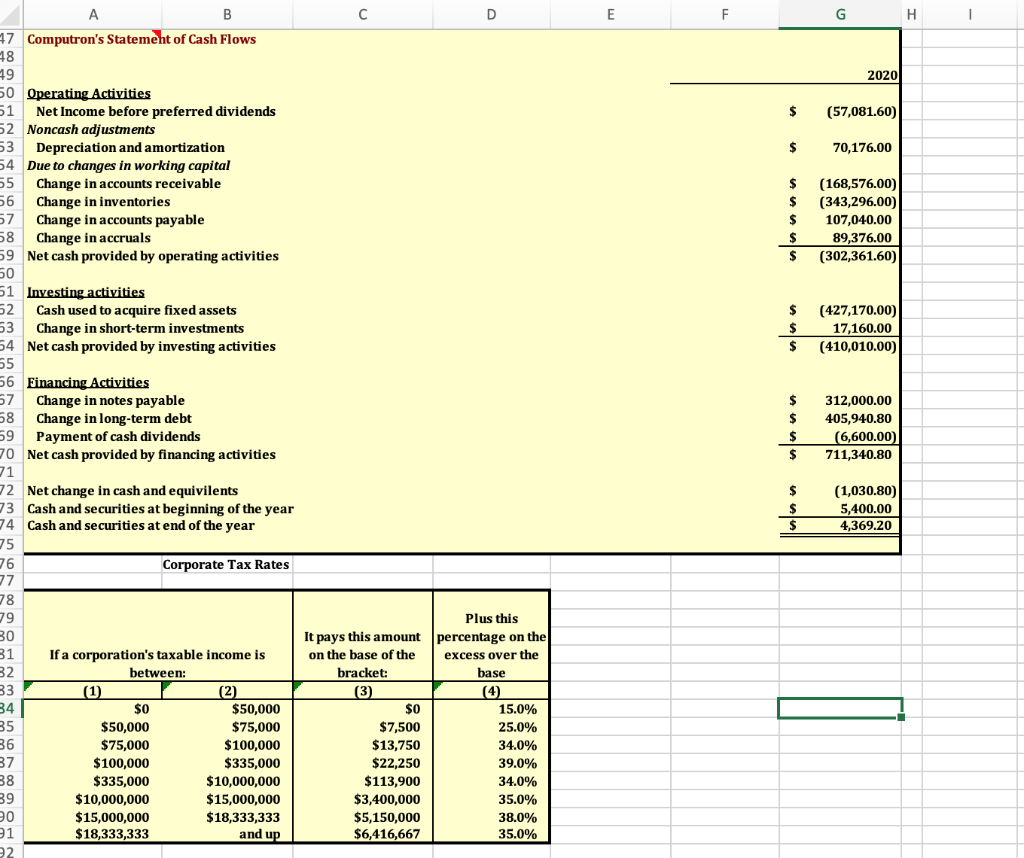

During the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data. (Data Attached)

a. What happened to Computron's market value added (MVA)?

b. Assume that a corporation has $200,000 of taxable income from operations. What is the company's federal tax liability?

c. Assume that you are in the 25% marginal tax bracket and that you have $50,000 to invest. You have narrowed your investment choices down to municipal bonds yielding 7% or equally risky corporate bonds with a yield of 10%. Which one should you choose and why? At what marginal tax rate would you be indifferent?

