Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jerry Ltd., a publicly listed company, needs to determine its earnings per share (EPS) information for its current year ended December 31. The following

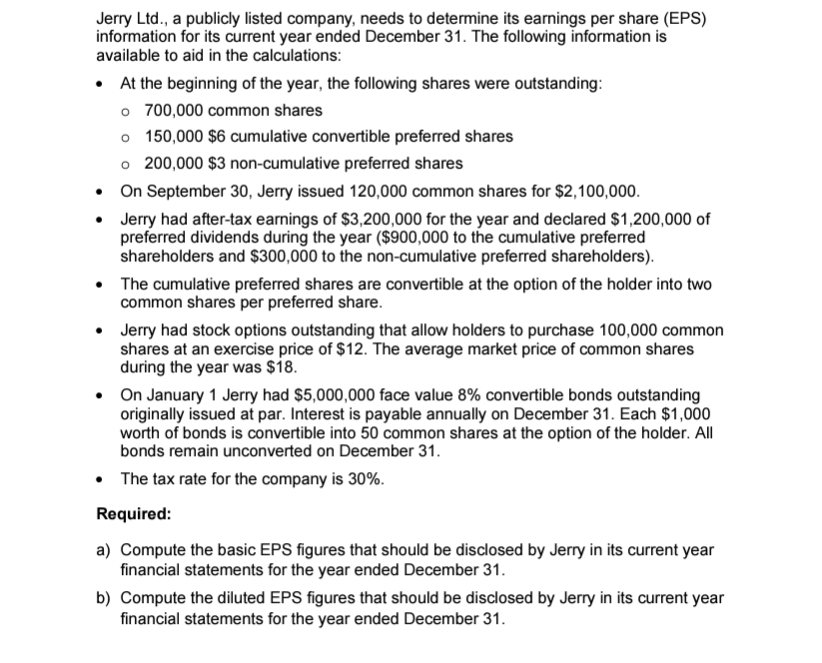

Jerry Ltd., a publicly listed company, needs to determine its earnings per share (EPS) information for its current year ended December 31. The following information is available to aid in the calculations: At the beginning of the year, the following shares were outstanding: 700,000 common shares 150,000 $6 cumulative convertible preferred shares 200,000 $3 non-cumulative preferred shares On September 30, Jerry issued 120,000 common shares for $2,100,000. Jerry had after-tax earnings of $3,200,000 for the year and declared $1,200,000 of preferred dividends during the year ($900,000 to the cumulative preferred shareholders and $300,000 to the non-cumulative preferred shareholders). The cumulative preferred shares are convertible at the option of the holder into two common shares per preferred share. Jerry had stock options outstanding that allow holders to purchase 100,000 common shares at an exercise price of $12. The average market price of common shares during the year was $18. On January 1 Jerry had $5,000,000 face value 8% convertible bonds outstanding originally issued at par. Interest is payable annually on December 31. Each $1,000 worth of bonds is convertible into 50 common shares at the option of the holder. All bonds remain unconverted on December 31. The tax rate for the company is 30%. Required: a) Compute the basic EPS figures that should be disclosed by Jerry in its current year financial statements for the year ended December 31. b) Compute the diluted EPS figures that should be disclosed by Jerry in its current year financial statements for the year ended December 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To compute the basic EPS figures we need to determine the weighted average number of common shares outstanding during the year Step 1 Calcula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started