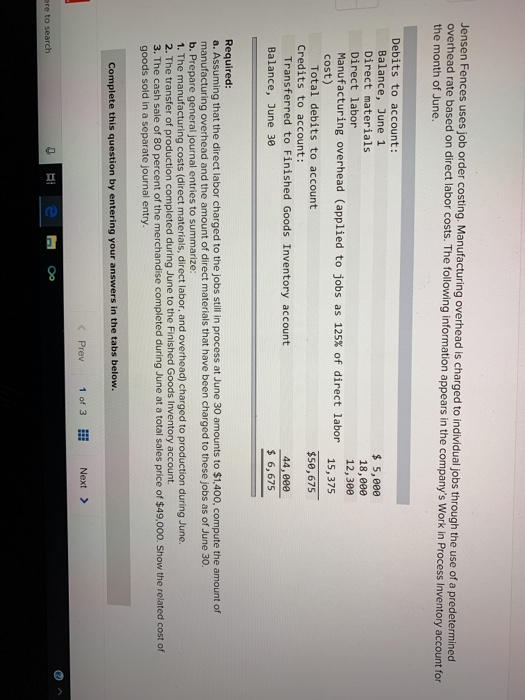

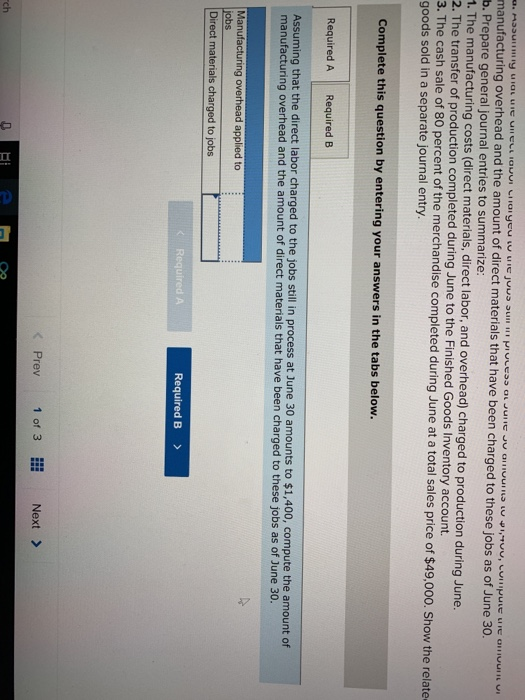

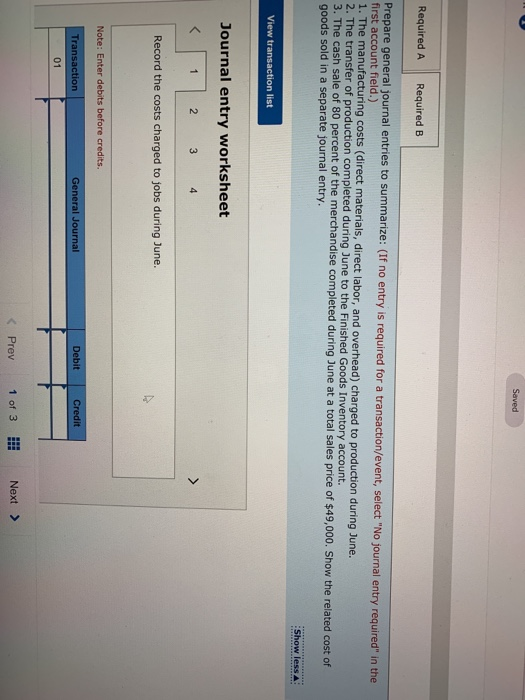

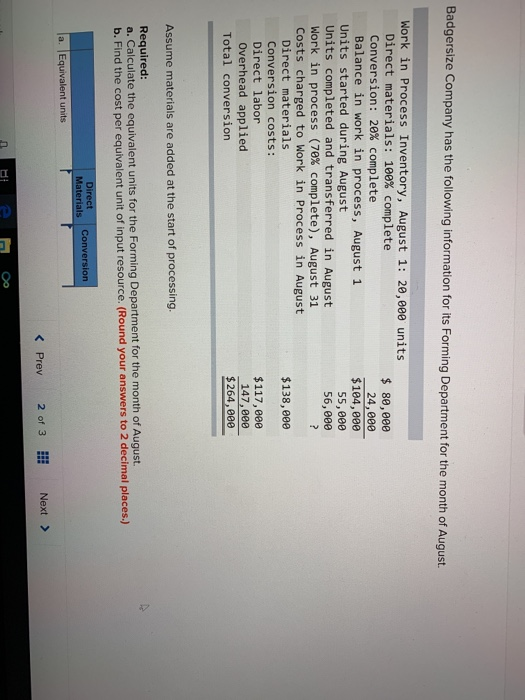

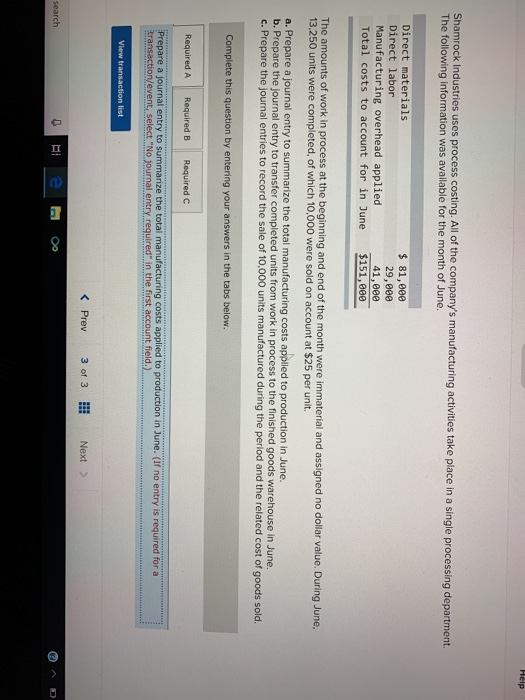

Jensen Fences overhead rate based on direct la the month of June. uses job order costing. Manufacturing overhead is charged to individual jobs through the use of a predetermined bor costs. The following information appears in the company's Work in Process Inventory account for Debits to account: Balance, June 1 Direct materials Direct labor Manufacturing overhead (applied to jobs as 125% of direct labor cost) 5,eee 18,800 12,300 15,375 Total debits to account $50,675 Credits to account: Transferred to Finished Goods Inventory account 44,800 Balance, June 30 6,675 Required a. Assuming that the direct labor charged to the jobs still in process at June 30 amounts to $1,400, compute the amount of manufacturing overhead and the amount of direct materials that have been charged to these jobs as of June 30. b. Prepare general journal entries to summarize: 1. The manufacturing costs (direct materials, direct labor, and overhead) charged to production during June. 2. The transfer of production completed during June to the Finished Goods Inventory account. 3. The cash sale of 80 percent of the merchandise completed during June at a total sales price of $49,000. Show the related cost of goods sold in a separate journal entry. Complete this question by entering your answers in the tabs below. Prev 1 of 3 Next ere to search manufacturing overhead and the amount of direct materials that have been charged to the b. Prepare general journal entries to summarize: 1. The manufacturing costs (direct materials, direct labor, and overhead) charged to p se jobs as of June 30. roduction during June. fer of production completed during June to the Finished Goods Inventory account. 