Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jeopardy! question: The answer is because holders of zero - coupon bonds must pay taxes each year on zero - coupon bonds as if they

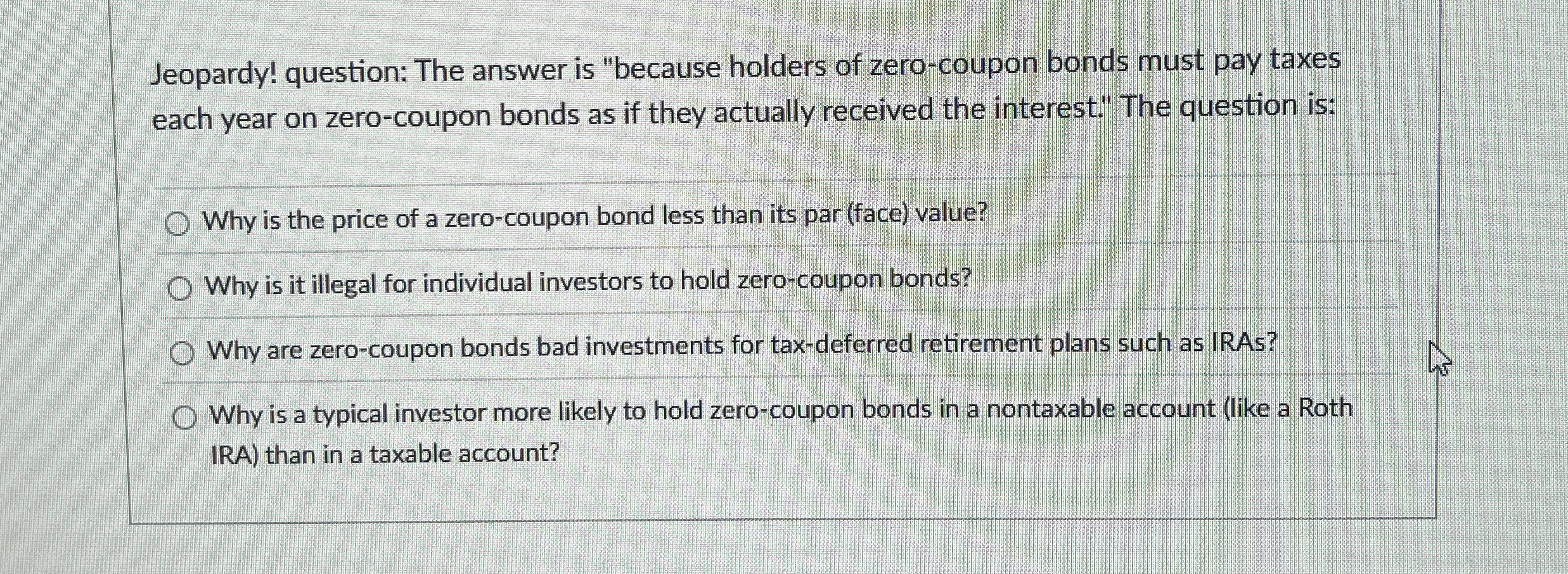

Jeopardy! question: The answer is "because holders of zerocoupon bonds must pay taxes

each year on zerocoupon bonds as if they actually received the interest." The question is:

Why is the price of a zerocoupon bond less than its par face value?

Why is it illegal for individual investors to hold zerocoupon bonds?

Why are zerocoupon bonds bad investments for taxdeferred retirement plans such as IRAs?

Why is a typical investor more likely to hold zerocoupon bonds in a nontaxable account like a Roth

IRA than in a taxable account?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started