Question

Jenny is considering buying a bond issued by Capstone Corporation. The bond has a face value of $5,000 but is currently selling for $4,900. Jenny

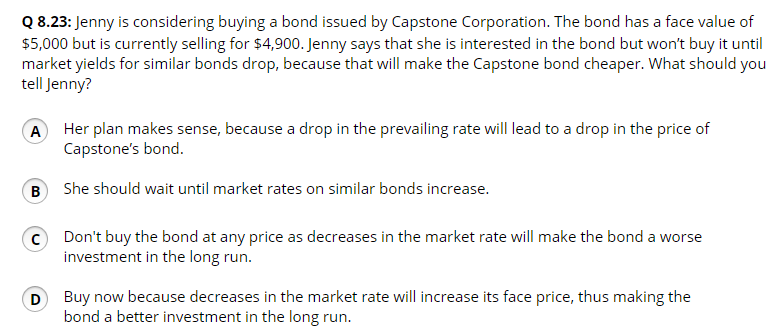

Jenny is considering buying a bond issued by Capstone Corporation. The bond has a face value of $5,000 but is currently selling for $4,900. Jenny says that she is interested in the bond but wont buy it until market yields for similar bonds drop, because that will make the Capstone bond cheaper. What should you tell Jenny?

-

A : Her plan makes sense, because a drop in the prevailing rate will lead to a drop in the price of Capstones bond.

-

B : She should wait until market rates on similar bonds increase.

-

C : Don't buy the bond at any price as decreases in the market rate will make the bond a worse investment in the long run.

-

D : Buy now because decreases in the market rate will increase its face price, thus making the bond a better investment in the long run.

-

Can someone help me with this problem.

-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started