Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jenny has just completed the course Introduction to Financial Management and has gotten excited about impact investing. She has chosen 4 investments that provide some

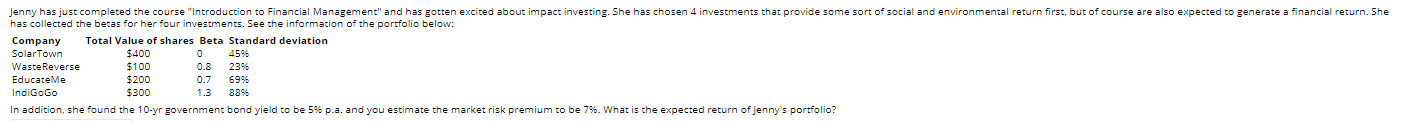

Jenny has just completed the course "Introduction to Financial Management" and has gotten excited about impact investing. She has chosen 4 investments that provide some sort of social and environmental return first, but of course are also expected to generate a financial return. She has collected the betas for her four investments. See the information of the portfolio below

In addition, she found the 10-yr government bond yield to be 5% p.a. and you estimate the market risk premium to be 7%. What is the expected return of Jenny's portfolio?

Jenny has just completed the course "Introduction to Financial Management" and has gotten excited about impact investing. She has chosen 4 investments that provide some sort of social and environmental return first, but of course are also expected to generate a financial return. She has collected the betas for her four investments. See the information of the portfolio below: Company Total Value of shares Beta Standard deviation SolarTown $400 4596 Waste Reverse $100 0.8 2396 EducateMe $200 0.7 6996 IndiGoGo $300 1.3 8896 In addition, she found the 10-yr government bond yield to be 5% p.a. and you estimate the market risk premium to be 79. What is the expected return of Jenny's portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started