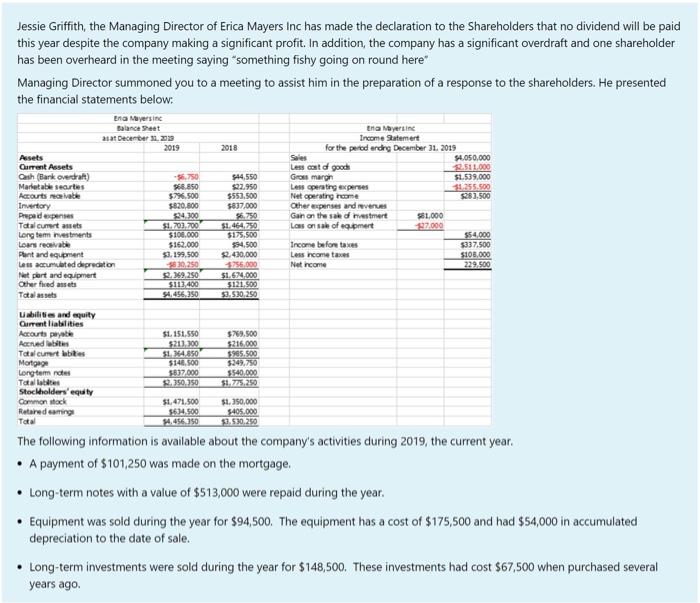

Jessie Griffith, the Managing Director of Erica Mayers Inc has made the declaration to the Shareholders that no dividend will be paid this year despite the company making a significant profit. In addition, the company has a significant overdraft and one shareholder has been overheard in the meeting saying "something fishy going on round here" Managing Director summoned you to a meeting to assist him in the preparation of a response to the shareholders. He presented the financial statements below: Ena Myersin Balance Sheet asat December 2009 2019 2018 944,550 $22.950 $550.500 5837,000 Era Myersin Income Statement for the periodendro December 31, 2019 $4.050.000 Less cost of gooch 2.511.000 Gross margir $1.509,000 Les operating experses 31.255.500 Net operating roome $287.500 Other expenses and revenues Gain on the sake of mestment 561,000 Lass on sale of mert 97000 $54.000 Income before taxes 5337.500 Less income taxes $100.000 Net income 229,500 Assets Current Assets Cash (Bark overdraft) Maritable sorties Accounts receivable Invertory Prepaid expenses Total current assets Long term investments Los receivable Plant and equement Les accumulated depredaton Net port and equipment Other fied assets Totale abilities and equity Current liabilities Accounts payable Accrued bites Total currt bites Mortgage Longterm res Total tables Stockholders'equity Common stock Rated caring Total 568.850 $7.500 $820.800 24.300 $1.202.700 $100.000 $162.000 53. 199.500 30.259 5239.250 $113.400 54.456, 350 $1,464,750 $175.500 $94.500 $2.430,000 125.000 $1.624,000 $121.500 53.530,250 $1,151,550 520.300 51. A.850 $140.500 5837.000 22.250.350 $769,500 5216.000 $905.500 5.249.750 $540.000 $1.75.250 51.471.500 56.34.500 $1.150.000 5405.000 $3.530.250 The following information is available about the company's activities during 2019, the current year. A payment of $101,250 was made on the mortgage Long-term notes with a value of $513,000 were repaid during the year. Equipment was sold during the year for $94,500. The equipment has a cost of $175,500 and had $54,000 in accumulated depreciation to the date of sale. Long-term investments were sold during the year for $148,500. These investments had cost $67,500 when purchased several years ago Jessie Griffith, the Managing Director of Erica Mayers Inc has made the declaration to the Shareholders that no dividend will be paid this year despite the company making a significant profit. In addition, the company has a significant overdraft and one shareholder has been overheard in the meeting saying "something fishy going on round here" Managing Director summoned you to a meeting to assist him in the preparation of a response to the shareholders. He presented the financial statements below: Ena Myersin Balance Sheet asat December 2009 2019 2018 944,550 $22.950 $550.500 5837,000 Era Myersin Income Statement for the periodendro December 31, 2019 $4.050.000 Less cost of gooch 2.511.000 Gross margir $1.509,000 Les operating experses 31.255.500 Net operating roome $287.500 Other expenses and revenues Gain on the sake of mestment 561,000 Lass on sale of mert 97000 $54.000 Income before taxes 5337.500 Less income taxes $100.000 Net income 229,500 Assets Current Assets Cash (Bark overdraft) Maritable sorties Accounts receivable Invertory Prepaid expenses Total current assets Long term investments Los receivable Plant and equement Les accumulated depredaton Net port and equipment Other fied assets Totale abilities and equity Current liabilities Accounts payable Accrued bites Total currt bites Mortgage Longterm res Total tables Stockholders'equity Common stock Rated caring Total 568.850 $7.500 $820.800 24.300 $1.202.700 $100.000 $162.000 53. 199.500 30.259 5239.250 $113.400 54.456, 350 $1,464,750 $175.500 $94.500 $2.430,000 125.000 $1.624,000 $121.500 53.530,250 $1,151,550 520.300 51. A.850 $140.500 5837.000 22.250.350 $769,500 5216.000 $905.500 5.249.750 $540.000 $1.75.250 51.471.500 56.34.500 $1.150.000 5405.000 $3.530.250 The following information is available about the company's activities during 2019, the current year. A payment of $101,250 was made on the mortgage Long-term notes with a value of $513,000 were repaid during the year. Equipment was sold during the year for $94,500. The equipment has a cost of $175,500 and had $54,000 in accumulated depreciation to the date of sale. Long-term investments were sold during the year for $148,500. These investments had cost $67,500 when purchased several years ago