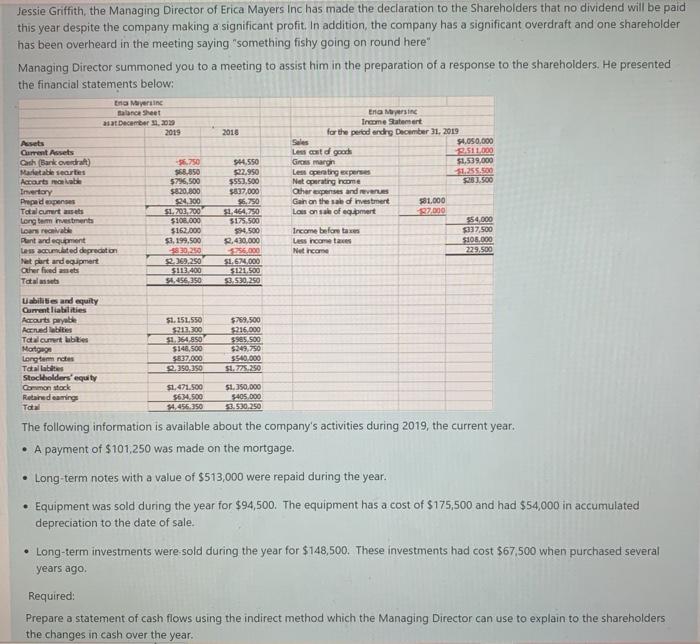

Jessie Griffith the Managing Director of Erica Mayers Inc has made the declaration to the Shareholders that no dividend will be paid this year despite the company making a significant profit. In addition, the company has a significant overdraft and one shareholder has been overheard in the meeting saying "something fishy going on round here" Managing Director summoned you to a meeting to assist him in the preparation of a response to the shareholders. He presented the financial statements below: 2018 Ena Myersin Balance Sheet at December 11, 2029 2019 Assets Current Assets Cash (Bank overdraft) Malable seres $68.850 Accounts robe $796,500 Invertory $820,800 Prepadenges 924.300 Talcument auss 51.703.200 Long term investment $10.000 Loans receive $162.000 Pent and equipment $3,199.500 Les accumulated depreciation Net part and equipmert 92.309,250 Other fedmets SIL.400 Total 54.456.750 Ena Myersin Income Satement for the periodendro December 31, 2019 Sales $4.050.000 Less contgooch 24511.000 Gross margir $1.509,000 Les operating experses 11.255.500 Net operating income $26.500 Other expenses and revenue Gain on the sale of investment 581.000 Los on sale of emert 87.000 S44.550 $22.950 $550.500 $837,000 56.750 $1.464.250 5175.500 S500 2.410.000 1256.000 $1,624 000 5121.500 93.530,250 Income before taxes Less income taxe Net income $137.500 $108.000 229,500 abilities and equity Gument liabilities Accounts payable Au labies Totalcar labies Mortgage Long tam notes Toallab Stockholders' equity Gormon stock Retardeaming Total $1.151.550 5212.200 $164.850 $140, 500 $837.000 0.350, 350 $79.500 $216.000 sses, 500 $249.750 51.773.250 $1,471.500 5634.500 $1,350,000 5405.000 3.530,250 The following information is available about the company's activities during 2019, the current year. A payment of $101.250 was made on the mortgage. Long-term notes with a value of $513,000 were repaid during the year. Equipment was sold during the year for $94,500. The equipment has a cost of $175,500 and had $54,000 in accumulated depreciation to the date of sale. Long-term investments were sold during the year for $148,500. These investments had cost $67,500 when purchased several years ago Required: Prepare a statement of cash flows using the indirect method which the Managing Director can use to explain to the shareholders the changes in cash over the year