Question

Jenny wants to invest her money to meet a liability of $12,000.00 six months from now. She can pick between portfolios A and B

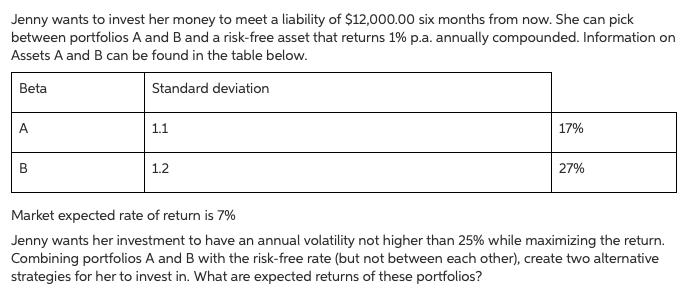

Jenny wants to invest her money to meet a liability of $12,000.00 six months from now. She can pick between portfolios A and B and a risk-free asset that returns 1% p.a. annually compounded. Information on Assets A and B can be found in the table below. Standard deviation Beta A B 1.1 1.2 17% 27% Market expected rate of return is 7% Jenny wants her investment to have an annual volatility not higher than 25% while maximizing the return. Combining portfolios A and B with the risk-free rate (but not between each other), create two alternative strategies for her to invest in. What are expected returns of these portfolios?

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To create two alternative investment strategies for Jenny that meet her criteria of an annual volati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Management Science

Authors: Bernard W. Taylor

11th Edition

132751917, 978-0132751919

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App