Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jerry World currently has $200,000 of wealth and Jerry intend to allocate it across three stocks as follows: $70,000 in Webb stock, $40,000 in

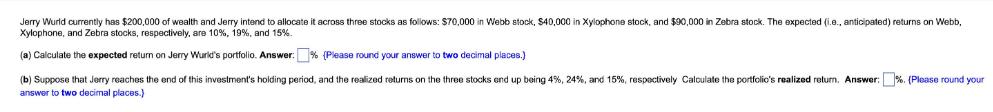

Jerry World currently has $200,000 of wealth and Jerry intend to allocate it across three stocks as follows: $70,000 in Webb stock, $40,000 in Xylophone stock, and $90,000 in Zebra stock. The expected (i.e., anticipated) returns Webb, Xylophone, and Zebra stocks, respectively, are 10 % , 19%, and 15%. (a) Calculate the expected return on Jerry Wurld's portfolio. Answer: % (Please round your answer to two decimal places.) (b) Suppose that Jerry reaches the end of this investment's holding period, and the realized returns on the three stocks end up being 4%, 24%, and 15%, respectively Calculate the portfolio's realized return. Answer:%. (Please round your answer to two decimal places.)

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the expected return on Jerrys portfolio you can use a weighted average of the expecte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started