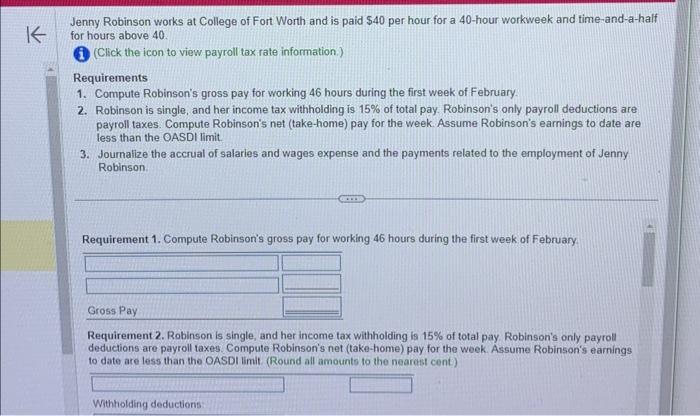

Jenny Robinson works at College of Fort Worth and is paid $40 per hour for a 40 -hour workweek and time-and-a-half for hours above 40 . (1. (Click the icon to view payroll tax rate information.) Requirements 1. Compute Robinson's gross pay for working 46 hours during the first week of February. 2. Robinson is single, and her income tax withholding is 15% of total pay. Robinson's only payroll deductions are payroll taxes. Compute Robinson's net (take-home) pay for the week. Assume Robinson's earnings to date are less than the OASDI limit. 3. Journalize the accrual of salaries and wages expense and the payments related to the employment of Jenny Robinson. Requirement 1. Compute Robinson's gross pay for working 46 hours during the first week of February: Requirement 2. Robinson is single, and her income tax withholding is 15% of total pay. Robinson's only payroll deductions are payroll taxes. Compute Robinson's net (take-home) pay for the week. Assume Robinson's earnings to date are less than the OASDI limit. (Round all amounte to the nearest cent) Jenny Robinson works at College of Fort Worth and is paid $40 per hour for a 40 -hour workweek and time-and-a-half for hours above 40 . (1. (Click the icon to view payroll tax rate information.) Requirements 1. Compute Robinson's gross pay for working 46 hours during the first week of February. 2. Robinson is single, and her income tax withholding is 15% of total pay. Robinson's only payroll deductions are payroll taxes. Compute Robinson's net (take-home) pay for the week. Assume Robinson's earnings to date are less than the OASDI limit. 3. Journalize the accrual of salaries and wages expense and the payments related to the employment of Jenny Robinson. Requirement 1. Compute Robinson's gross pay for working 46 hours during the first week of February: Requirement 2. Robinson is single, and her income tax withholding is 15% of total pay. Robinson's only payroll deductions are payroll taxes. Compute Robinson's net (take-home) pay for the week. Assume Robinson's earnings to date are less than the OASDI limit. (Round all amounte to the nearest cent)