3. The cash sale of 80 percent of the merchandise completed during June at a total sales price of $49,000. Show the relate goods sold in a separate journal entry. Complete this question by entering your answers in the tabs below. Required A Required B Assuming that the direct labor charged to the jobs still in process at June 30 amounts to $1,400, compute the amount of manufacturing overhead and the amount of direct materials that have been charged to these jobs as of June 30. Manufacturing overhead applied to obs Direct materials charged to jobs Required A Required B Prev 1 of 3 Next ch Required A Required B Prepare general journal entries to summarize: (If no entry is required for a transaction/event first account field.) 1. The manufacturing costs (direct materials, direct labor, and overhead) charged to production during June. 2. The transfer of production completed during June to the Finished Goods Inventory account. , select "No journal entry required" in the e cash sale of 80 percent of the merchandise completed during June at a total sales price of $49,000. Show the related cost of goods sold in a separate journal entry. Show lessA View transaction list Journal entry worksheet 2 Record the costs charged to jobs during June. er debits before credits Transaction General Journal DebitCredit 01 Prev1 of 3 Next > Shamrock Industries uses process costing. All of the company's manufacturing activities take place in a single processing department. The following information was available for the month of June. Direct materials Direct labor Manufacturing overhead applied Total costs to account for in June $151,000 81,900 29,900 41,800 The amounts of work in process at the beginning and end of the month were immaterial and assigned no dolar value. During June, 3,250 units were completed, of which 10,000 were sold on account at $25 per unit. a. Prepare a journal entry to summarize the total manufacturing costs applied to production in June. b. Prepare the journal entry to transfer completed units from work in process to the finished goods warehouse in June. c. Prepare the journal entries to record the sale of 10,000 units manufactured during the period and the related cost of goods sold. Complete this question by entering your answers in the tabs below Required A Required B Required C Prepare a journal entry to summarize the total manufacturing costs applied to production in June. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) earch