Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jeremy (unmarried) earned $100,500 in salary and $6,050 in interest income during the year. Jeremy's employer withheld $10,000 of federal income taxes from Jeremy's

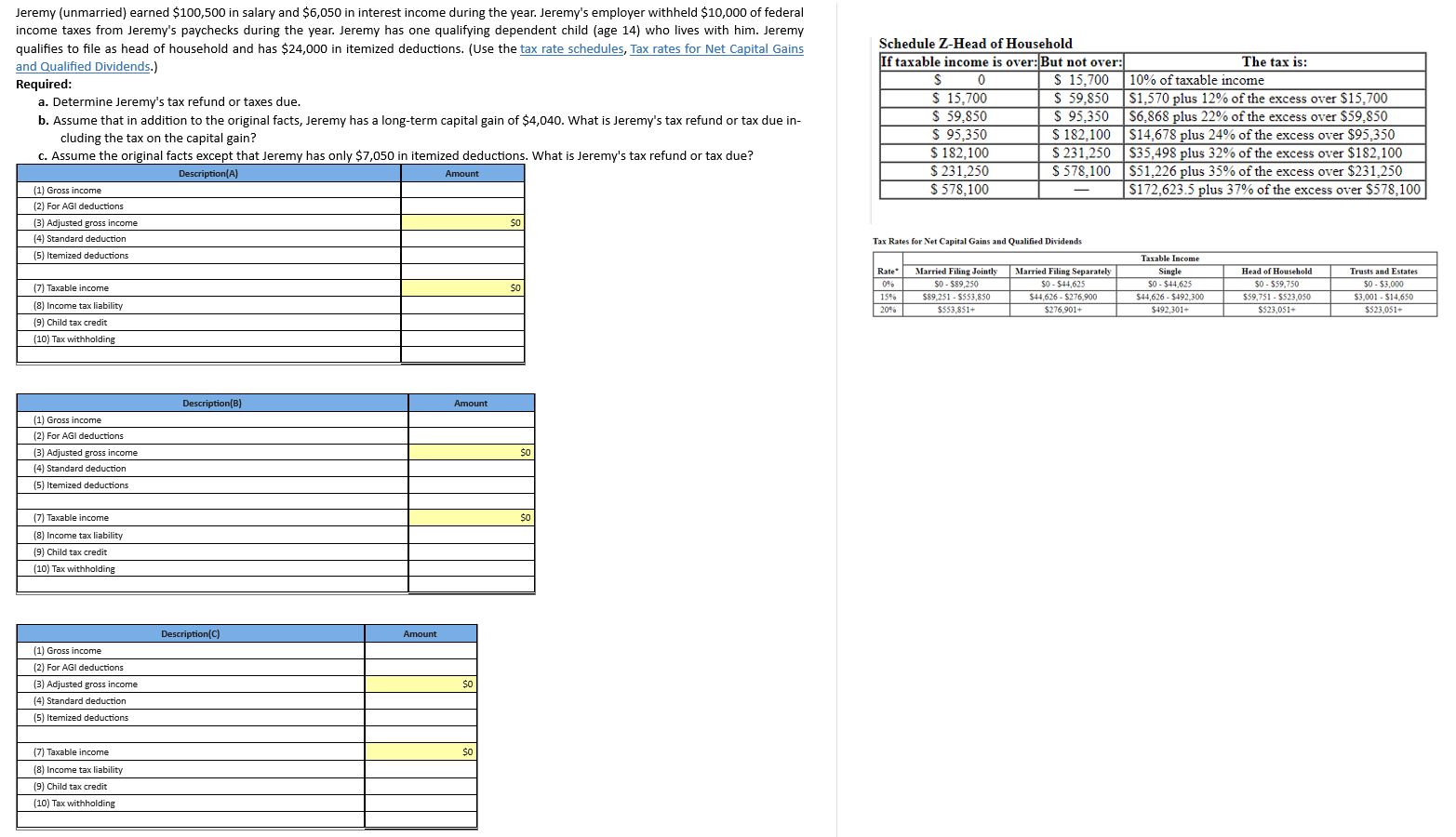

Jeremy (unmarried) earned $100,500 in salary and $6,050 in interest income during the year. Jeremy's employer withheld $10,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $24,000 in itemized deductions. (Use the tax rate schedules, Tax rates for Net Capital Gains and Qualified Dividends.) Required: a. Determine Jeremy's tax refund or taxes due. b. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,040. What is Jeremy's tax refund or tax due in- cluding the tax on the capital gain? c. Assume the original facts except that Jeremy has only $7,050 in itemized deductions. What is Jeremy's tax refund or tax due? (1) Gross income (2) For AGI deductions Description(A) Amount Schedule Z-Head of Household If taxable income is over: But not over: $ $ 15,700 0 $ 15,700 $ 59,850 $ 95,350 $ 59,850 $ 95,350 $ 182,100 $231,250 $578,100 $ 182,100 $231,250 $578,100 The tax is: 10% of taxable income $1,570 plus 12% of the excess over $15,700 $6,868 plus 22% of the excess over $59,850 $14,678 plus 24% of the excess over $95,350 $35,498 plus 32% of the excess over $182,100 $51,226 plus 35% of the excess over $231,250 $172,623.5 plus 37% of the excess over $578,100 (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (7) Taxable income (8) Income tax liability (9) Child tax credit (10) Tax withholding (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (7) Taxable income (8) Income tax liability (9) Child tax credit (10) Tax withholding (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (7) Taxable income (8) Income tax liability (9) Child tax credit (10) Tax withholding Description(B) Amount Description(C) Amount $0 $0 SO $0 $0 Tax Rates for Net Capital Gains and Qualified Dividends Rate Married Filing Jointly 0% $0-$89,250 15% $89,251 $553,850 20% $553,851+ Married Filing Separately $0-$44,625 $44,626-$276,900 $276,901+ Taxable Income Single $0 - $44,625 $44,626-$492,300 $492,301+ Head of Household $0-$59,750 $59,751 $523,050 $523,051+ Trusts and Estates $0 - $3,000 $3,001-$14,650 $523,051+

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required A Tax Refund or Taxes Due Original Facts 1 Calculate Jeremys taxable income Gross income 100500 salary 6050 interest 106550 AGI 106550 24000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66432ad24fbdd_952122.pdf

180 KBs PDF File

66432ad24fbdd_952122.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started