Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jess Gilmore has budgeted that output and sales of his single product, Glowmore, will be 100 000 units for the coming year. At this

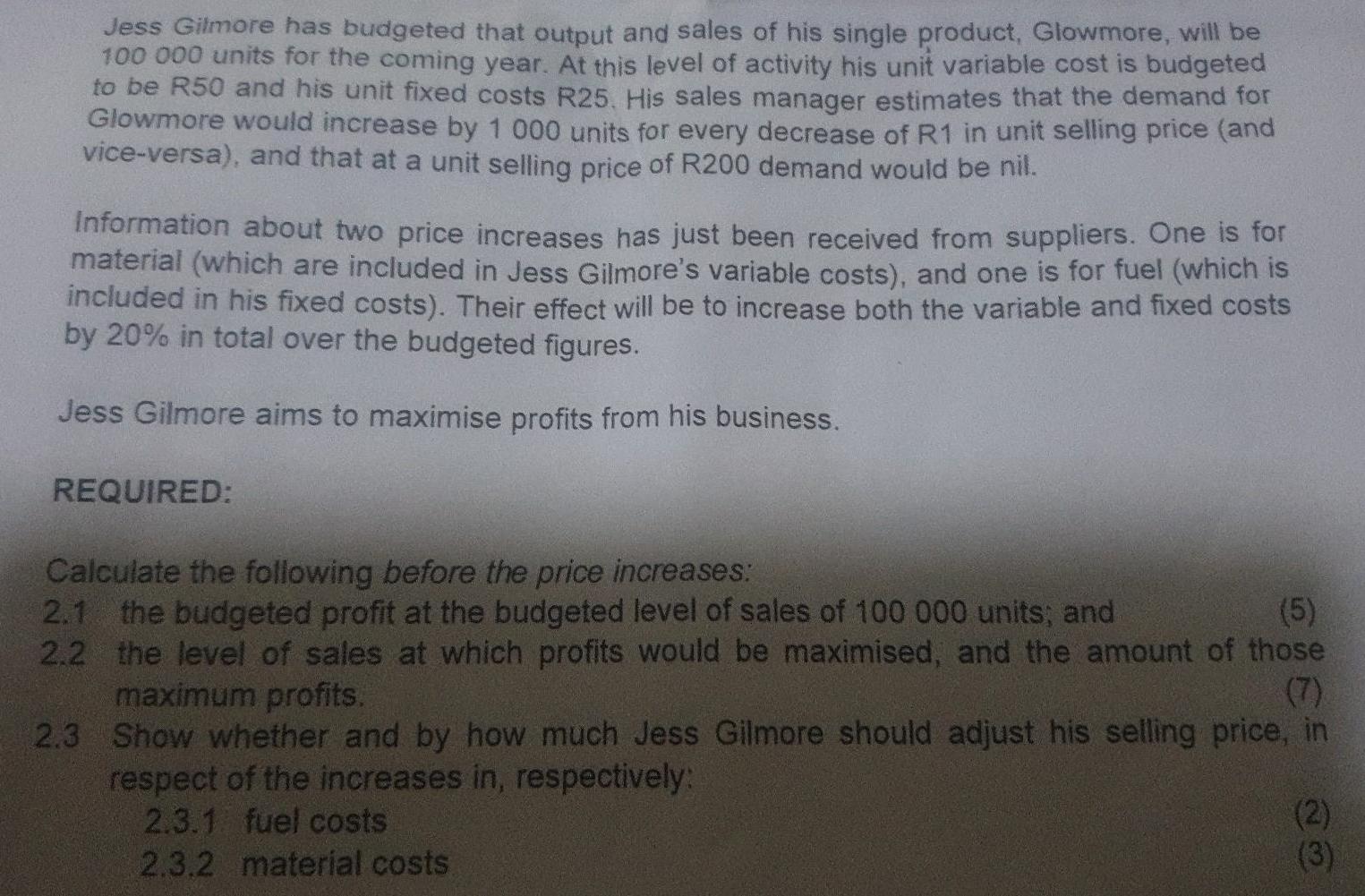

Jess Gilmore has budgeted that output and sales of his single product, Glowmore, will be 100 000 units for the coming year. At this level of activity his unit variable cost is budgeted to be R50 and his unit fixed costs R25. His sales manager estimates that the demand for Glowmore would increase by 1 000 units for every decrease of R1 in unit selling price (and vice-versa), and that at a unit selling price of R200 demand would be nil. Information about two price increases has just been received from suppliers. One is for material (which are included in Jess Gilmore's variable costs), and one is for fuel (which is included in his fixed costs). Their effect will be to increase both the variable and fixed costs by 20% in total over the budgeted figures. Jess Gilmore aims to maximise profits from his business. REQUIRED: Calculate the following before the price increases: 2.1 the budgeted profit at the budgeted level of sales of 100 000 units; and (5) 2.2 the level of sales at which profits would be maximised, and the amount of those maximum profits. (7) 2.3 Show whether and by how much Jess Gilmore should adjust his selling price, in respect of the increases in, respectively: 2.3.1 fuel costs 2.3.2 material costs (2) (3)

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

21 The budgeted profit at the budgeted level of sales of 100 000 units is calculated as follows Total revenue 100 000 x 200 R20000000 Total variable c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started