Answered step by step

Verified Expert Solution

Question

1 Approved Answer

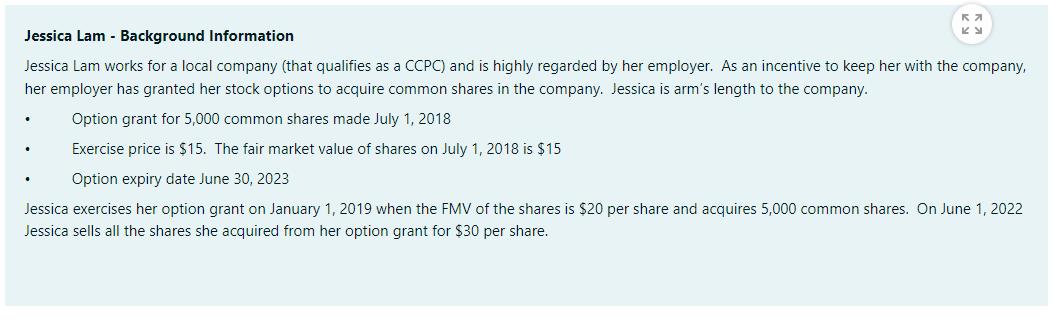

Jessica Lam - Background Information Jessica Lam works for a local company (that qualifies as a CCPC) and is highly regarded by her employer.

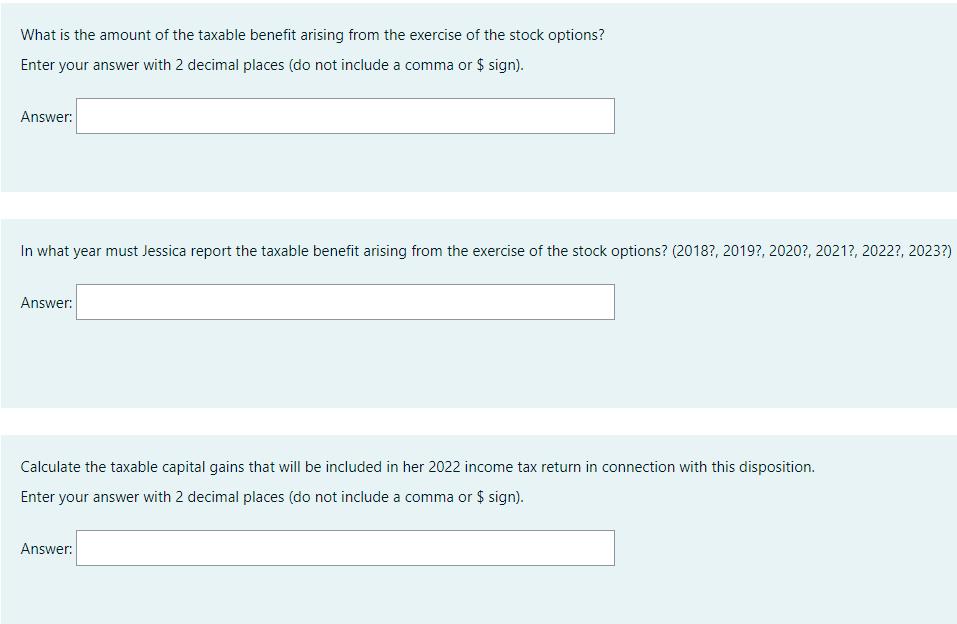

Jessica Lam - Background Information Jessica Lam works for a local company (that qualifies as a CCPC) and is highly regarded by her employer. As an incentive to keep her with the company, her employer has granted her stock options to acquire common shares in the company. Jessica is arm's length to the company. Option grant for 5,000 common shares made July 1, 2018 Exercise price is $15. The fair market value of shares on July 1, 2018 is $15 Option expiry date June 30, 2023 Jessica exercises her option grant on January 1, 2019 when the FMV of the shares is $20 per share and acquires 5,000 common shares. On June 1, 2022 Jessica sells all the shares she acquired from her option grant for $30 per share. . KE . What is the amount of the taxable benefit arising from the exercise of the stock options? Enter your answer with 2 decimal places (do not include a comma or $ sign). Answer: In what year must Jessica report the taxable benefit arising from the exercise of the stock options? (2018?, 2019?, 2020?, 2021?, 2022?, 2023?) Answer: Calculate the taxable capital gains that will be included in her 2022 income tax return in connection with this disposition. Enter your answer with 2 decimal places (do not include a comma or $ sign). Answer:

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer The amount of the taxable benefit arising from the exercise of the stock options is 50000 Thi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started