Answered step by step

Verified Expert Solution

Question

1 Approved Answer

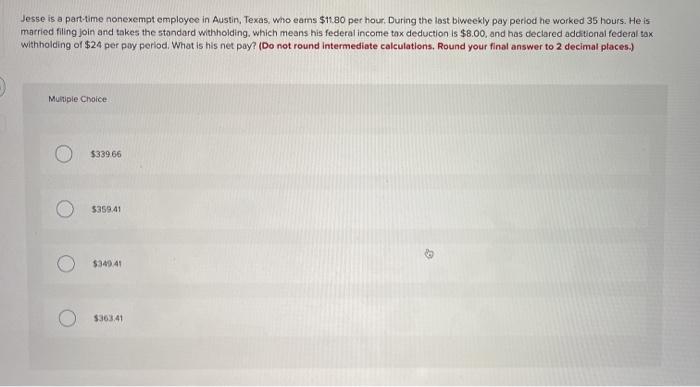

Jesse is a part-time non-exempt employee in Austin Texas who earns $11.80 per hour. During the last biweekly pay. He worked 35 hours. He is

Jesse is a part-time non-exempt employee in Austin Texas who earns $11.80 per hour. During the last biweekly pay. He worked 35 hours. He is married feeling join and takes the standard withholding, which means his federal income tax deduction is eight dollars, and has declared additional federal tax withholding of $24 per pay period. What is his net pay?

Jesse is a part-time nonexempt employee in Austin, Texas, who earns $11.80 per hour. During the last biweekly pay period he worked 35 hours. He is married filling join and takes the standard withholding, which means his federal income tax deduction is $8.00, and has declared additional federal tax withholding of $24 per pay period. What is his net pay? (Do not round Intermediate calculations, Round your final answer to 2 decimal places.) Multiple Choice $33966 5359.41 $349.41 $363.41

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started