Question

Jessica and Richard graduated with Business degrees a year ago, have decent stable jobs and are trying to connect their dreams with their finances. Jessica

Jessica and Richard graduated with Business degrees a year ago, have decent stable jobs and are trying to connect their dreams with their finances.

Jessica has set her eyes on a nice apartment, which is currently available on the market for $300,000. If they take a mortgage, the $1200 rent they currently pay could instead accumulate as equity on their own place. Her family members are willing to lend her the down payment as long as Jessica and Richard will pay back the loan in monthly payments over the next 5 years with 2% interest, same rate as a savings deposit. Their acquaintance purchased a similar apartment by paying down 20% and was quoted 4% interest for a 30 year mortgage.

Richard is against the idea. He thinks that the mortgage rates plus the $200 monthly maintenance fees may be a bit too much at the moment. Also, the general expectation of the economic experts is that the apartment prices will fall by 15% in the next 5 years.

Jessica's monthly net income is $3016, Thomas's is $2940 and both incomes can be assumed to be constant for the next five years. Their biggest concern right now is the debt they have accumulated so far. Jessica has $16,000 in student loans, for which she will make monthly payments at 4.5% interest quarterly compounded, for 2 more years. Richard currently has $20,000 in student loans with the same interest rate as Jessica's, which he will pay in the next 3 years. He also has $7500 in credit card debt, at 9% compounded monthly, which he will pay off in 3 years.

Their average monthly household expenditure is $2000 (This does not include rent or debt payments), and they believe these will be constant in the long run.

Question 1:

As all the payments are per month, and different loans have different compounding periods, what is the effective monthly interest for each loan?

Question 2:

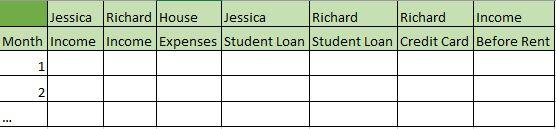

Complete the table to show month-by-month for the next 60 months, the family's income after expenses and debt, before the rent payment.

Jessica Richard House Jessica Richard Richard Income Month Income Income Expenses Student Loan Student Loan Credit Card Before Rent *** 1 2

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution Here are the answers to the questions 1 Effective monthly interest rates Jessi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started