Jeremy earned $80,000 in salary and $7,000 in interest income during the year. Jeremy has two qualifying dependent children who live with him. He qualifies to file as head of household and has $11,500 in itemized deductions. Neither of his dependents qualifies for the child tax credit.(Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.)

| a. | Use the 2014 tax rate schedules to determine Jeremys taxes due. 1 Gross Income 2 For AGI deductions 3 Adjusted Gross Income 4 Standard deduction 5 Itemized deductions 6 7 personal and dependency exemptions 8 Taxable income Income tax liability | b. | Assume that in addition to the original facts, Jeremy has a long-term capital gain of $3,500. What is Jeremys tax liability including the tax on the capital gain? Description Amount (1) Gross income $ (2) For AGI deductions (3) Adjusted gross income $ (4) Standard deduction (5) Itemized deductions (6) of standard deductions or itemized deductions (7) Personal and dependency exemptions (8) Taxable income $ Income tax liability $ | c. | Assume the original facts except that Jeremy had only $6,500 in itemized deductions. What is Jeremys total income tax liability? Description Amount (1) Gross income $ (2) For AGI deductions (3) Adjusted gross income $ (4) Standard deduction (5) Itemized deductions (6) of standard deductions or itemized deductions (7) Personal and dependency exemptions (8) Taxable income $ Income tax liability $ | | |

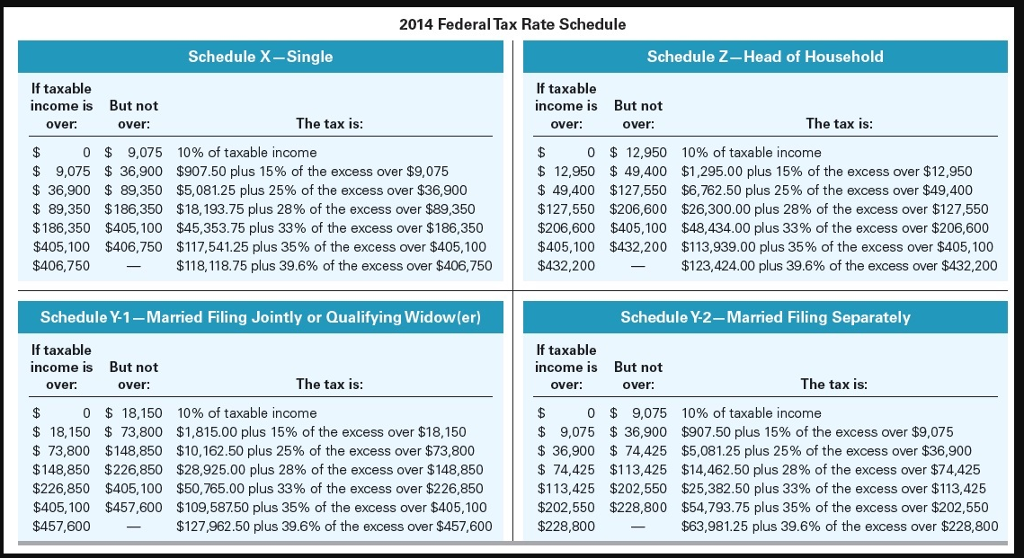

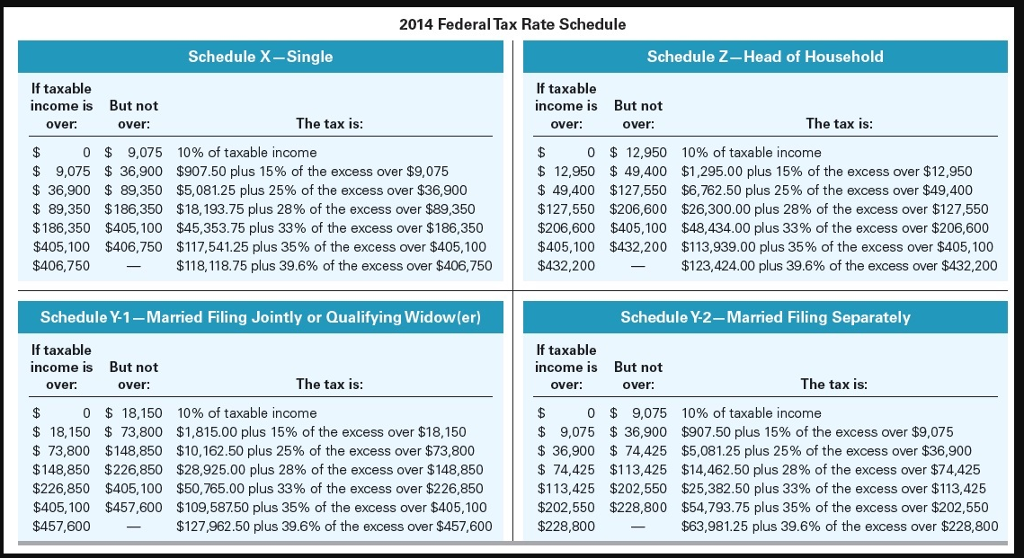

2014 Federal Tax Rate Schedule Schedule K--Single Schedule Z-Head of Household If taxable income is over If taxable income is over: But not But not over: The tax is: over: The tax IS: 0 $ 9,075 $ 36,900 $ 89,350 $186,350 $405,100 $406,750 9,075 $ 36,900 $ 89,350 $ 186,350 $405,100 $406,750 $ 10% of taxable income $907.50 plus 15% of the excess over $9,075 $5,081.25 plus 25% of the excess over $36,900 $18,193.75 plus 28% of the excess over $89,350 $45,353.75 plus 33% of the excess over $186,350 0 $ 12,950 $ 49,400 $127,550 $206,600 $405,100 $432,200 $ 12,950 $ 49,400 $ 127,550 $206,600 $405,100 $432,200 10% of taxable income $1,295.00 plus 15% of the excess over $12,950 $6,762.50 plus 25% of the excess over $49,400 $26,300.00 plus 28% of the excess over $127,550 $48,434.00 plus 33% of the excess over $206,600 $113,939.00 plus 35% of the excess over $405,100 $123,424.00 plus 39.6% of the excess over $432,200 117,541.25 plus 35% of the excess over $405,100 $118,118.75 plus 39.6% of the excess over $406,750 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) Schedule Y-2-Married Filing Separately If taxable income is over. If taxable income is over: But not But not over: The tax is: over. The tax is: $ 18,150 $ 73,800 $148,850 $226,850 $405,100 $457,600 10% of taxable income $1,815.00 plus 15% of the excess over $18,150 $10,162.50 plus 25% of the excess over $73,800 $28,925.00 plus 28% of the excess over $148,850 $50,765.00 plus 33% of the excess over $226,850 $ 109,587 50 plus 35% of the excess over $405,100 $127,962.50 plus 39.6% of the excess over $457,600 $ 0 $ 18,150 $ 73,800 $148,850 $226,850 $405,100 $457,600 0 $ 9,075 $ 36,900 74,425 $113,425 $202,550 $228,800 9,075 $36,900 $ 74,425 $113,425 $202,550 $228,800 10% of taxable income $907.50 plus 15% of the excess over $9,075 $5,081.25 plus 25% of the excess over $36,900 $14,462.50 plus 28% of the excess over $74,425 $25,382.50 plus 33% of the excess over $113,425 $54,793.75 plus 35% of the excess over $202,550 $63,981.25 plus 39.6% of the excess over $228,800