Computron's Income Statement 2019 2020 $ 9 INCOME STATEMENT Net sales 7 Cost of Goods Sold (Except depr. and amort.) Other Expenses Depreciation and amortization Total Operating Costs 11 Earnings before interest and taxes (EBIT) 12 Less interest 13 Pre-tax earnings 14 Taxes (40%) 15 Net Income 2,059,200 1,718,400 204,000 11,340 1,933,740 125,460 37,500 87,960 35,184 52,776 $ $ $ $ $ $ $ $ $ $ 3,500,640 2,988,000 432,000 70,176 3,490,176 10,464 105,600 (95,136) (38,054) (57,082) 16 $ $ 13,200 40% 6,600 40% 2019 2020 26 17 18 Dividends 19 Tax rate 20 21 Computron's Balance Sheets 22 23 24 Assets 25 Cash and equivalents Short-term investments 27 Accounts receivable 28 Inventories 29 Total current assets 30 Gross fixed assets 31 Less: Accumulated depreciation 32 Net plant and equipment 33 Total assets 34 35 Liabilities and equity 36 Accounts payable 37 Notes payable 38 Accruals 39 Total current liabilities 40 Long-term bonds 41 Common Stock 42 Retained Earnings 43 Total Equity 44 Total Liabilites and Equity 5,400 29,160 210,720 429,120 674,400 294,600 87,720 206,880 881,280 $ $ $ $ $ $ $ $ $ 4,369 12,000 379,296 772,416 1,168,081 721,770 157,896 563,874 1,731,955 nnnnnnnnn 87,360 120,000 81,600 288,960 194,059 276,000 122,261 398,261 881,280 $ $ $ $ $ $ $ $ $ 194,400 432,000 170,976 797,376 600,000 276,000 58,579 334,579 1,731,955 46 B 47 Computron's Statement of Cash Flows 2020 $ (57,081.60) $ 70,176.00 50 Operating Activities 51 Net Income before preferred dividends 52 Noncash adjustments 53 Depreciation and amortization 54 Due to changes in working capital 55 Change in accounts receivable 56 Change in inventories 57 Change in accounts payable 58 Change in accruals 59 Net cash provided by operating activities 50 51 Investing activities 52 Cash used to acquire fixed assets 53 Change in short-term investments 54 Net cash provided by investing activities $ (168,576.00) (343,296.00) 107,040.00 89,376.00 (302,361.60) $ $ $ $ $ (427,170.00) 17,160.00 (410,010.00) 56 Financing Activities 57 Change in notes payable 58 Change in long-term debt 59 Payment of cash dividends 70 Net cash provided by financing activities 71 72 Net change in cash and equivilents 73 Cash and securities at beginning of the year Cash and securities at end of the year 312,000.00 405,940.80 (6,600.00) 711,340.80 $ $ (1,030.80) 5,400.00 4,369.20 Corporate Tax Rates 30 31 It pays this amount on the base of the bracket: 32 33 (3) 34 $0 If a corporation's taxable income is between: (1) (2) $50,000 $50,000 $75,000 $75,000 $100,000 $100,000 $335,000 $335,000 $10,000,000 $10,000,000 $15,000,000 $15,000,000 $18,333,333 $18,333,333 and up $0 $7,500 $13,750 $22,250 $113,900 $3,400,000 $5,150,000 $6,416,667 Plus this percentage on the excess over the base (4) 15.0% 25.0% 34.0% 39.0% 34.0% 35.0% 38.0% 35.0% 38 39 20 21 2 Computron's Income Statement 2019 2020 $ 9 INCOME STATEMENT Net sales 7 Cost of Goods Sold (Except depr. and amort.) Other Expenses Depreciation and amortization Total Operating Costs 11 Earnings before interest and taxes (EBIT) 12 Less interest 13 Pre-tax earnings 14 Taxes (40%) 15 Net Income 2,059,200 1,718,400 204,000 11,340 1,933,740 125,460 37,500 87,960 35,184 52,776 $ $ $ $ $ $ $ $ $ $ 3,500,640 2,988,000 432,000 70,176 3,490,176 10,464 105,600 (95,136) (38,054) (57,082) 16 $ $ 13,200 40% 6,600 40% 2019 2020 26 17 18 Dividends 19 Tax rate 20 21 Computron's Balance Sheets 22 23 24 Assets 25 Cash and equivalents Short-term investments 27 Accounts receivable 28 Inventories 29 Total current assets 30 Gross fixed assets 31 Less: Accumulated depreciation 32 Net plant and equipment 33 Total assets 34 35 Liabilities and equity 36 Accounts payable 37 Notes payable 38 Accruals 39 Total current liabilities 40 Long-term bonds 41 Common Stock 42 Retained Earnings 43 Total Equity 44 Total Liabilites and Equity 5,400 29,160 210,720 429,120 674,400 294,600 87,720 206,880 881,280 $ $ $ $ $ $ $ $ $ 4,369 12,000 379,296 772,416 1,168,081 721,770 157,896 563,874 1,731,955 nnnnnnnnn 87,360 120,000 81,600 288,960 194,059 276,000 122,261 398,261 881,280 $ $ $ $ $ $ $ $ $ 194,400 432,000 170,976 797,376 600,000 276,000 58,579 334,579 1,731,955 46 B 47 Computron's Statement of Cash Flows 2020 $ (57,081.60) $ 70,176.00 50 Operating Activities 51 Net Income before preferred dividends 52 Noncash adjustments 53 Depreciation and amortization 54 Due to changes in working capital 55 Change in accounts receivable 56 Change in inventories 57 Change in accounts payable 58 Change in accruals 59 Net cash provided by operating activities 50 51 Investing activities 52 Cash used to acquire fixed assets 53 Change in short-term investments 54 Net cash provided by investing activities $ (168,576.00) (343,296.00) 107,040.00 89,376.00 (302,361.60) $ $ $ $ $ (427,170.00) 17,160.00 (410,010.00) 56 Financing Activities 57 Change in notes payable 58 Change in long-term debt 59 Payment of cash dividends 70 Net cash provided by financing activities 71 72 Net change in cash and equivilents 73 Cash and securities at beginning of the year Cash and securities at end of the year 312,000.00 405,940.80 (6,600.00) 711,340.80 $ $ (1,030.80) 5,400.00 4,369.20 Corporate Tax Rates 30 31 It pays this amount on the base of the bracket: 32 33 (3) 34 $0 If a corporation's taxable income is between: (1) (2) $50,000 $50,000 $75,000 $75,000 $100,000 $100,000 $335,000 $335,000 $10,000,000 $10,000,000 $15,000,000 $15,000,000 $18,333,333 $18,333,333 and up $0 $7,500 $13,750 $22,250 $113,900 $3,400,000 $5,150,000 $6,416,667 Plus this percentage on the excess over the base (4) 15.0% 25.0% 34.0% 39.0% 34.0% 35.0% 38.0% 35.0% 38 39 20 21 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started