Question

The current share price of STW Corp is $53. Given his forecasts of the future share value, Jim wrote two call options on STW

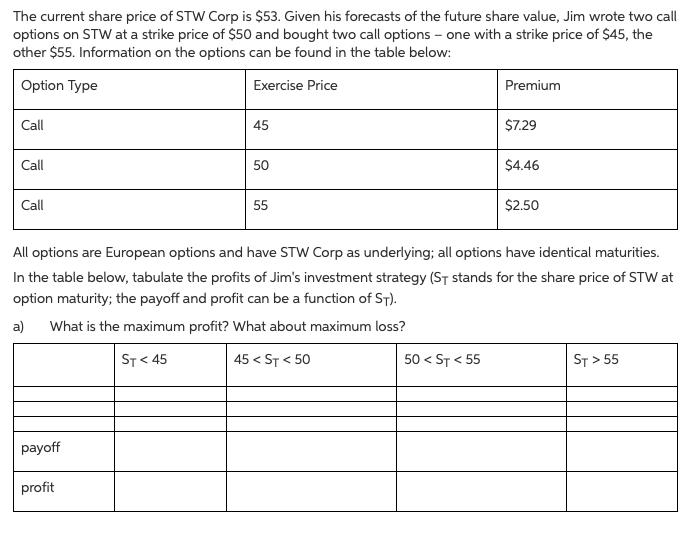

The current share price of STW Corp is $53. Given his forecasts of the future share value, Jim wrote two call options on STW at a strike price of $50 and bought two call options - one with a strike price of $45, the other $55. Information on the options can be found in the table below: Option Type Exercise Price Call Call Call 45 payoff profit 50 55 Premium 50 < ST < 55 $7.29 $4.46 All options are European options and have STW Corp as underlying; all options have identical maturities. In the table below, tabulate the profits of Jim's investment strategy (ST stands for the share price of STW at option maturity; the payoff and profit can be a function of ST). a) What is the maximum profit? What about maximum loss? ST < 45 45 ST < 50 $2.50 ST > 55

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App